FormSource: Example - 1040 IRA Required Minimum Distribution Reminder Letters

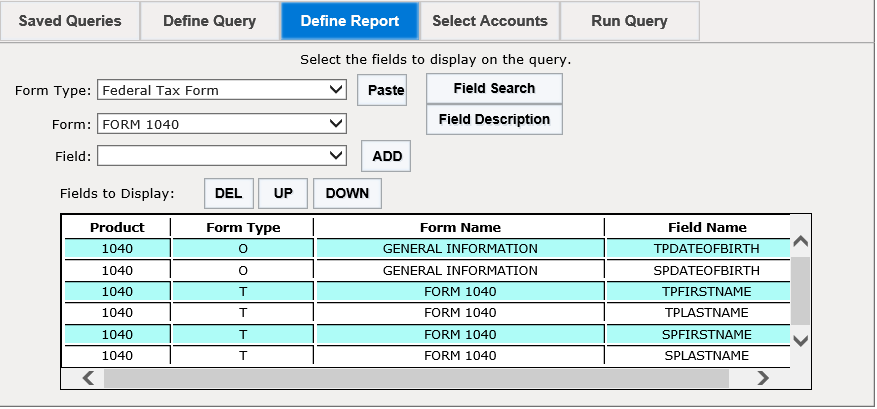

A firm needs to contact clients who reach age 70-1/2 at any time during the year in order to inform them of the IRA rules regarding required minimum distributions. The query results should include the taxpayers’ names.

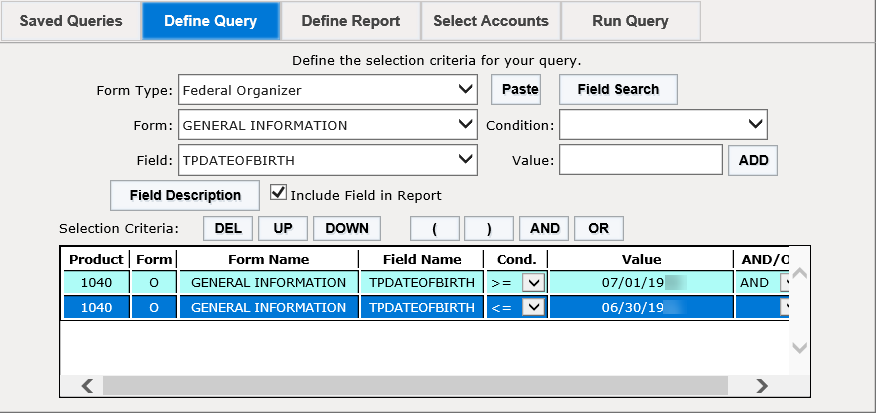

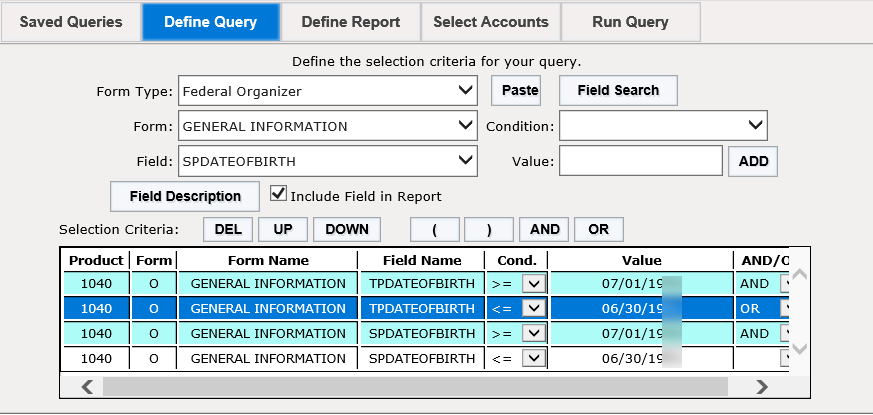

Query Criteria

To identify the clients, query the 1040 tax returns for all taxpayers and/or spouses with a birth date between July 1, 1951 and June 30, 1952. The taxpayer and spouse dates of birth are used on the 1040 tax return to determine if the age 65 or older exemptions apply. These dates do not appear on the tax return, so you would find this information on the federal Organizer screen.

Report Fields Example

RS Browser/fs_examples_1.htm/TY2021

Last Modified: 03/25/2021

Last System Build: 02/03/2022

©2021-2022 Thomson Reuters/Tax & Accounting.