1120: Allocation and Apportionment

Click here to download a PDF copy of this tutorial.

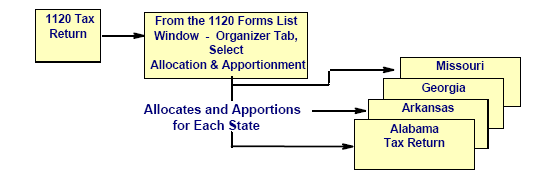

The Allocation and Apportionment (“A&A”) system is an integral part of the 1120 Tax Application.

With Allocation and Apportionment, you need to enter allocated or non-business income, payroll, property, and sales amounts. The tax application does the everywhere amounts for you.

A&A calculates the apportionment ratio in accordance with individual state laws.

This tutorial illustrates Apportionment. Allocation operates in a similar manner.

Topics

- 1120: Activating Allocation and Apportionment

- 1120: Allocation and Apportionment - Entering Data

- 1120: Allocation and Apportionment - Overriding Data

- 1120: Allocation and Apportionment - Reviewing Options

- 1120: Allocation and Apportionment - Activating States

- 1120: Reviewing Allocation and Apportionment

- 1120: Allocation and Apportionment Summary

Overview

A&A collects information from data entry state by state for non-business income, property, payroll and sales.

Once your states are activated in 1120, the information flows to the state tax returns based on general state tax law.

The everywhere amounts are calculated automatically, or you can choose to override data.

What Do You Need To Do?

- Activate Allocation and Apportionment. This alerts the system to use the A&A area, compute A&A, and send it to the State tax.

- Enter data needed for Allocation and Apportionment. Use either Data Entry folders or the Organizer/Overrides folder.

- Review Optional Methods. Review A&A options needed to complete your return or provide for special exceptions.

- Activate Individual States. Generate the state return in the 1120 tax application. This allows information from the Allocation and Apportionment folder to automatically flow to the state tax return.

- Verify Results. Review A&A information on the computed A&A detail state tax forms and make adjustments. These adjustments calculate on the state tax return.

Tutorials/1120_aa_intro.htm/TY2019

Last Modified: 01/28/2020

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.