Replacement Flag

The Replacement Flag defines the manner in which data fields in the target tax return are initialized prior to the start of the import. If a Data Connection import file does not have a valid Replacement Flag (code M, R, U, or H) in the file header record, the file cannot be listed as an import candidate by the batch import function and, as a consequence, will not be available for import. The codes and corresponding actions are as follows:

M: Field level Replacement Flag This is the recommended flag for import. The existing data in the target tax return are not deleted or replaced unless specified in the import file. The only data replaced are the values of the specified form and field name combination in the import file of the corresponding target tax return fields. Any existing group data alignment stays intact. It is highly recommended to export first, if importing into an existing return, in order not to duplicate activity numbers already used and have the correct indices for the import file.

U: Form level Replacement Flag The data and group alignment will be deleted in the target tax application on all fields whose forms are listed in the import file. The incoming data from the import file will then populate the corresponding data fields in the target tax return. Data on fields whose forms are not listed in the import file will retain the data that existed before the import.

The U flag will reset the data indices to have consecutive numbering starting with one. The correct alignment of the copy, group, and subgroup indices including placeholder null value data lines must be fabricated in the import file, or data can become misaligned.

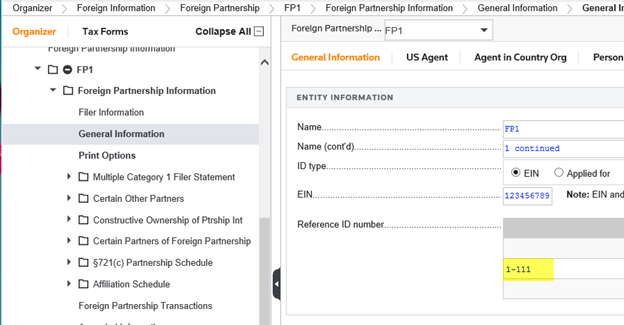

These are group data lines for import using the U flag, including a blank placeholder data line for field FP PARTNERSHIP EIN for the second group member. If this is not included, then the third group member, FP PARTNERSHIP EIN input, would import to the second group members FP PARTNERSHIP EIN field.

"6284JC","","","","","U"

"FORM 8865","1","1","0","FP ENTITY INFO REFE ID NUM","1-111","O"

"FORM 8865","1","2","0","FP ENTITY INFO REFE ID NUM","1-222","O"

"FORM 8865","2","1","0","FP ENTITY INFO REFE ID NUM","2-111","O"

"FORM 8865","2","2","0","FP ENTITY INFO REFE ID NUM","2-222","O"

"FORM 8865","0","1","0","FP NAME LINE 1","FP1","O"

"FORM 8865","0","2","0","FP NAME LINE 1","FP2","O"

"FORM 8865","0","3","0","FP NAME LINE 1","FP3","O"

"FORM 8865","1","0","0","FP NAME LINE 2","1 continued","O"

"FORM 8865","2","0","0","FP NAME LINE 2","2 continued","O"

"FORM 8865","3”,"0","0","FP NAME LINE 2","3 continued","O"

"FORM 8865","1","0","0","FP PARTNERSHIP EIN","123456789","O"

"FORM 8865","2","0","0","FP PARTNERSHIP EIN","","O"

"FORM 8865","3","0","0","FP PARTNERSHIP EIN","345678901","O"

H: Hybrid Replacement Flag The H flag deletes data like the U flag and imports data like the M flag. All enabled data fields in the form names given in the import file will be reset, but the indices will remain intact. Therefore, the indices in the import file must be the same as what exists in the return.

Here is an H flag import with indices that do not start at first position and/or are not in consecutive order. Note the Reference ID number was imported to line three of the group box because the group number is 3 in the import file.

"6284JC","","","","","H"

"FORM 8865","10","3","0","FP ENTITY INFO REFE ID NUM","1-111","O"

"FORM 8865","10","6","0","FP ENTITY INFO REFE ID NUM","1-222","O"

"FORM 8865","12","7","0","FP ENTITY INFO REFE ID NUM","2-111","O"

"FORM 8865","12","8","0","FP ENTITY INFO REFE ID NUM","2-222","O"

"FORM 8865","0","10","0","FP NAME LINE 1","FP1","O"

"FORM 8865","0","12","0","FP NAME LINE 1","FP2","O"

