GoSystem Tax Features

Unlike traditional systems that automate only the processing phase of the tax compliance process, GoSystem Tax automates all phases, including tax and data management, review, and the ability to track figures to source data.

GoSystem Tax provides you with comprehensive tax compliance capabilities that automate federal and state tax compliance processes using a central data collection view called Organizer. You can import or roll over previously imported data and other information to the Organizer from a prior year tax file.

To minimize repetitive data entry, GoSystem Tax carries the appropriate data from the federal entries to the state/local returns that you specify. We build special state allowances and reporting requirements right into the application. You then supplement this information by entering detail for certain tax transactions directly in Organizer.

Organizer centralizes your source data for easy and quick review. Selected forms, workpapers, and trial balance accounts are hyperlinked together, facilitating navigation from output to input. With a simple click of the mouse, you can view supporting detail or an appropriate input dialog from a line on the return.

With GoSystem Tax, you get:

- Tax return management tools

- Comprehensive federal, state, and local return processing capabilities, including tax defaults

- Review, analysis tools, audit trails, and diagnostics that link to data

- Trial Balance and data sourcing

- Tax planning

- Preseason and other services

- Extensive documentation, including help, frequently asked questions, and release notes

- Data mining

Tax Return Management

GoSystem Tax provides you with multiple tools to manage your firm’s tax returns. The GoSystem Tax Browser gives you a familiar browser look and functionality. The features include easy access to your returns, the ability to set or choose criteria to filter your view, the flexibility to change the view to see only the returns and information you need, and firm-level tax defaults by location. Other features include:

- Multi-year return access

- Central access to all return types

- Tax register sorting, filtering, and search capabilities

- Comprehensive tax defaults

- Batch processing capabilities for rolling over tax return data

- Batch processing for Organizer print to the current year

- Batch capabilities for most data and assignment features

- Batch processing capabilities for estimates and extensions

- Milestone, task, and invoicing features for tax return process tracking

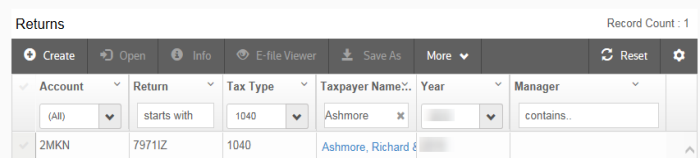

With the RS Browser, you can define the details by setting such display criteria as tax type and tax year. You can now filter your list “on the fly” without going from screen to screen.

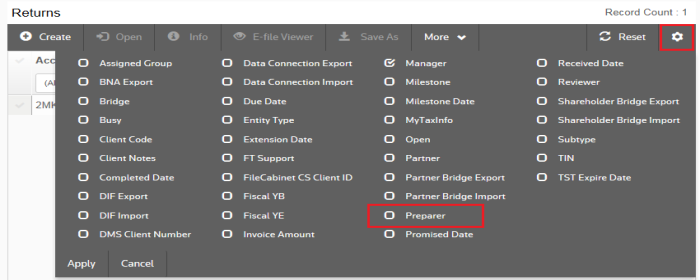

By clicking the gear icon on the right, you can add columns of data to use in filtering and sorting. For example, you can add Preparer as a criterion for filtering.

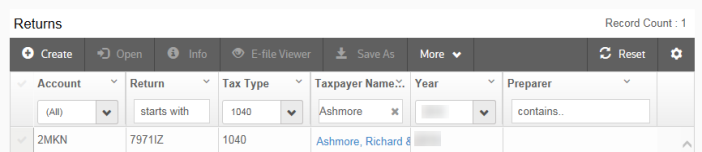

The Preparer column will then appear in the table.

GoTracker

The GoTracker™ module provides due date tracking, setting milestones, tasks, time logging, and invoicing. GoTracker allows firms to set up tasks for monitoring and tracking the workflow of tax returns to completion.

- The Tasks feature first categorizes how time is spent while completing the return. Then tasks are compiled into time logs and may be printed in detail or summary to assist with time-tracking needs.

- Time logs feed the Tax Invoicing system, which creates taxpayer invoices by flat rate, form/schedule, number of pages, time, or any combination of these.

- Tasks can be set up on a firm-wide basis or by location by using default tasks or firm-designed tasks.

- Milestones show the current status of returns, such as Preparation, Review, or Signature. If necessary, you can create a customized return status. You can sort returns by milestones to assist in project management.

Data Mining

FormSource® is the ultimate in tax return data mining. Use FormSource to assist you with multiple tax return management tasks and to secure additional billable engagements. FormSource access allows you to query data from multiple tax years. Following is a list of features and benefits:

- Original data is always secure: Other tax return query products use your live data to produce query results. With FormSource, your original data is secure and untouched. FormSource uses a copy of the tax return data file to ensure that the original data file is secure and untouched.

- Firm-wide Data Mining: Other data gathering tools require multioffice firms to run queries on a site-by-site basis and then merge the data. FormSource allows the Administrator to perform data mining activities on a firm-wide basis, providing a snapshot of firm activities. The unique open data base structure of GoSystem Tax centralizes all data to make it available for data mining.

