Data Import Template: 1040 K-1 Template

Click here for a mapping of fields on the K-1 data import template. This report cross-references line numbers in each K-1 to the column headings in the K1 Data Import Template.

The K-1 Template import feature can populate many of the fields on the 1040 Schedule K-1 input screens. This template is exclusively used for the 1040 tax application.

The three components of K-1 importing are:

- Template file 1040_2021_Sch K_1_Template

- Data Import Template: Performing an Import

- Data Import Template: Performing an Export

1040_2021_Sch_K_1_Template.xlsm

The K1_Template.xlsm contains the data to be imported into the Organizer. This file is referred to as the Data Import Template and is provided by Thomson Reuters. Data is populated in the Excel files using the Data Import Template as the starting point.

Required Fields for Import

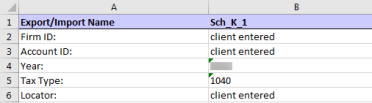

- TR_Setup tab

- Firm ID

- Account ID

- Year

- Tax Type

- Locator

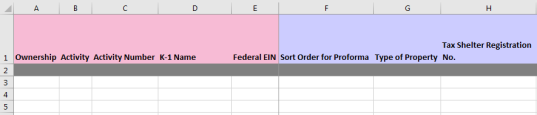

- TR_1040_Sch_K_1_Detail tab

- Ownership

- Activity

- Activity Number

- K-1 Name

- Federal EIN

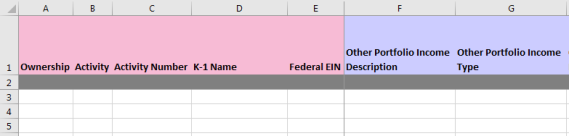

- TR_1040_Sch_K_1_Group_Detail tab (only required if group detail will be imported)

- Ownership

- Activity

- Activity Number

- K-1 Name

- Federal EIN

Drop-down Listings

If you have macros enabled, the spreadsheet will have a pop-up dialog when a field is selected that contains a fixed value. The selection will provide a description and, when selected, will write the correct value needed for the tax application to the field.

If you choose not to use the macros in the template, the details for the values needed are available on the TR_1040_Sch_K_1_Strings tab.

If improper values are entered, then unexpected results can occur.

Navigation for Fields in the K1 Template

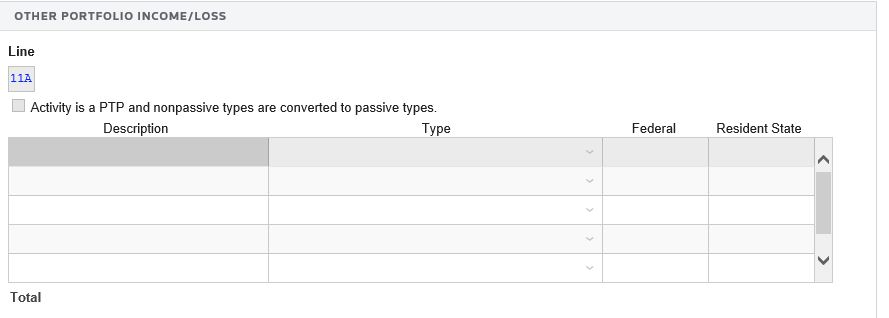

- Organizer > Income > Schedule K-1 > (Name) > Schedule K-1 Information

Tabs on the K1 Template

Tab 1: TR_Setup

The TR_Setup tab contains header information. These fields are fixed and not variable. The firm ID, account ID, and locator number allow Thomson Reuters to match the K-1 Template to your firm’s account. Only the 1040 tax application is available for this import. The tax year begins with 2017 and forward.

If you choose not to enable the macros, you must make sure the column heading is correct for the option you are using.

Tab 2: TR_1040_Sch_K_1_Detail

The TR_1040_Sch_K_1_Detail tab is where the actual data to import is located. There can be multiple rows of data. However, the first and second rows are fixed. The import will use the column descriptions to know where to import the data.

The first five columns must remain as they are. The remaining columns can be moved or deleted to fit your needs.

Subsequent rows will import into a single locator (locator number entered on the TR_Setup tab). Each row will consist of a separate Schedule K-1 to be imported into the program.

K-1 data in the return will be deleted prior to import. If you have data in the return you wish to save, please do an export first for the K-1 detail.

Once the data is exported, please do not reorder the data if you plan to reimport. Doing so may cause the import to fail if it cannot tie out the data between the Detail and Group tabs.

Note that new activities must go at the bottom of the data. On rollover to next year, the activities can be reordered based upon column F, Sort Order for Proforma, on the Detail tab.

Tab 3: TR_1040_Sch_K_1_Group_Detail

The TR_1040_Sch_K_1_Group_Detail tab is where you would input data for group data fields. The first five columns and the first two rows are fixed. You can also import multiple rows of data.

What is Available to Import?

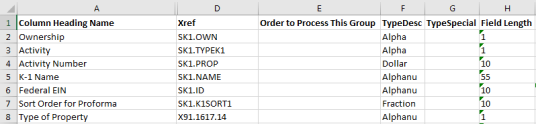

See the TR_1040_Sch_K_1_Map tab in the template file for details on the column heading name to be used:

- XrefName

- Order to Process This Group

- TypeDesc (type of data for the field)

- field length that can be imported.

To see what column heading will transfer to which field in the application:

- Open the Organizer screen you wish to access.

- Then use right mouse click on the field, select Field Info, and use the detail on the screen.

Import/Export/data_import_template_1040_k1.htm/TY2021

Last Modified: 06/11/2020

Last System Build: 10/18/2022

©2021-2022 Thomson Reuters/Tax & Accounting.