1041 E-file: Reviewing E-file Diagnostics

Perform a full recompute of the locator, and make the necessary corrections:

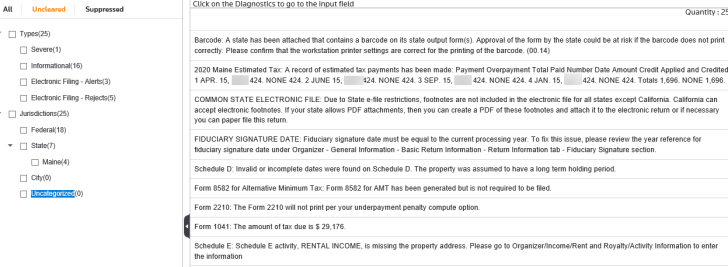

- Select View > Diagnostics. Select the E-file option.

- Review the return information causing the diagnostic, and make any necessary changes to prevent the diagnostic from being regenerated during subsequent tax return computes.

- Repeat the diagnostic review process for all e-file diagnostics existing on the locator.

Some forms cannot be e-filed. When an extension requires an IRS form that cannot be e-filed, a corresponding e-file diagnostic is generated.

- Perform a full recompute on the locator and review any new e-file diagnostics that may have been generated, modifying input as necessary. Repeat the data modification, compute, and review process until there are no e-file diagnostics listed for the locator. The application creates an e-file data file (to be filed with the IRS) only when no e-file diagnostics exist.

Types of Diagnostics

Alert Diagnostics: These do not prevent the creation of a qualified e-file. You should still investigate the conditions causing the Alert diagnostics, as these may reveal input errors.

Reject Diagnostics: These diagnostics identify conditions in the return that will result in an IRS rejection for failure to meet IRS Business Rules. Reject diagnostics also identify many of the common conditions that may result in an XML validation error. You must correct the conditions generating a Reject diagnostic before you can generate a qualified e-file.

XML Validation Errors: Data that does not meet the strict schema formatting requirements of the IRS schemas result in XML validation errors.

How to Find the E-file Diagnostics

Click here to see a short video about how to use the e-file diagnostics information in Organizer.

https://onesourcesupport.onesourcelogin.com/Product/self_Service/SearchingforDiagnostics/index.html

E-file/1041_ef_return_7.htm/TY2020

Last Modified: 09/13/2021

Last System Build: 09/13/2021

©2020-2021 Thomson Reuters/Tax & Accounting.