Assigning Owners of Tax Defaults

Within firms having multiple accounts, the firm administrator may need to assign an owner of the tax defaults for each account number of the firm. By creating location administrators, you can designate an owner of the tax defaults for an account to administrators in a given location.

To assign Tax Defaults:

- Log in as the firm administrator.

- Select Admin > Tax Defaults.

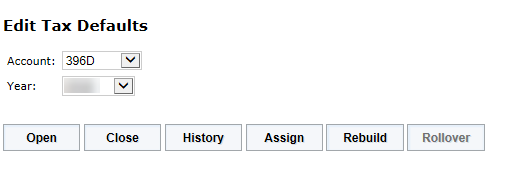

- The screen shown below appears.

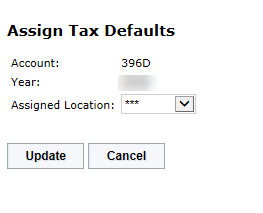

- Firm administrators have an Assign button visible on the Tax Defaults screen. After selecting the account and year, the firm administrator can assign administrators in the designated location as owners of the tax defaults for account 396D. The following figure shows the assignment screen where you can select the location.

This means that any administrator in the selected location can edit tax defaults for account 396D. All returns opened in account 396D will use the 396D tax defaults. No nonadministrator user on account 396D may edit the tax defaults for the account.

This owner designation of the tax defaults for an account gives you control over which administrators can set up and modify your tax defaults.

RS Resources/exp_groups_users_12.htm/TY2021

Last Modified: 03/19/2020

Last System Build: 09/25/2022

©2021-2022 Thomson Reuters/Tax & Accounting.