Batch Print: Checking the Status of the Batch Print

Using Batch Print * Printing the Tax Return PDF

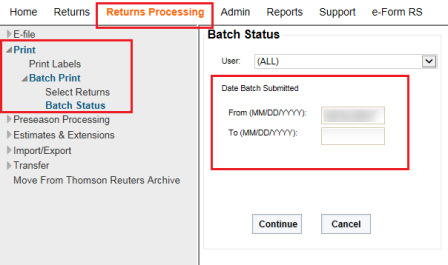

- To check the status of the batch, click Batch Status.

- Select the originator of the batch from the list of user names in the drop-down list.

- Enter the batch submission date (or range of dates, beginning and ending) in the appropriate format.

- Click Continue.

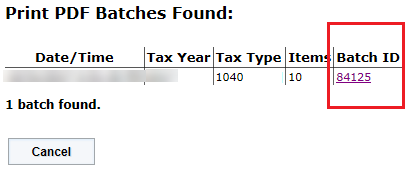

- A list of batches submitted appears. Click the desired Batch ID hyperlink to display the status of the list of returns.

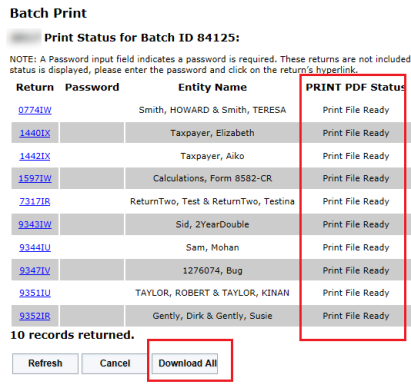

- To download PDF files with the status of Print File Ready, except those that require a password, click Download All.

- To download PDF files that require a password, enter the password and click the return hyperlink.

- A pop-up dialog appears asking if you want to Open, Save, or Cancel the download.

- You can Save the file to the default download directory or choose Save As to change the name of the file. Select the drive and path where you want to save the file.

- The message Downloading will appear in the Download Status column for each selected return as it downloads.

- When all the selected return PDFs have finished downloading, you will see the following message:

- The word Finished will appear in the Download Status column for each selected return.

For return PDF files, the naming convention is X111111Y.PDF where X is the entity signifier (A- 1040), 111111 is the locator number, and Y is the last digit of the tax year (for 2021, Y is the digit 1).

Viewing and Printing the PDF Files

- To view the PDF files, choose the option to View download and open the saved zip file. Double-click the PDF return.

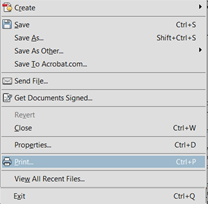

- To print return PDFs, with the return PDF open, select the option File > Print.

RS Browser/batch_print_2.htm/TY2021

Last Modified: 06/11/2020

Last System Build: 02/03/2022

©2021-2022 Thomson Reuters/Tax & Accounting.