FormSource: Example - 1040 Clients Benefiting from Education Expense Planning

A firm wants to expand its tax planning practice by contacting clients that could receive a tax benefit from starting educational savings accounts for qualified dependents.

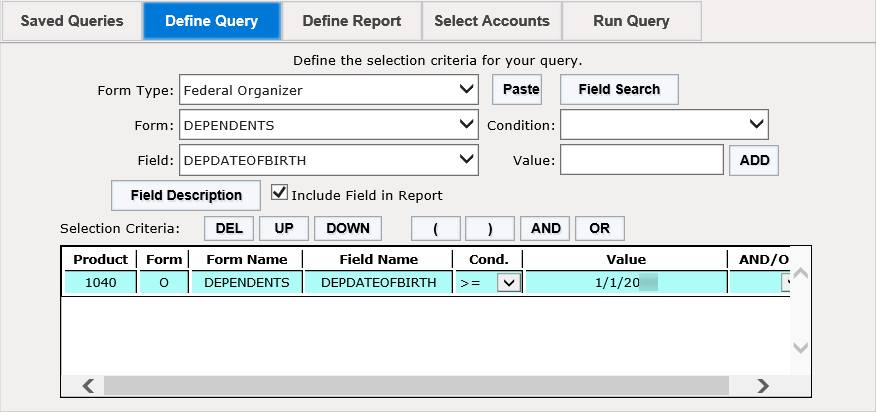

Query Criteria

One way to accomplish this is to search for all 1040 clients with dependents who are age of 18 or under during the year (born after 12/31/2004. The dependent date of birth is found on the federal Organizer:

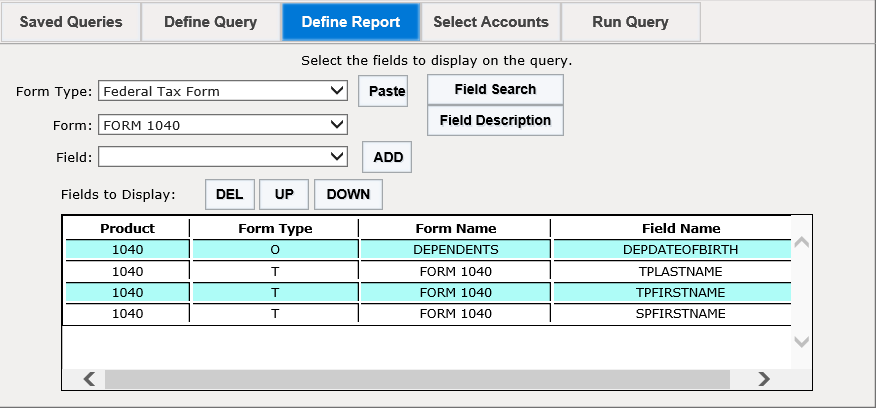

Reports Field Example

RS Browser/fs_examples_2.htm/TY2021

Last Modified: 03/25/2021

Last System Build: 02/03/2022

©2021-2022 Thomson Reuters/Tax & Accounting.