Integration with K-1 Analyzer: Attaching a PDF to a Return

Follow these steps to attach PDF files:

- Go to Federal E-file > Attachments > PDF Attachments > Summary screen, and select the Attach PDF button.

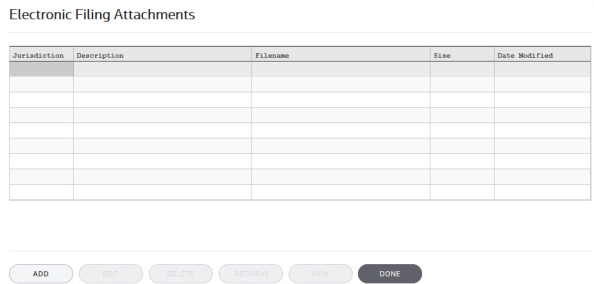

- The following Electronic Filing Attachments screen is displayed:

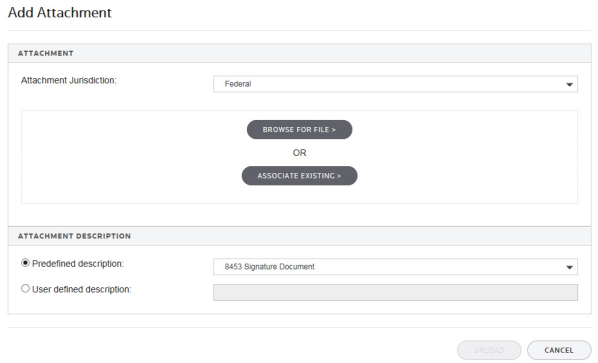

- On the Electronic Filing Attachments screen, select Add to add a new attachment.

- On the Add Attachment pop-up screen, select the Attachment Jurisdiction from the drop-down list that applies to this attachment. Select Next.

- The next dialog box allows you to browse to the location of the desired PDF file. Highlight the PDF file, and then select Open.

- The Add Attachment to Federal Return pop-up screen displays information about the selected attachment. You must now select a meaningful title for the attachment. Either you can elect one of the listed titles by selecting the IRS predefined description option, or enter your own User defined description. The default user-defined title is the file name, without the extension. After selecting either option, select Finish.

The IRS has created lists of recommended names and descriptions for PDF attachments at https://www.irs.gov/Tax-Professionals/e-File-Providers-&-Partners/Recommended-Names-and-Descriptions-for-PDF-Files-attached-to-Modernized-e-File-MeF-Business-Submissions. - A pop-up dialog box confirms the Attachment successfully added. Select OK.

- The selected PDF file now appears in the Electronic Filing Attachments window showing the selected jurisdiction, attachment title (description), file name, file size, and date modified. Select Done to complete the attachment.

- The details for each PDF attachment are displayed below the Summary screen. The name of the attached file should appear under that file folder. Details for each PDF attachment are presented on a separate detail screen.

Import/Export/k1_analyzer_pdf_attachment.htm/TY2021

Last Modified: 05/21/2020

Last System Build: 10/18/2022

©2021-2022 Thomson Reuters/Tax & Accounting.