Partner Bridge: Partner Information Worksheet

Partner Information Worksheet Overview

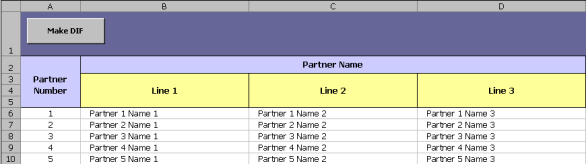

The first four (4) columns of the Partner Information worksheet are illustrated below.

The worksheet contains 323* columns of data as shown in the table below and represents all partner information except special allocations.

| Worksheet Columns | # Of Columns | Content |

|---|---|---|

| A - AJ, JY, LB-LI | 45 | Partner Federal information |

| AK - GP, IA-JX, JZ-KF, KH-KK, KM-LA, LJ-LO | 244 | Partner State information |

| GQ - HP*, KG, KL | 28 | Partner Local information |

| HU - HZ | 6 | Form 8805 Information |

* The columns HQ-HT are used to reformat the partner name for state purposes and are not included in this count. See Partner Bridge: Reformat Partner Name (State Purposes Only).

You should complete the Partner Information worksheet in its entirety before starting data entry for the Special Allocations worksheet because the former worksheet provides the partner identification information required by the latter worksheet.

You can easily populate this worksheet by exporting the partner information from a 2021 1065 return that has been rolled over from the prior tax year.

You can open the export file in Microsoft® Excel™ and then copy and paste the data cells into the Partner Information worksheet.

Import/Export/pbridge_partner_information_worksheet_1.htm/TY2021

Last Modified: 03/20/2020

Last System Build: 10/18/2022

©2021-2022 Thomson Reuters/Tax & Accounting.