1065 Disaster Assistance Designation

Click here to download a PDF copy of this guide.

Federal

To enter disaster designations for the 1065 federal return, do the following:

- Go to Organizer > General Information > Basic Return Information > Return Information.

- Scroll to the Disaster Relief Provisions section at the bottom of the screen.

- Enter the IRS-issued Disaster Designation. This statement will print at the top of the federal return.

- Enter an override for the return due date, if required.

- In this event, or in the event of a state-specific event that is not adopted by the IRS, go to the State Disasters Provisions screen. Go to Organizer > States > Common State > Disaster Provisions. Then follow the steps shown under the States heading below.

- Perform a full recompute before generating the print file.

States

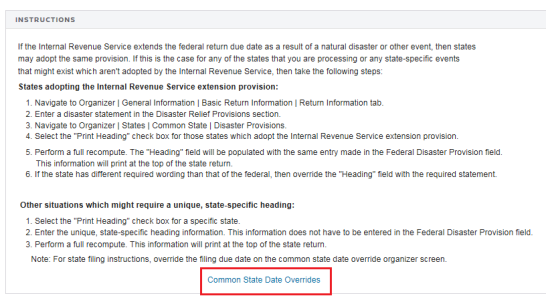

If the IRS extends the federal return due date as a result of a natural disaster or other event, then states may adopt the same provision. If this is the case for any of the states that you are processing OR any state-specific events that might exist which are not adopted by the IRS, then take the following steps:

States Adopting the IRS Extension Provisions

- Enter the federal information as indicated above.

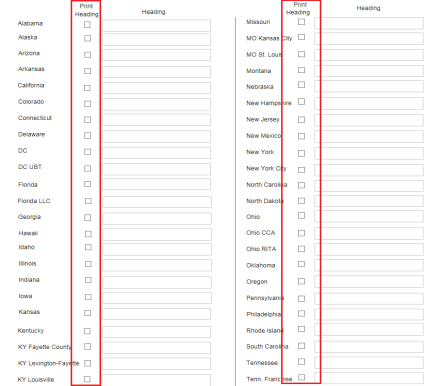

- Go to Organizer > States > Common State > Disaster Provisions.

- Select the Print Heading check box for those states adopting the Internal Revenue Service extension provision.

- Perform a full recompute.

- The Heading field uses the same entry as that made in the Disaster field, found in the federal Disaster Relief Provisions section and prints at the top of the state return.

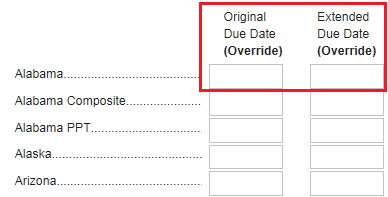

- To override the state filing due date, click the Common State Date Overrides hyperlink.

- Enter an extended due date in the field for the specific state.

- Perform a full recompute before generating the print file.

Other Situations Requiring Unique State-Specific Heading Information

- Select the Print Heading check box for a specific state.

- Enter a unique, state-specific heading information in the state’s Heading field. If the state heading information is entered on this screen, it does not have to be entered in the federal Disaster Relief Provisions field.

- Click the Common State Date Overrides hyperlink, and enter the extended due date for that particular state.

- Perform a full recompute before generating the print file.

Tax Application Disaster Assistance/1065_disaster.htm/TY2021

Last Modified: 02/03/2022

Last System Build: 02/03/2022

©2021-2022 Thomson Reuters/Tax & Accounting.