Customizing Letters and Filing Instructions

There are two ways to customize your letter or filing instruction for a given return.

Optional Paragraphs

Optional Paragraphs allow you to select to include or exclude them from the print. Some optional paragraphs have conditions around them that will cause them to only trigger if those conditions exist in a given return.

For example, the IRA section in 1040 is an Optional Paragraph, but simply checking to include it will not make the content print. The return also has to have IRA information entered in to it to trigger the print.

Conversely, if a return does have IRA information entered in it, but you chose to exclude the Optional Paragraph related to IRA, it will not print.

Optional Paragraph selections will roll over from year to year, so that the selections made in a 2020 return will be in effect for the 2021 return.

Preparer Sections

The second level of customization you may have available is a Preparer Section. An administrator in your firm who has rights to Letters and Filing Instructions can set up a section that will allow you to type any content you wish to include in the printed letter or filing instruction for that return. Any text you enter in this area will be saved with the return and printed each time you print (unless you go remove the text from the section).

There are three types of Preparer Sections:

- Default Preparer Sections

- State Specific Preparer Sections

- Advanced Preparer Sections

Text you type in to a Default Preparer Section or Advanced Preparer Section will print for all states on that return. Text you type in to a State Specific Preparer Section will print for that state on that return instead of the text in the Default Preparer Section. Only one Preparer Section per State per return can be created.

Preparer section content will roll over from year to year, so that text entered in a Preparer Section in 2020 will also be there in 2021. You must go to 2021 and remove it from the locator if you do not wish to have it print in the 2021 letter or filing instruction.

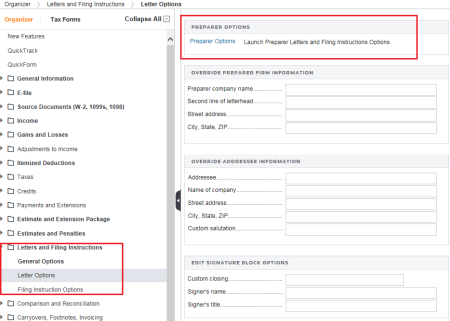

To access the Preparer Options screens for all return types, click the Preparer Options button that is located at the top of the Letter Options screen and also at the top of the Filing Instruction Options screen.

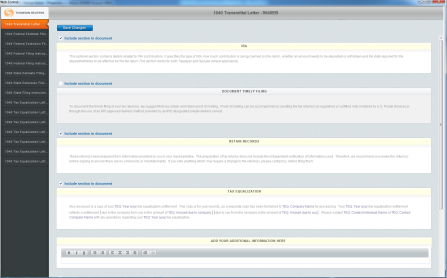

Once you click to launch the Preparer Options screen, a window will open showing you all that is available for your selection and input.

You will notice the various letters and filing instructions listed down the left – this list shows all letters and filing instructions, in the system, where there are options or input available.

For Optional Paragraphs, you will be able to check or uncheck the box to include/exclude that content in your printed letter. The screen below shows both an included and an excluded optional paragraph. Your selections will be saved with the return so that you do not have to continually make those selections.

Be sure to click Save Changes before navigating away from the screen.

Clicking the title of the filing instruction or letter at the left will change to another set of Optional Paragraphs.

If there is a Preparer Section available for you, you will see it in any place on the screen, and you may see more than one. The key for a Preparer Section is the blank area you can type in, under the Section header/title.

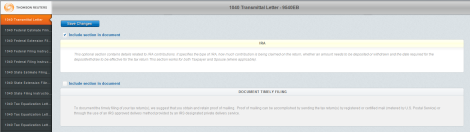

The space will expand as you type more text and it will word wrap.

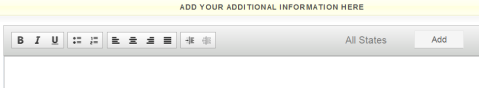

The original Preparer Section that displays is considered the Default Preparer Section and has All States shown on the tool bar. Any text entered in this Section will be in the Filing Instructions for each State on this return that does not have a State Specific Preparer Section.

When you click the Add button, you will be presented with a list of states to select from. After the state is selected, a Preparer Section specific to that state will be displayed directly below the Default Preparer Section.

As shown below, a Preparer Section has been added for 1120 Alabama. Any text entered in this Section will be on the 1120 Alabama Filing Instructions for this return instead of the text entered in the Default Preparer Section.

You are also able to do the following in a Preparer Section:

- apply font formatting (bold, italic, underline) (in red)

- change the justification of the text (in blue)

- create a bulleted or numbered list (in green)

- change indention on the text (in purple).

If your administrator has allowed an Advanced Preparer Section, any text entered in this section will be in the filing instructions for each state in the return. You cannot apply changes to a specific state like you can with the Default Preparer Section.

The Advanced Preparer Section allows you to enter and edit text like the Default Preparer Section, but provides additional features that the Default Preparer Section does not.

In addition to the formatting options available to the Default Preparer Section, you can do the following in an Advanced Preparer Section:

- insert tables (in green)

- insert field references (in blue)

- insert conditions to control print (in red).

Any text you enter in a Preparer Section will save with the return and print each time you print the Letters and Filing Instructions. Be sure to click the Save Changes button before navigating away from the screen so that your text will be saved.

The last step for letters and filing instructions, at the preparer level, is to print the documents. By clicking Print or Print Preview, you will see your transmittal letter and your filing instructions.

The transmittal letter will now reflect what is being printed, instead of what is activated in the return. For example, if you choose to print only the Alabama and Pennsylvania returns, a transmittal letter will print and the forms listing will show only the Alabama and Pennsylvania forms.

Letters and Filing Instructions/user_customizing_lafi.htm/TY2021

Last Modified: 08/13/2020

Last System Build: 10/19/2021

©2021-2022 Thomson Reuters/Tax & Accounting.