Short-Year Rollover: Rolling Over the Return in RS Browser

The browser path to Short Year Rollover begins with selecting the Returns Processing tab in the top menu, and then Preseason Processing > Preseason in Your Office. This is the same path that is normally used to rollover returns. A new option, Short Year Rollover, is now available in the navigation pane on the left side of the screen.

To access the Short Year Rollover option in the Browser:

- In the Browser, select Returns Processing in the top menu.

- Select Preseason Processing > Preseason in Your Office.

- Select Short Year Rollover > Select Returns.

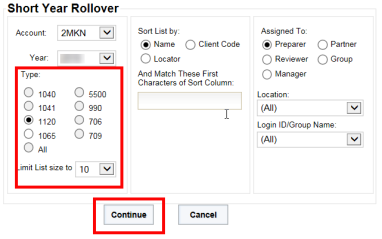

- The Short Year Rollover screen displays the same set of choices that are used to define a regular return or rollover locator, but unlike those returns only the 1065 or 1120 return Type can be selected. Select the search criteria, and then select the Continue button.

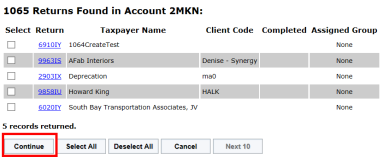

- On the next screen, select the return to rollover by selecting the check box by the name. Then, select the Continue button.

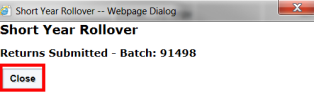

- The Short Year Rollover dialog box is displayed. Select Close.

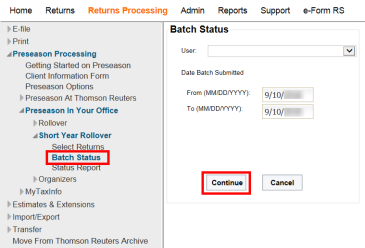

- On the menu, select Preseason Processing > Preseason In Your Office > Short Year Rollover > Batch Status.

- Enter the Date the Batch Submitted (From and To). Select Continue.

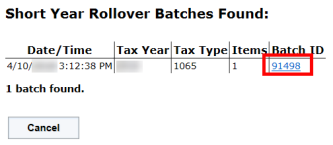

- Select the Batch ID link on the Short Year Rollover Batches Found screen.

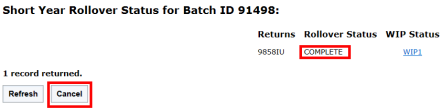

- A dialog box confirms the Rollover Status is Complete. Select Cancel.

RS Browser/short_year_rollover_2.htm/TY2021

Last Modified: 02/13/2020

Last System Build: 02/03/2022

©2021-2022 Thomson Reuters/Tax & Accounting.