Submitting E-filed Returns

After reviewing the return in E-file Viewer and Info, you are ready to e-file the return.

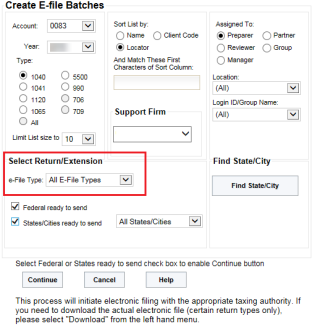

Selecting Returns

- Go to Returns Processing > E-file > Select Returns.

- Make your Account, Year, Tax Type and Limit List size options. If your return has a client code, enter that also in order to refine your results. By using the Assigned To: option, you can limit the size of the resulting return list even further.

- You can see the full list of returns available for e-file by choosing All E-File Types (not limited to any particular Form) or All E-File Extensions (no particular Extension Form).

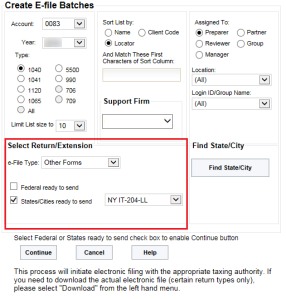

Selecting Federal and State Options

- Specific federal and/or state options are listed in the drop-down lists for each jurisdiction type – by federal or by states or both. Use this option when you want to narrow the results shown.

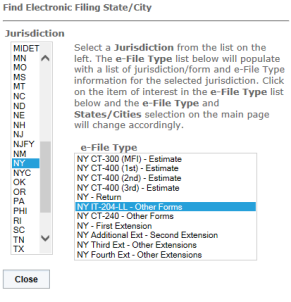

- To help you quickly find a specific file to submit to any taxing authority, use the Find State/City option.

- Choose the jurisdiction you want to e-file in the drop-down list (based on the tax type selected in the basic criteria section above). For our example, we will focus on the 1120 New York state forms list and the IT 204-LL Return.

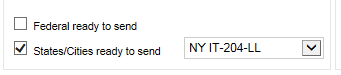

- The Select Returns/Extension options will immediately change to the Other Forms Display e-File Type and the NY IT-204-LL tax return option.

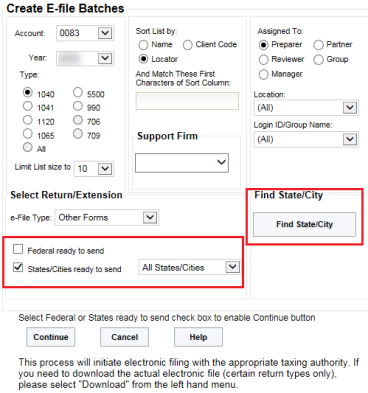

- If this is the return type and jurisdiction you want to e-file, check the box for the States/Cities ready to send. Then click Continue, and the list of New York IT 204-LL returns that are qualified and ready to send will show on the next page. For Qualified Mismatch status, see Using the E-file Summary Report.

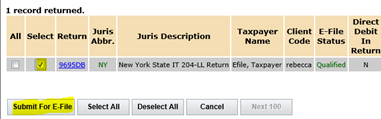

- You can submit the NY IT 204-LL by using one of three options:

- Check the All check box.

- Check the Select check box.

- Right-click the Return ID number.

- In this illustration we will check the Select box and click the Submit For E-file button below the return list. When multiple forms are to be selected, the Select All option may be convenient.

- The qualified XML file(s) will be submitted to the proper taxing authorities, and a status will automatically be displayed showing the e-file processing stages as the return goes through the submission processes.

E-file/rs_efile_viewer_6.htm/TY2021

Last Modified: 02/17/2020

Last System Build: 08/30/2022

©2021-2022 Thomson Reuters/Tax & Accounting.