Previewing the Template

You can preview the letter or filing instruction with sample data applied. Click or hover over the Actions button in the upper right corner of the template page, and then select Preview.

The template is brought up in a preview page (this initial, quick preview contains no page breaks, so it is one long page previewing).

The tax return field references that are included in the template display a value in the preview. This value is currently the default preview data supplied with the Letters and Filing Instructions module.

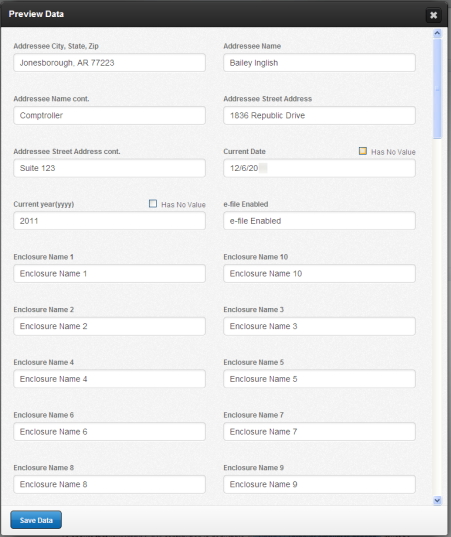

You can change these field references by clicking the Edit Preview Data button inside the preview. The Edit Preview Data dialog will show all available field references in a given template, including those used in conditions. These values are customized on a template-by-template basis. The preview data fields are listed alphabetically.

After making changes, click the Save Data button at the bottom of the window.

For preview data for the Form Listing, each form is separated by a comma. Putting commas in the Preview Data field for Forms Listing is equivalent to the Enter key.

To test conditions using sample data, change the value in the Preview Data field for the condition.

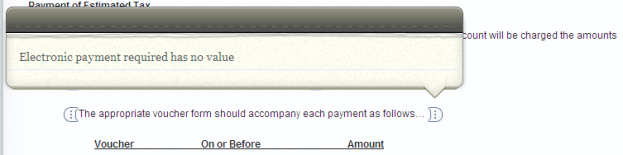

Example: For the condition below, change the value (in Preview Data) for Electronic payment required to blank (having no value). This causes the sentence contained in this condition not to display.

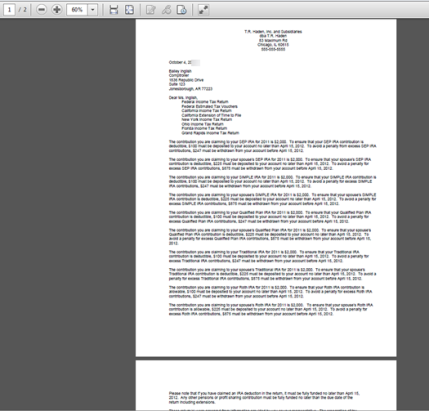

- To preview the letter with page breaks, click the To PDF button in the preview window.

- You will get a prompt to enter a Letterhead.

If you want to preview the template with the default header and footer or with your new header and footer created in Letters and Filing Instructions, click Preview PDF without entering anything. - A new window will open showing you what a printed version of your letter or filing instruction, with Preview Data, will look like (including page breaks and footers).

Letters and Filing Instructions/admin_previewing_template.htm/TY2021

Last Modified: 08/22/2019

Last System Build: 10/19/2021

©2021-2022 Thomson Reuters/Tax & Accounting.