1040: Expatriate Returns - Form 2555: Foreign Earned Income

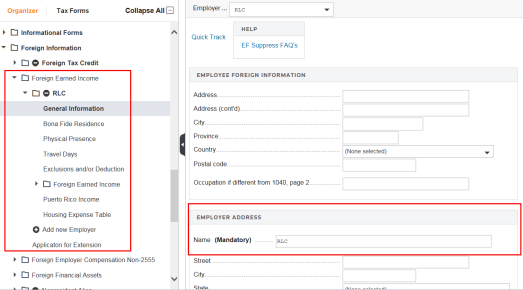

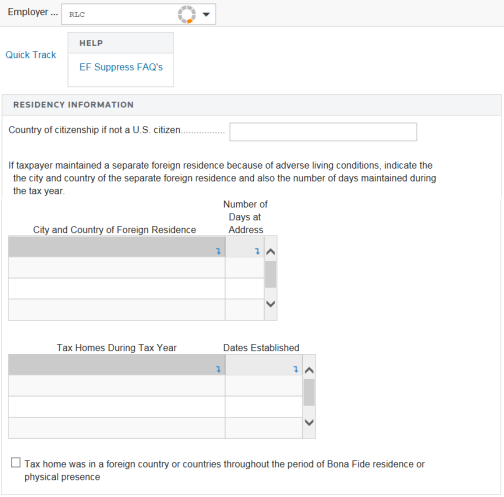

Scroll down the General Information screen to enter additional foreign residence information.

Use the Bona Fide Residence screen in the Foreign Earned Income folder to enter bona fide residence information related to this employer.

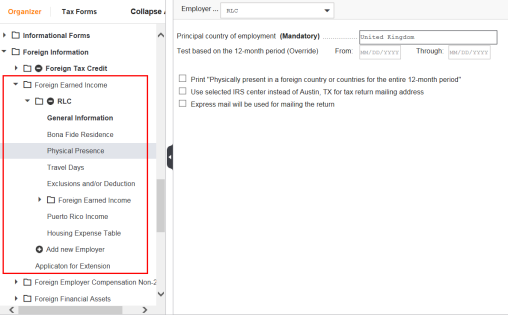

You can enter information for physical presence instead of bona fide residence on the Physical Presence screen. The tax application calculates the physical presence test.

The principal country of employment is a mandatory entry.

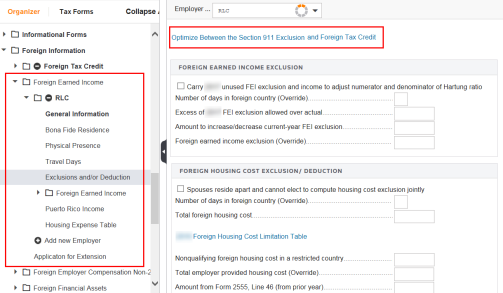

To optimize returns between §911 exclusion(s) and foreign tax credit, you must click the Optimize Between the Section 911 Exclusion and Foreign Tax Credit button (shown below) to select an optimization code on the Exclusions and/or Deduction screen. See Foreign Optimization.

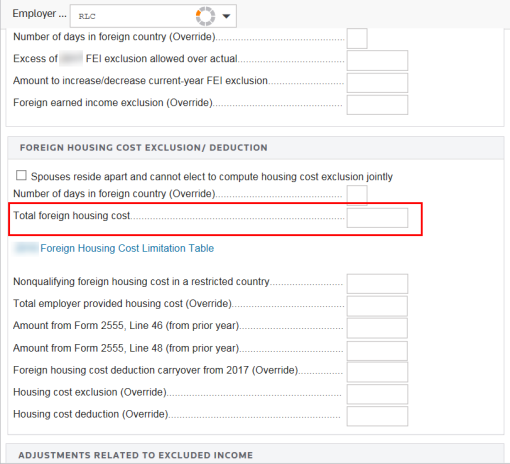

Scroll down the Exclusion and/or Deduction screen to enter foreign housing costs.

