Batch Estimates/Extensions

Click here to download a PDF copy of this guide.

Use Batch Estimates and Extensions to generate extensions and /or estimates for clients without opening the locators. You can generate federal and/or state estimates and extensions.

Using Batch Estimates and Extensions

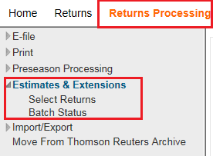

- In the Browser, select Returns Processing > Estimates & Extensions > Select Returns.

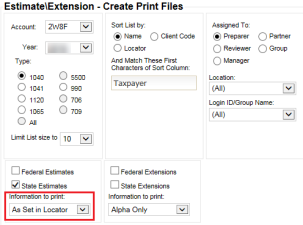

- In the Estimates & Extensions – Create Print Files Browser screen, select the following criteria:

- account number

- tax year

- tax type

- list size limit

- list by name, client code, or return

- characters to sort by

- list by preparer, manager, or reviewer

- specific location (optional)

- specific Login ID/Group Name (optional).

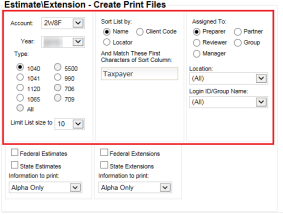

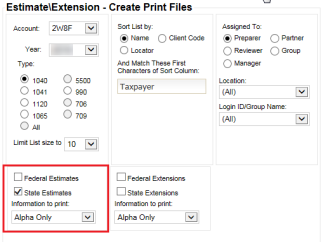

- For printing federal and/or state estimates, in the Estimates & Extensions – Create Print Files screen, click the check box for the Federal Estimates and/or the State Estimates.

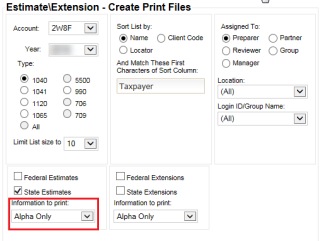

- For printing federal and/or state estimates with alphabetical information only, choose the Alpha Only option from the Information to Print drop-down list.

Estimates will not print for scanline states. Scanlines are incompatible with the manually entered data on Alpha Only forms. The manually entered data is not reflected within the scanline and therefore causes the scanline to be incorrect. Below is a list of states that contain scanlines on their estimate forms.

1065: AL, DC UBT, FL 1065, MN, RI, TN Franchise, and WI

1120: AL, GA, LA, MO, MS, NC, NJ, NY, SC, UT, and WI

1040: AL, DE, GA, LA, MO, NH, NHBT, NJ, SC, VT, and WI

1041: GA, NH, NJ, SC, and WI - For printing federal and/or state estimates using locator amounts and options, choose the As Set in Locator option from the Information to Print drop-down list.

For 1120 and 1065 locators, if an extension amount is entered in the locator, that amount will be printed on the extension. If an extension amount is not entered, the extension will print alphabetical information only.

For 1040, 1041, and 990 locators, choose the appropriate option. The Alpha and Numeric option will print based on the amounts entered. If the Alpha Only state estimate option is chosen within the locator, estimates will not print for scanline states.

Scanlines are incompatible with the manually entered data on Alpha Only forms. The manually entered data is not reflected within the scanline and causes the scanline to be incorrect. Below is a list of states that contain scanlines on their estimate forms.1065: AL, DC UBT, FL 1065, MN, RI, TN Franchise, and WI

1120: AL, GA, LA, MO, MS, NC, NJ, NY, SC, UT, and WI

1040: AL, DE, GA, LA, MD, MO, NH, NHBT, NJ, SC, VT, and WI1041: GA, NJ, SC, and WI

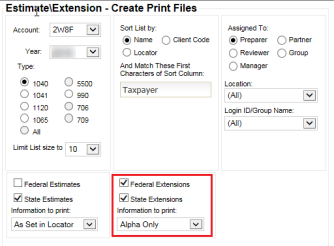

- For printing federal and/or state extensions, in the Estimates & Extensions – Create Print Files screen, click the check box for the Federal Extensions and/or the State Extensions.

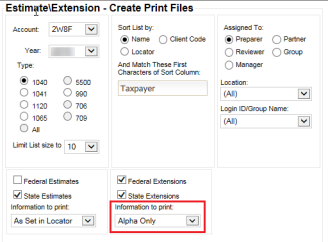

- For printing federal and/or state extensions with alphabetical information only, choose the Alpha Only option from the Information to Print drop-down list.

