1120: Reviewing Allocation and Apportionment

The final step in using Allocation and Apportionment is to review and verify the information on the computed A&A Detail state tax forms and make any adjustments. These adjustments calculate on the state tax return.

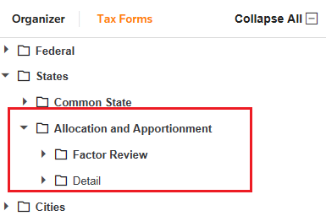

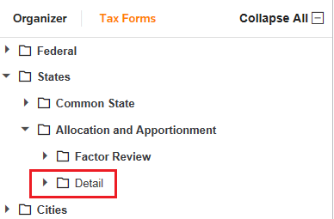

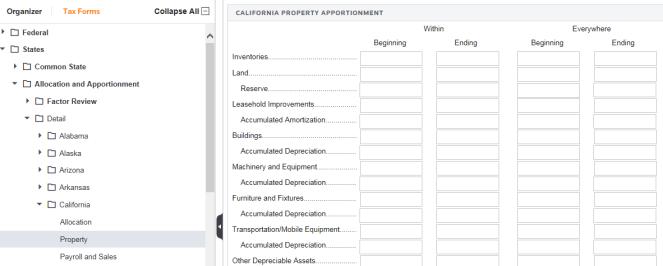

If you disagree with a calculation on the state apportionment schedule, access the A&A Detail screens and review the information. To access the A&A Detail, select States > Allocation and Apportionment.

Use A&A Detail to review and adjust your state information.

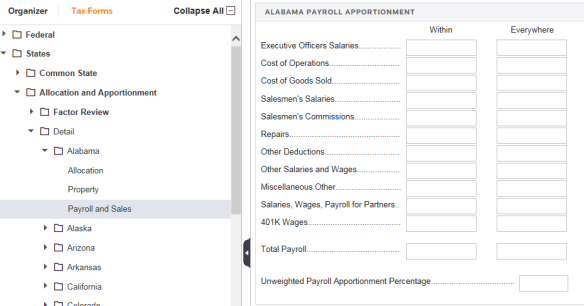

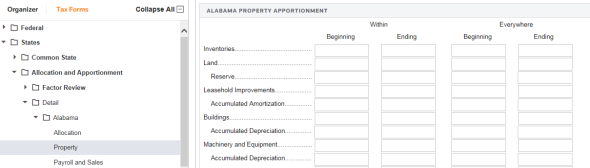

The forms are divided by state. Select the state you wish to review to see allocation, property, payroll, and sales information.

If you used the Data Entry Organizers to enter your information, the data flows to these forms based on the state tax law. If you need to override any information, you can type in the amount in the A&A Detail folders.

To override a computed amount on this screen without black override text appearing (for example, Leasehold Improvements), enter the override using the Organizer/Overrides Organizer instead of doing it here.

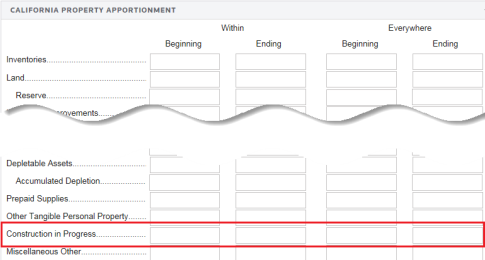

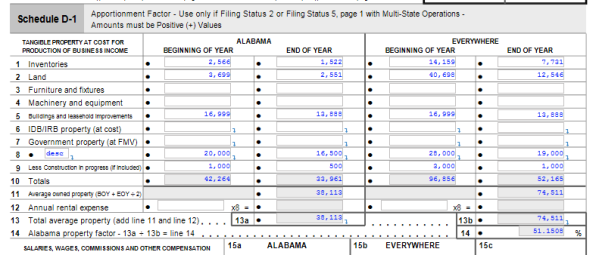

Since we employ the general state tax law, exceptions may exist. For example, the state of California does not allow construction in progress unless your company is a construction contractor. Since this company is a construction contractor, you must use the A&A Detail form for California to make the appropriate adjustment. Once the construction in progress amounts are entered in the applicable fields, the information will flow to the state tax return.

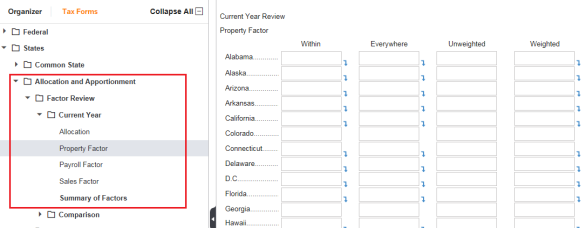

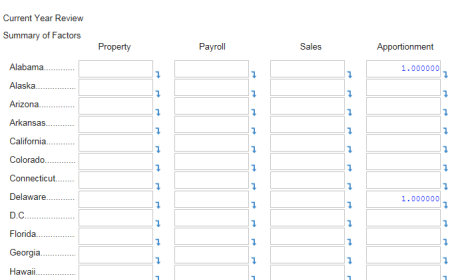

Under A&A Factor Review, you can review both Current Year and Comparisons to last year amounts for Allocations, Property, Payroll, and Sales. Under the Current Year folder, there is also a Summary of Factors.

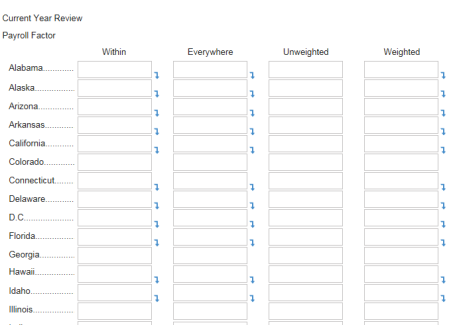

Under Current Factors, each form lists all state amounts for within the state and everywhere as well as weighted and unweighted factors for your review. The Payroll Factor screen is shown below.

The Summary of Factors screen shows the Property, Payroll, Sales, and Apportionment factors for each state in one convenient location.

By reviewing the actual state tax forms, Page 3, you can verify the amounts entered in Allocations and Apportionment actually show up on the Alabama Schedule D-1 which will be filed as part of the state tax return.

Tutorials/1120_aa_reviewing.htm/TY2019

Last Modified: 02/14/2020

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.