1120: Allocation and Apportionment - Overriding Data

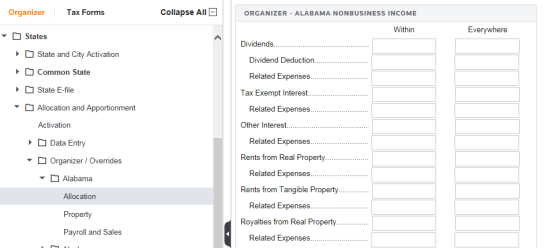

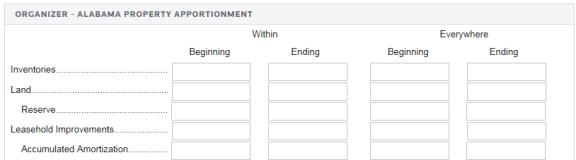

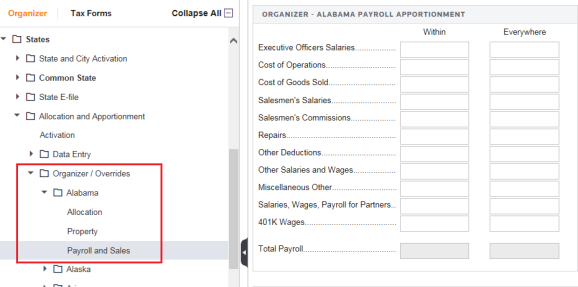

The Organizer/Overrides take your data entered here directly to the state tax returns. Your data flows to the state return without any automatic adjustment the tax application would normally make regarding state tax law requirements.

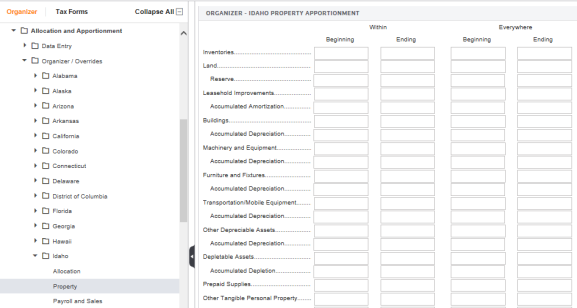

Using the Organizer/Overrides, remember to enter your everywhere numbers. You must enter both the within and the everywhere number for the item you overrode.

The information entered here flows to the A&A Detail tax forms and calculates for the state tax forms. Anything you enter on these organizers flows directly to a line on the state tax return.

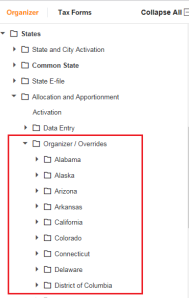

Each state in the 1120 A&A Organizer/Organizer forms list window includes a list of factors available for data entry. The items listed vary state to state. You can use these Organizer folders to enter A&A overrides and detail for certain items.

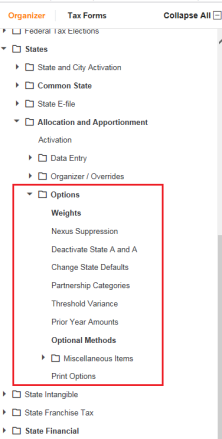

To specify an apportionment method other than the default, click the A&A Options folder.

Tutorials/1120_aa_data_overrides.htm/TY2019

Last Modified: 10/09/2019

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.