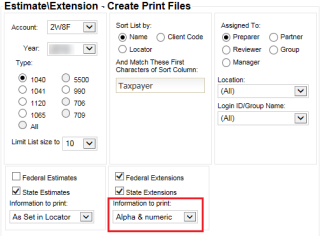

- For printing federal and/or state extensions using alpha and numeric information, choose the Alpha & numeric option from the Information to Print drop-down list.

1065 and 1120 locators: When an extension amount is entered in the locator, the extension will print with that amount. Filing instructions and/or transmittal letters will also print for those locators that have those client documents set up. When an extension amount is not entered, the extensions forms will be generated with alphabetical information only.

1040, 1041, and 990 locators: These locators will print extensions with alphabetical information only. State extensions will not print for scanline states. Scanlines are incompatible with the manually entered data on Alpha Only forms. The manually entered data is not reflected within the scanline and will cause the scanline to be incorrect. Below is a list of states that contain scanlines on their extension forms.

1040: AL, CA*, DE, GA, MA, NH, NHBT, NJ, SC and WI

1041: AL, NH, and NJ

*The California extension forms do not have a scanline but are included in the scanline states because the State of California Franchise Tax Board does not allow manually entered amounts.

- Click Continue to display a list of returns from which to create print files, or click Get Adobe Reader, if necessary, to download the Adobe Reader.

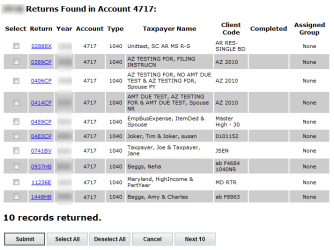

- If you select Submit, the list of returns appears. Select the returns you wish to print, and select one of the following options:

- Submit: Create selected print files from the list.

- Select All: Selects all returns in the list to create print files.

- Deselect All: Selects none of the returns in the list to create print files.

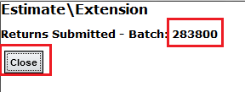

- If you click Submit, a dialog box appears with a batch number. Be sure to make a note of the batch number, and then click Close.

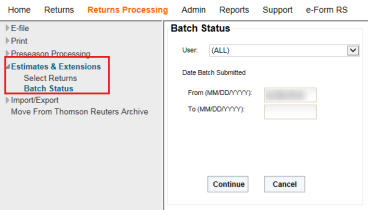

- To check the status of the batch, click Batch Status from the menu.

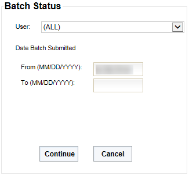

- Select the originator of the batch from the list of user names in the drop-down list.

- Enter the date information for when the batch was submitted in the appropriate format, and then click Continue.

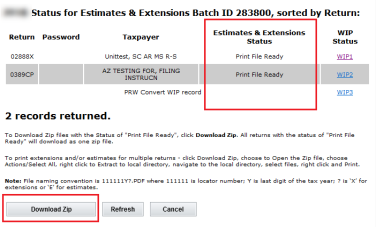

- A list of batches submitted appears. Click the desired Batch ID hyperlink to display the status of the list of returns.

- To download zip files with the Status of Print File Ready, click Download Zip.

Click Refresh on this screen if the Download Zip button is grayed out.

- All returns with the status of Print File Ready will download as one zip file.

The zip file can either be saved to the hard drive or opened.

The zip file will contain a PDF for each locator’s extension and estimates.The naming convention for estimate PDF files is 111111YE.PDF where 111111 is the locator number and Y is the last digit of the tax year. The naming convention for extension PDF files is 111111YX.PDF where 111111 is the locator number and Y is the last digit of the tax year. (For example, for Tax Year 2021, Y is the digit 1.)

You must enter the password for password protected returns and click its locator hyperlink separately in order to download the protected locator’s zip file.

- To save the PDF files unzipped:

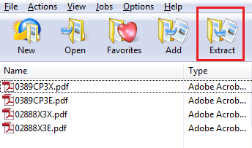

- Open the zip file within WinZip (or other zip extraction program).

- Highlight the files to save.

The screen shown may differ, depending on which version of the zip extractor you are using.

- Either use the Extract function or drag and drop to a designated folder.

- To print estimate and/or extension PDFs:

- Extract the PDFs to a folder.

- Highlight those PDFs that you wish to print.

- Right-click and choose to Print.

RS Browser/batch_ee_1.htm/TY2021

Last Modified: 02/03/2022

Last System Build: 02/03/2022

©2021-2022 Thomson Reuters/Tax & Accounting.