- Complete customization: Other data gathering tools limit you to restrictive templates and fields. The standard “query” tool offered allows querying on average of 15,000 fields. FormSource enables data mining on almost 600,000 fields. Because you control what is included in your data mining formula, you have complete control and can easily get the information you need when you need it with no predefined templates.

- Data Mine input, output and workpaper fields: Because you may need information that is not necessarily in the printed tax return, FormSource gives you the choice of where you wish to pull the information. FormSource lets you choose entered fields, intermediate calculations, or final calculations to query.

- Data Mining formulas may be saved for use by others: FormSource allows efficient data mining activities. You can take a formula created by others and modify it to meet your needs.

- Display Results in Microsoft Excel: You can display your data mining results in Microsoft Excel for charting and further analysis. You can also copy and paste the results into Word and Access with minimal formatting. Pull names and addresses in with your results and easily create mail merge for efficient client follow-up and mailing.

Prior Year Access

Prior Year Access is access to GoSystem Tax that extends beyond the two most recent available tax year products. GoSystem Tax is sold with a standard license that includes access to the two most recent tax years’ applications. This standard access license lets you create new returns and access existing returns for both years. Access to tax applications beyond the standard two most recent available tax years’ products is an additional option. Products and features excluded from Prior Year Access include, but are not limited to:

- FormSource

- Batch Estimates and Extensions

- Tax Software Conversions

- E-file.

Review, Analysis Tools, and Audit Trail

We provide several features that facilitate analysis and review of tax returns from data entry through computation to tax form output. They include:

- Hyperlinks – ability to trace output amounts to source data

- Workpapers

- Tax forms and Organizers

- Diagnostics with drill-down to the data in question

- Print preview.

Import/Export Products

We provide import/export software for import of trial balance data from various sources. Direct imports are available for common general ledger and audit software packages. Our built-in flexibility allows you to import from any application with export capability.

Predefined import and export formats can be used to transfer Partner and Shareholder information into and out of the tax return.

GoFileRoom

GoSystem Tax is now seamlessly integrated with GoFileRoom, a document management tool that can store and share every document while providing secure, eyes-only access to confidential client information.

GoFileRoom’s tight integration into GoSystem Tax can save you time, money, and effort:

- Streamline tax preparation by organizing all source documents, including workpapers, correspondence, projections, W-2s, and 1099s in one easy-to-access location

- Safely archive audit engagements by storing finalized workspapers and financial statements

- Save space by eliminating bulky file cabinets

- Simplify maintenance by identifying obsolete documents for purging

- Improve client service with quick and easy access to files

- Keep files secure, giving your clients the confidentiality they require.

Tax Planning

Tax Planning software assists in forecasting tax liabilities:

- Current-year planning allows you to change summary amounts, and the system computes the impact of the changes on the overall tax liability. We track planning overrides so that detail and summary data agree.

- Export software enables future-year planning with BNA Income Tax Planner™ spreadsheet software or Planner CS™ software.

Preseason Products and Services

Preseason products and services include:

- Tax Software Conversion

- Rollover software and services

- Organizer print software and services, including customization services

- MyTaxInfo® Web-based Organizer.

CS Integration

GoSystem Tax is seamlessly integrated with the CS Professional Suite.

- For the asset management module, Fixed Assets CS, integration means that you never have to enter data twice.

- With Planner CS, you can import client data directly from GoSystem Tax to save time and effort.

- GoSystem Tax integrates into the workflow of Engagement CS to track the entire engagement from start to finish with advanced reporting and diagnostics. Ending tax or adjusted balances can be seamlessly transferred from GoSystem Tax to prepared required business returns in minutes.

- Use Practice CS to capture every billable activity, accelerate cash receipts, and ensure maximum revenue.

E-file

GoSystem Tax offers e-file for FBAR Form 114, 1040 federal and all states, 1041 federal and selected states, 1065 federal and selected states, 1120/1120S federal and selected states, 990 federal and selected states, and 5500 federal. Tools contained within the GoSystem Tax Browser let you easily monitor and status your e-filed transactions. The easy-to-use interface lets you sort by federal, state or both, and Requested, Awaiting Acknowledgment, Accepted, All, and other statuses. GoSystem Tax also provides standard diagnostics for issues related to e-file.

Anyone who prepares or assists in preparing federal tax returns for compensation must have a valid PTIN before preparing returns.

Tax Defaults

Our software enables you to establish firm-wide defaults to help ensure consistency in your firm. This option provides administrators with processing control and helps avoid redundant data entry. You can roll over tax defaults from year to year to reduce setup time.

Documentation, Training, and Support

We provide integrated help with each application covering software use, tax processing, and administration. Release Notes are located online at this web address: https://helpcenter.thomsonreuters.com/taxapp-release-notes/resources.htm and are also available in PDF format.

The case study tools provide data entry practice using test-type returns, and the user receives immediate feedback through comparison of the return to a master benchmark return.

Various support groups provide extensive assistance with all areas of tax processing, from technical questions to equipment and software installation. We provide both on-site and remote support.

Customer Center, our support web site, provides access to up-to-date documentation, post-release known issues, and other support resources.

For more information regarding our products or to obtain selected software demo copies, visit the Customer Center site.

RS Resources/features.htm/TY2021

Last Modified: 10/20/2020

Last System Build: 09/25/2022

©2021-2022 Thomson Reuters/Tax & Accounting.