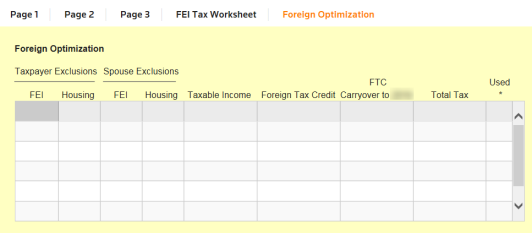

1040: Expatriate Returns - Foreign Optimization

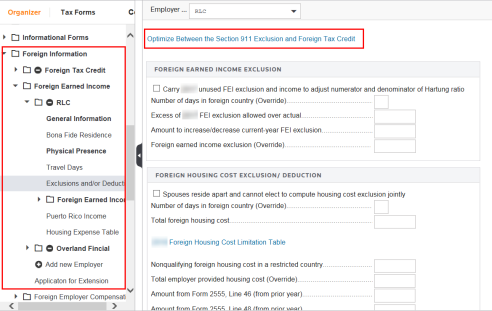

To force Section 911 exclusion or optimize between the Sec. 911 exclusions and the foreign tax credit, use the Exclusions and Deductions Organizer under Foreign Earned Income.

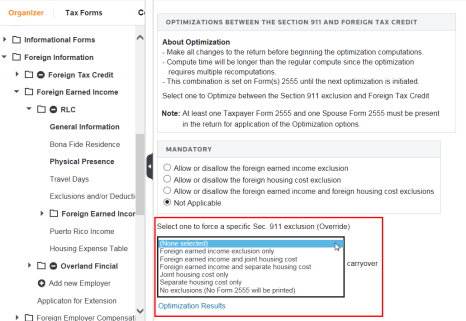

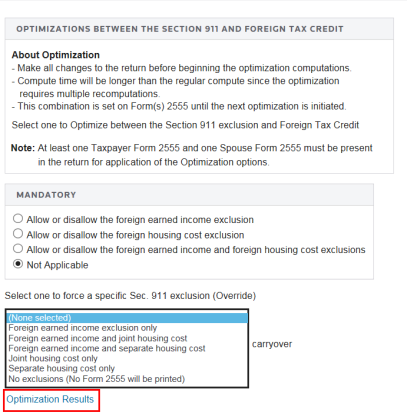

Select each list box to see the applicable choices. Here you can force specific §911 exclusions if necessary.

The Optimization features only apply when two 2555 forms are entered, one for Taxpayer and one for Spouse.

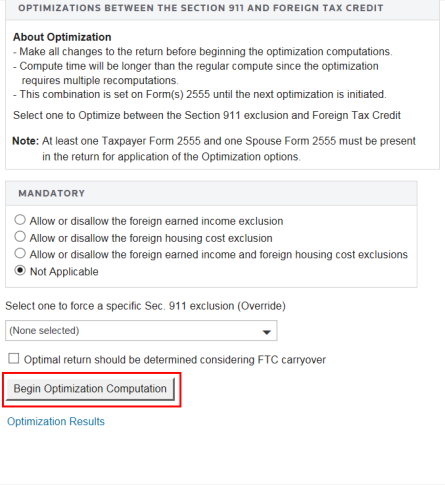

Click the Begin Optimization Computation button after making your selections.

After you have run the optimization calculation, you can view the results when you click the Optimization Results link (see arrow above), and a workpaper appears with the results.

Tutorials/1040_expat_foreign_opt.htm/TY2019

Last Modified: 02/14/2020

Last System Build: 06/18/2021

©2019-2020 Thomson Reuters/Tax & Accounting.