Security Options: Redacting Certain Personally Identifiable Information

The IRS has issued Regulation 301.7216-3, providing guidance affecting tax return preparers regarding the disclosure of a taxpayer’s Social Security number to a tax return preparer located outside the United States in order to provide an exception allowing such disclosure with the taxpayer’s consent in limited circumstances.

In most circumstances, such disclosure will not be necessary. In order to protect the privacy of the taxpayer, Thomson Reuters has created a feature that redacts certain personally identifiable information, such as SSNs on tax returns across all tax return types. This feature can be implemented as follows:

- Administrators can enable redaction of certain personally identifiable information at the firm level.

- Administrators can then elect to redact certain personally identifiable information at the group level, so that all accounts assigned to a group will be redacted.

- Administrators can then elect to show certain personally identifiable information for a given return at the return level.

Redacting Information at the Firm Level

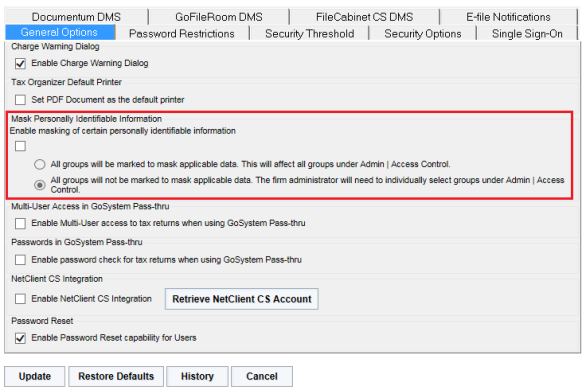

Administrators can choose firm-wide options to apply to all accounts and returns within the firm. To enable redaction of certain personally identifiable information at the firm level:

- Select Admin > Firm Configuration > General Options.

- Select the option to enable masking of personally identifiable information. Masking is the conversion of actual SSN to XXX-XX-NNNN when “NNNN” is the actual last four digits of SSN.

- If you select the option to mask the data in the step above, select one of the following options:

- All groups will be marked to redact applicable data This affects all groups under Admin > Access Control.

- All groups will not be marked to redact applicable data The Administrator must select individual groups under Admin > Access Control in order to keep those groups from viewing certain personally identifiable information.

- Click Update.

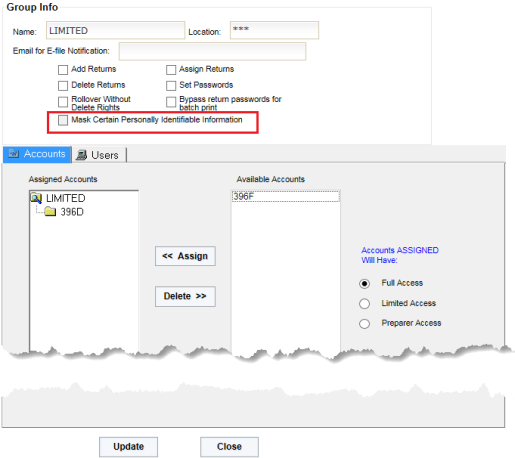

Redacting Information at the Group Level

If the second option under Step 3 above is selected, Administrators must select individual groups for redaction. To do so:

- Select Admin > Access Control > Groups.

- Select the Edit button.

- Select the option to redact personally identifiable information.

- Click the Update button.

A user assigned to a group that has default masking and another group with redacting enabled will inherit the default masking level. The user will be able to view the personal information within the return unless the option is overridden at the return level.

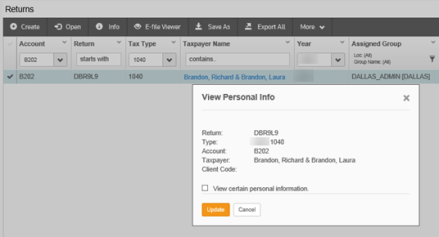

Redacting/Viewing Information at the Return Level

If the firm has enabled redaction of certain personally identifiable information at the firm level, you can unmask the personally identifiable information for a return as follows:

- Select the return to open.

- Select Returns > More > View Personal Information.

- Select the option to view personal information.

- If this box is checked, and you wish to redact certain personally identifiable information, clear the check box.

- Click the Update button.

Redaction: Known Limitations

- The printed return will print with masked data for a user without SSN rights, and will print with unmasked data for a user with SSN rights. The government copy can only be printed by a user with SSN rights. A user without SSN rights could possibly file a paper return (not government copy) with data that has been masked.

- Users with SSN rights have access to Existing Print Files. If a user without SSN rights generated the existing print file, the file will contain masked SSN data. The user can create a new print file to properly print unmasked SSN data. Users need to exercise caution to ensure that the printed return contains unmasked data before filing a return.

- Users without SSN rights do not have access to Existing Print Files. The software cannot mask a print file after it has been generated. We have removed the option to view these artifacts for those users without SSN rights.

- Users without SSN rights do not have access to Batch Estimates and Extensions View/Print option. The print file is generated with unmasked data.

- Users without SSN rights may have access to unmasked data if a compute is not performed before creating the print file. Some states in Individual returns require a full compute in order to mask all print data.

Print Preview

- Users without SSN rights do not have access to Existing Print Preview Files. The software cannot mask a print preview file after it has been generated. We have removed the option to view these artifacts for those users without SSN rights.

- Users with SSN rights have access to Existing Print Preview Files. If a user without SSN rights generated the existing print preview file, the file will contain masked SSN data. The user can create a new print file to properly print unmasked SSN data.

- Users without SSN rights may have access to unmasked data if a compute is not performed before creating the print preview. Some states in Individual returns require a full compute in order to mask all print data.

E-file

All users have the ability to create e-files. The e-files will contain unmasked SSN data. To maintain the security of SSN data, users without SSN rights will be unable to view XML electronic files through the XML E-file Viewer or XML download.

Overridden SSN Data

Overrides of SSN data on Tax Forms and Workpapers will not be masked for users without SSN rights.

Multi-User Access

- The multi-user access is available. The rights assigned to the first user to open the return decides the rights requirements of subsequent users’ access. If the second user has the same rights or higher rights as the first user, the second user will be allowed access and will see the return in its current format (either masked or unmasked). If a user without SSN rights attempts to open a return currently in use by a user with SSN rights, a message will appear informing the user of a rights mismatch.

- When multi-user access is in use and a user enters SSN data, all other users currently in the return will be able to view that data no matter what rights they have.

Export

- Planner CS and To DIF file export options from within a return are not available to users without SSN rights.

- All exported data is unmasked. Because the exported data is used for import and/or the creation of new returns, the data must be unmasked in order to create a viable return and maintain data integrity.

Business Returns

Redaction is not available for business returns.

RS Resources/exp_security_7.htm/TY2021

Last Modified: 03/19/2020

Last System Build: 09/25/2022

©2021-2022 Thomson Reuters/Tax & Accounting.