Viewing Default Templates

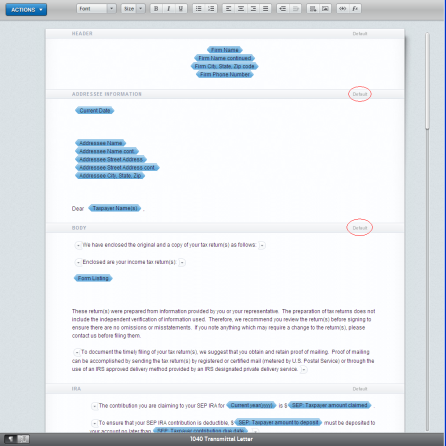

To view and/or edit the template, click anywhere in the icon above the template name. The template opens and displays in the Editor.

Once the template is open, you can begin reviewing and customizing the template to reflect the communication style of your firm.

When the template is first opened, all the sections have an indication in the header bar of Default. When you customize the template and save those customizations, you will see the Default change to Custom. When you customize a section, you “own” the contents of that section and will not get any automatic updates from Thomson Reuters. You will be provided information on any updates made, but the updates will not be pushed to that Custom section of the template (this will keep any customizations made intact and will not delete changes to update the template with a new default).

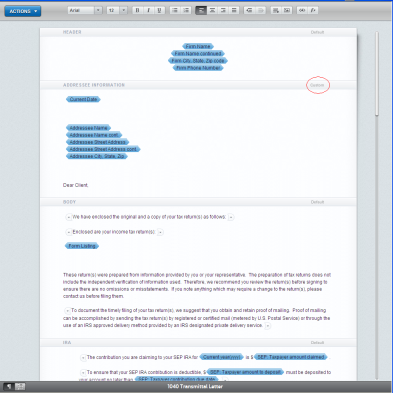

In the figure below, the field reference for Taxpayer Name(s) in the Addressee Information section has been changed to the typed word of Client.

Customizations are tracked on a section-by-section basis so that, if an update is released to the Addressee Information and the Body sections of this 1040 Transmittal Letter template, the above template would receive the updates to the Body section but would not receive any update to the Addressee Information section.

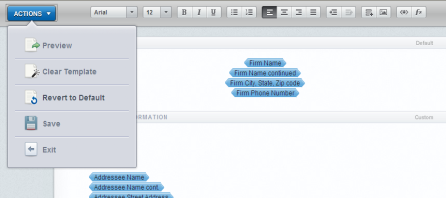

After saving customizations, a new menu item under the Actions menu allows you to revert the entire template back to the Thomson Reuters supplied default template. You can use this action item at any time to return to the default template (even after changes have been saved and the template has been closed). Once you revert to the default template, your custom template is removed, and you will have to begin customization from scratch.

To add text inside a Template, position the cursor where you want the text, and begin typing.

Letters and Filing Instructions/admin_viewing_default_templates.htm/TY2021

Last Modified: 08/26/2019

Last System Build: 10/19/2021

©2021-2022 Thomson Reuters/Tax & Accounting.