Review, Analysis Tools, and Audit Trail Features

Our software provides several features to facilitate analysis and review of tax returns, from data entry through computation and tax form output.

Hyperlinks

Hyperlinks provide links between related forms and data entry areas. They enable you to trace data from its source through computation detail to its final tax form value.

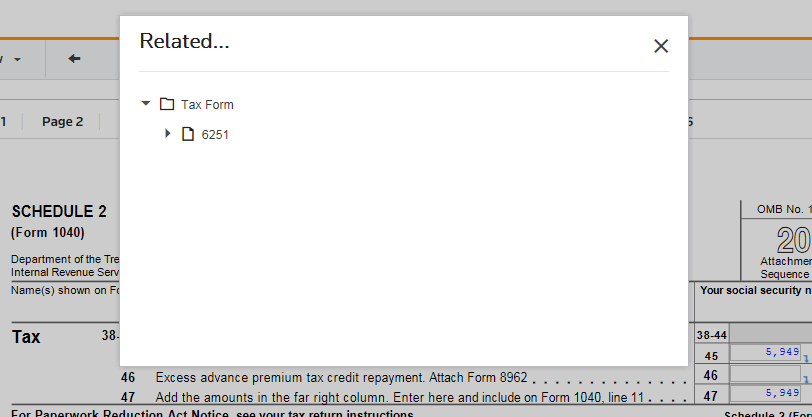

The following shows the related Tax FormOrganizers, and Workpaper displayed for line 45 (Alternative Minimum Tax) on Schedule 2 of Form 1040.

Workpapers

Intermediate-level screens called Workpapers link Organizer amounts to Tax Forms amounts. They provide detailed information that supports the calculated values on the tax return. Workpapers allow you to review data and easily get to source data to make changes.

Changes made on Organizer screens ensure that the data will flow to the rest of the return.

Tax Forms

Tax Forms, facsimiles of tax return forms, provide the overall results of a tax return. After data entry, you can review the return and adjust information as needed. The audit trail capability helps you to determine the source of every number in the tax return. Tax Forms allows you to easily reconcile our computed totals. Symbols, such as check marks and asterisks, flag specific conditions about a given field, such as fields containing overrides of our calculated amounts.

Tax Forms enables you to:

- Review overrides against computed values

- Review summary-level data

- Access detail for certain data fields

- Review and clear diagnostics.

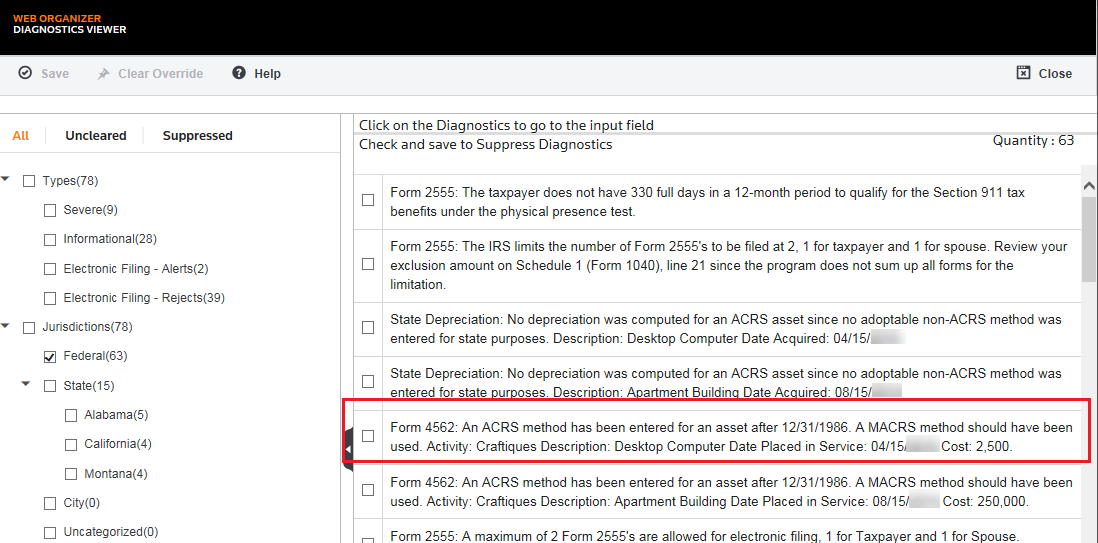

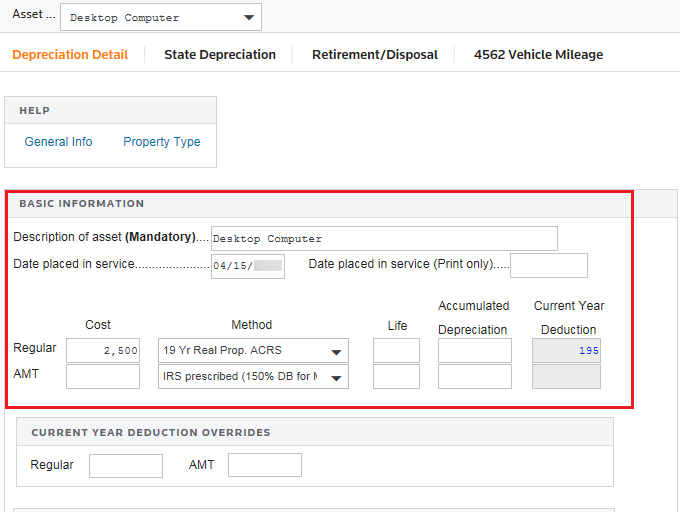

Diagnostics

GoSystem Tax creates records, called Diagnostics, of any inconsistencies, errors, or omissions found when a return is computed. Numbers show the quantity of every diagnostic category (how many severe, informational, and e-file diagnostic messages have been reported). Diagnostics are also segregated by federal and state within each category.

You can easily navigate from the Diagnostics list to the screen that generated the diagnostic by clicking the diagnostic and then switching to the Organizer. The screen associated with the diagnostic will appear in the Organizer.

You can “clear” or “suppress” diagnostics. However, all diagnostics will print. The “Cleared” or “suppressed” diagnostics print with an asterisk “*” beside the diagnostic. If you are printing diagnostics for a state, only that state’s diagnostics will print.

Print and Print Preview

Print Preview provides a view of a completed return exactly as it will print, with all forms, schedules, supporting statements, transmittal letters, and filing instructions. Multiple print options, including Preparer (All), Taxpayer, and Government copies, allow you to automatically print applicable forms and schedules.

1040 Administrative Information

Administrative Information provides a single place to record taxpayer information (name, phone number, tax elections, special preparation and routing instructions, and so forth). You can also record the budgeted and actual amount of time required to complete the return.

1040 K-1 Reconciliation

Tax Reconciliation offers K-1 reconciliation in spreadsheet format for 1040 tax returns.

1040 Checklists

Use default tax return checklists based on AICPA standards, or create custom checklists to duplicate any checklist currently in use, complete them on-screen, and print them. You can use these checklists to verify the accuracy, thoroughness, and preparation status of a given tax return, ensuring your firm’s use of best practices.

RS Resources/review_audit.htm/TY2021

Last Modified: 06/30/2020

Last System Build: 09/25/2022

©2021-2022 Thomson Reuters/Tax & Accounting.