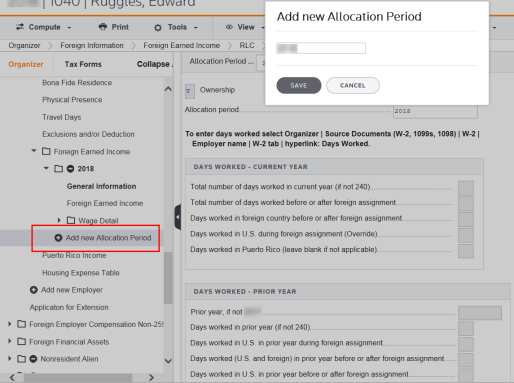

Select Add new Allocation Period to add an allocation period.

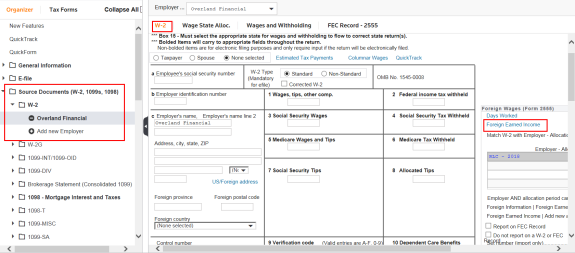

Foreign compensation is entered at Organizer > Source Documents > W-2 > Add new Employer.

Important: Enter the desired value from the Employer - Allocation Period grid into the Match W-2 with Employer - Allocation Period field.

If the foreign compensation should be reported on a Foreign Employer Compensation (FEC) Record, select the check box for Report on FEC Record. If you select the check box to Report on FEC Record, select the hyperlink: Non-W-2 (FEC Record).

If the foreign compensation should not be reported on a Form W-2 or FEC Record, select the check box for Do not report on a W-2 or FEC Record.

Select the hyperlink Days Worked to enter days worked information.

Select the hyperlink Foreign Earned Income to enter foreign compensation.

Go to Organizer > Source Documents > W-2 > employer name and elect the Foreign Earned Income hyperlink.

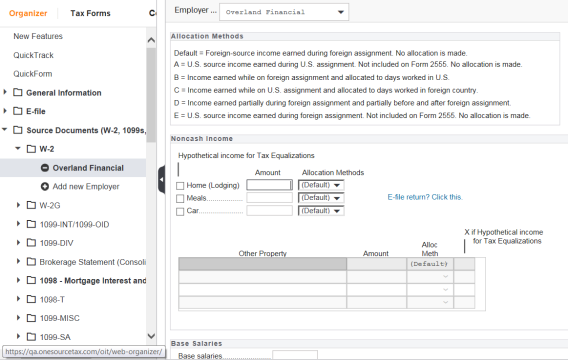

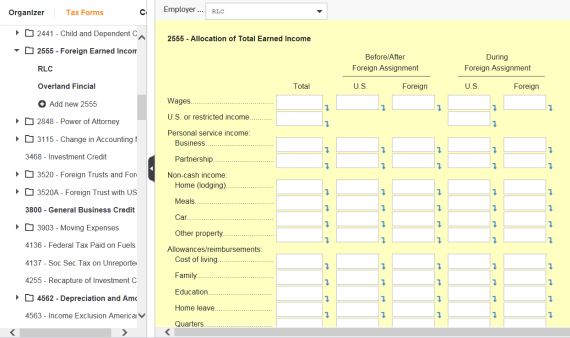

Enter base salaries and other foreign compensation. Selecting an allocation method determines how the income is divided between US and foreign assignments. Non-cash income is also entered on this organizer screen. You can allocate the part of each non-cash income item to the days worked in the US.

After inputting foreign compensation, the allocation of compensation can be reviewed in the printed return as well as in tax forms view at Tax Forms > Federal > 2555 – Foreign Earned Income > employer name > Page 2 tab. Drill down on line 19.

Tutorials/1040_expat_2555.htm/TY2019

Last Modified: 08/13/2020

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.