Using the E-file Summary Report

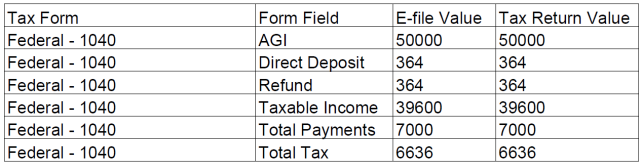

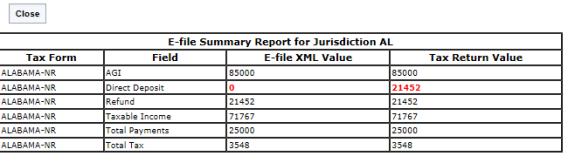

The E-file Summary Report displays key amounts from both the locator and XML e-file side by side for each jurisdiction that is qualified for e-file to enable review of any differences of the key amounts.

Even if there are differences, the return can still be submitted for e-file. This is only an alert that the return has been computed subsequent to the last e-file XML creation with different results for key amounts.

There are two places where the E-file Summary Report can be viewed.

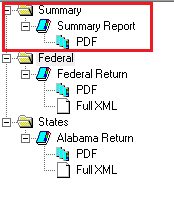

E-file Viewer

Click the PDF folder to open the PDF file in a separate window.

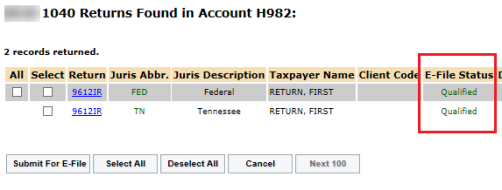

E-file Submission (Returns Processing > E-file > Return)

If the amounts match between the locator and the e-file, the E-file Status will be Qualified.

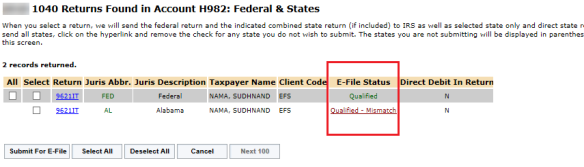

- If any of the key amounts shown do not match between the locator and the e-file (for example, when the amounts in the locator have changed but a new e-file was not created), the e-file status on RS Browser shows as Qualified – Mismatch instead of Qualified.

- Click the Qualified – Mismatch status to show the E-file Summary Report, which highlights any differences in red.

The return can still be submitted for e-file if the e-file status is Qualified Mismatch. This is only an alert that the return has been computed subsequent to the last e-file XML creation with different results for key amounts.

- To resolve any differences between the e-file and the tax return values, open the locator and re-create the e-file XML file.

E-file/rs_efile_viewer_5.htm/TY2021

Last Modified: 02/17/2020

Last System Build: 08/30/2022

©2021-2022 Thomson Reuters/Tax & Accounting.