Return XML: Tying the Build Report.XLS to a Client XML File

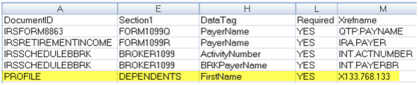

Continuing with the example above, we will tie the Dependents > FirstName in the XML to the Build Report. Illustrated in the first figure below is the top part of the tab XML_Required Fields in the 1040 Build Report. Some columns are hidden so that we can display the relevant ones. Required fields are the fields that must be in the data file for associated data. As demonstrated, if the required field for dependents is missing but other data for dependents are in the file, the import stops.

Build Report.XLS file: Tab “XML Required Fields”

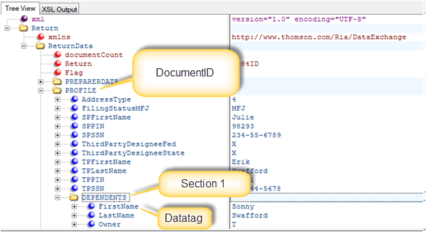

Looking at this tab in the Build Report, the DocumentID column has the item profile highlighted. We can see this in the XML file as a folder in the figure below.

In the tab, the Section1 column has the item Dependents. Section1 is a group of data within the DocumentID. Any Section2 will be a group within Section1. A third Section3 will be group data within Section2. The sections are only in the XML file if the data requires it. In the XML file shown in the figure below, the Section1 is the folder Dependents.

Exported XML File

Moving over one column in the figure for the tab XML Required Fields, the DataTag column has FirstName for Dependents. When reviewing the DataTag FirstName in the XML file, you see the actual data stored for import on the right half of the screen. The bluish purple balls in the file are the DataTags. In our example, the DataTag FirstName value is Sonny.

The same rules apply to other items on the XML Required Fields tab. For the Broker1099, if the Datatag “BRKPayerName” or “ActivityNumber” are missing from the XML file but other items for Broker1099 exist, the file is no longer valid.

The final column for the tab XML Required Fields is Xrefname. This is a specific value for each field that allows you to search the spreadsheet quickly if you know it. Each Xrefname occurs only once in a tax application. Each field has an Xrefname, if enabled.

Import/Export/rxml_online_11.htm/TY2021

Last Modified: 03/20/2020

Last System Build: 10/18/2022

©2021-2022 Thomson Reuters/Tax & Accounting.