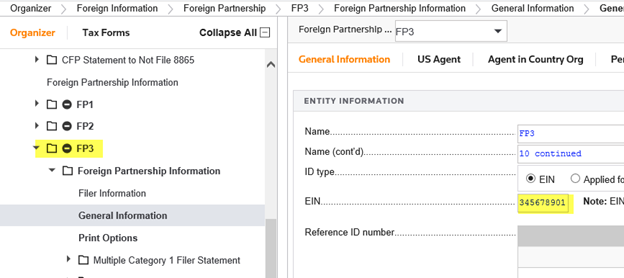

"FORM 8865","0","13","0","FP NAME LINE 1","FP3","O"

"FORM 8865","10","0","0","FP NAME LINE 2","1 continued","O"

"FORM 8865","12","0","0","FP NAME LINE 2","2 continued","O"

"FORM 8865","13","0","0","FP NAME LINE 2","10 continued","O"

"FORM 8865","10","0","0","FP PARTNERSHIP EIN","123456789","O"

"FORM 8865","12","0","0","FP PARTNERSHIP EIN","","O"

"FORM 8865","13","0","0","FP PARTNERSHIP EIN","345678901","O"

Below is an export from the return after the fields above that were imported with non-consecutive indices using the H flag. The structure of the indices from the import file were preserved in the return.

"FORM 8865","10","3","0","FP ENTITY INFO REFE ID NUM","1-111","O"

"FORM 8865","10","6","0","FP ENTITY INFO REFE ID NUM","1-222","O"

"FORM 8865","12","7","0","FP ENTITY INFO REFE ID NUM","2-111","O"

"FORM 8865","12","8","0","FP ENTITY INFO REFE ID NUM","2-222","O"

"FORM 8865","0","10","0","FP NAME LINE 1","FP1","O"

"FORM 8865","0","12","0","FP NAME LINE 1","FP2","O"

"FORM 8865","0","13","0","FP NAME LINE 1","FP3","O"

"FORM 8865","10","0","0","FP NAME LINE 2","1 continued","O"

"FORM 8865","12","0","0","FP NAME LINE 2","2 continued","O"

"FORM 8865","13","0","0","FP NAME LINE 2","10 continued","O"

"FORM 8865","10","0","0","FP PARTNERSHIP EIN","123456789","O"

"FORM 8865","13","0","0","FP PARTNERSHIP EIN","345678901","O"

R: Return level Replacement Flag All data on fields that are represented in the Org Data Dictionary worksheet in the build report are deleted in the target tax application. The incoming data from the import file then populates the corresponding data fields in the target tax return. The return level Replacement Flag (code R) is the default for all Data Connection exports. Like the U flag, the correct alignment of the copy, group, and subgroup indices including placeholder null value data lines must be fabricated in the import, or data can become misaligned.

Additional Information

Form and field names must be grouped together in the import file using any flag except for M.

This example of mixed form names will not import using the R, U, or H flags.

"FORM 2210","0","0","0","AMT TAX COMPUTATION PERIOD 2","04/01 - 05/31","O"

"FORM 1116 OPTIONS","0","0","0","ACCOUNTINGMETHOD","P","O"

"FORM 2210","0","0","0","AMT TAX COMPUTATION PERIOD 3","06/01 - 08/31","O"

"FORM 1116 OPTIONS","0","0","0","ALLOCATE FOR TAX TO 911 INC S","X","O"

"FORM 2210","0","0","0","AMT TAX COMPUTATION PERIOD 4","09/01 - 12/31","O"

"FORM 1116 OPTIONS","0","0","0","ALLOCATE FOR TAX TO 911 INC T","X","O"

This example will import using the all replacement flags.

"FORM 2210","0","0","0","AMT TAX COMPUTATION PERIOD 2","04/01 - 05/31","O"

"FORM 2210","0","0","0","AMT TAX COMPUTATION PERIOD 3","06/01 - 08/31","O"

"FORM 2210","0","0","0","AMT TAX COMPUTATION PERIOD 4","09/01 - 12/31","O"

"FORM 1116 OPTIONS","0","0","0","ACCOUNTINGMETHOD","P","O"

"FORM 1116 OPTIONS","0","0","0","ALLOCATE FOR TAX TO 911 INC S","X","O"

"FORM 1116 OPTIONS","0","0","0","ALLOCATE FOR TAX TO 911 INC T","X","O"

Import/Export/dc_specs_gst_27.htm/TY2021

Last Modified: 02/23/2021

Last System Build: 10/18/2022

©2021-2022 Thomson Reuters/Tax & Accounting.