Return XML: Filename Conventions: File Record Types

Return XML import and export files are structurally identical – both file types contain the same record types in the same position. For that reason, Return XML export files can be used as import files without modification.

The following shows the first three rows of a Return XML file in Notepad.

<?xml version="1.0" encoding="utf-8"?>

<Return xmlns="http://www.thomson.com/Ria/DataExchange">

<ReturnData documentCount="1" Return="X1234L" Flag="H">

The first two rows are mandatory and cannot be changed. They tell the system what to expect and the standards followed. The third row has Return, and X1234L is the locator number. The ‘ReturnData documentCount’ equals one signifying data for one return will follow. If a return is exported, the ‘Return’ number can then be changed by the client after opening in XML Notepad to another locator number. After saving, the same file can be reused to import into another return.

The flag ‘H’ tells the system to delete all mapped data that exists in a specific document ID and import data from the file into it. An example is if Form 2106 exists in the import file (IRSFORM2106 in the figure below), then all mapped data in the Form 2106 folder will be deleted prior to import. This is to ensure that, upon import, the sequence of properties is maintained, and there is no trapped data. The flag ‘H’ has to remain static and no other flags are supported with Return XML.

Only data in the map will be deleted. If data exists in those screens not in the map, data could be left behind.

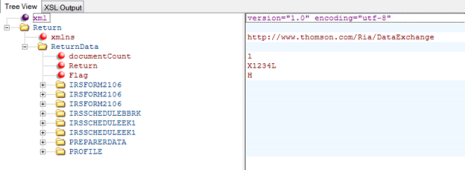

Records subsequent to the header can be modified by the customers. They can vary depending on the tax return. Looking at the same file as above, but in XML Notepad, it appears like this:

In this 1040 return, we see items for the 2106, brokerage statement, K1s, preparer data, and client profile. This is the beginning of the data records. We will address data records later with how they tie to the *Build Report and the tax application.

Import/Export/rxml_online_8.htm/TY2021

Last Modified: 03/20/2020

Last System Build: 10/18/2022

©2021-2022 Thomson Reuters/Tax & Accounting.