1041 E-file: Creating the E-file

After verifying that e-file diagnostics do not exist, create the e-file to send to the IRS by clicking the button on the Organizer screen.

Make sure that the file is generated as the last step before sending (after ALL changes have been made to the return). If not, incorrect information will be sent to the IRS.

- Go to E-file > Enable/Create.

- Click the Create Return E-files button. This button will create all e-files for federal and activated states with one click.

- Check the E-file Status column. If the file was created without any problem, the application shows a message in the column stating XML file is created - Return is ‘Qualified.’

- If issues exist with the e-file, note the message in the E-file Status column. If you receive the message that XML is created but NOT qualified - Diag needs to be cleared, resolve the diagnostics as detailed in 1041 E-file: Reviewing E-file Diagnostics.

- You may also receive this message if validation issues exist: XML is created but NOT qualified - Please clear vali.errors. See 1041 E-file: Checking for E-file Validation Errors.

- Note the date/time of e-file creation, number of validation errors, XML file name, and direct debit indicator.

- If, for some reason, you need to delete the e-file, click the Delete button in the Delete E-file column. This button deletes only the e-file, but does not delete any information on the return.

Deleting an E-file

The Delete button deletes the existing XML file for that jurisdiction. To delete an e-file:

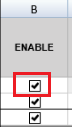

- Make sure the Enable check box is checked. You cannot delete an e-file if this check box is blank!

- Click the Delete button in the Delete E-file column.

- The E-file Status changes to indicate that the XML file has been deleted.

If you have clicked the Delete button and the Enable check box was blank, do the following:

- Check the Enable check box.

- Click the Create Return E-files button.

- Click the Delete button.

E-file/1041_ef_return_8.htm/TY2020

Last Modified: 08/13/2020

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.