1065/1120 Mandatory State Members E-File Requirement

Currently the states of Alabama and New York Business Returns (tax types 1065 and 1120) require that all members of a consolidated group (parent, subsidiary, etc.) must be submitted separately for e-file. When a lower member return containing either of these two states are brought into an upper level consolidated return and qualified for e-file, not only does the top level return have to be submitted for e-file, but each of the lower members of the group must be qualified and submitted as well.

To do this, we have included a search feature unique for those two states. To e-file either Alabama or New York, go to the Returns Processing > E-file > Select Returns menu.

Consol Display Option

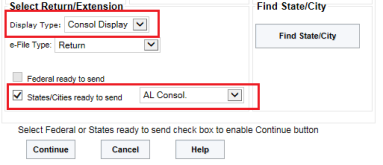

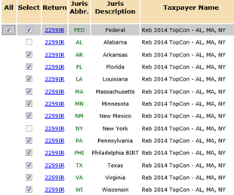

- On the Select Returns/Extension options, choose the Consol Display Type and the Return E-file Type as shown below:

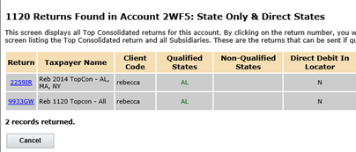

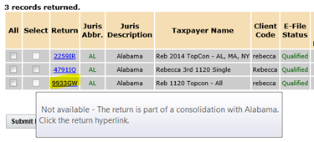

- The results will display the top and member returns for either Alabama or New York. In this case, only the Alabama consolidated returns will show since Alabama was selected on the previous page.

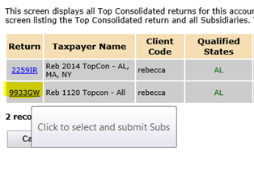

- In order to submit the Alabama consolidation return along with the lower members, you MUST click the hyperlink of the top consolidated return.

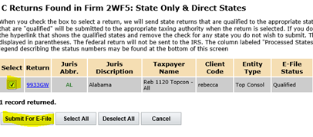

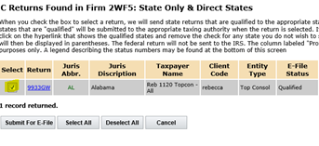

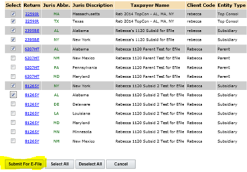

- On the next page, the Alabama return will be shown along with the Select check mark or hyperlink option.

- When the return is selected, click the Submit For E-File button to complete the Alabama consolidated e-file submission process.

- When you click the Submit for E-File button, the Alabama (or New York) topcon and all members of the selected consolidated return will be submitted to the Alabama (or New York) taxing authority.

Regular Display Option

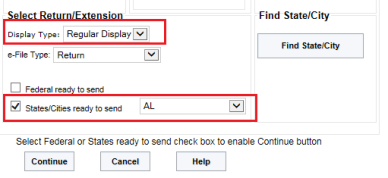

- When the Display Type is Regular, the E-file Type is Return, and the States/Cities option is Alabama, you will see a list of all Alabama returns whether they are Single or Consolidated returns.

- All check boxes displayed beside Alabama (or New York) consolidated returns are grayed out and are not available to Submit For E-File. A message will pop up reminding you to submit this return with the entire consolidated group. Click the hyperlink on the subsidiary return ID.

- Since this top consolidation return includes a qualified Alabama XML, you must click the hyperlink as shown above.

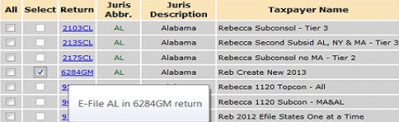

- From the second Return Found screen, you must check the Alabama return to submit for e-file.

Note that now a check box is active and the return’s hyperlink is available. Either option will allow you to submit the Alabama topcon and all its members to the Alabama taxing authority.

Single Alabama or New York Forms

You can submit single returns on the Regular Display option from the first Returns screen by clicking the hyperlink or putting a check mark in the Selected column. In this case, this return has a Single Alabama return ready for e-file.

Regular Display with All States Option

When the All States/Cities E-file option is chosen, the results on the Returns screen will show all qualified states and cities for all entity types.

Single company returns with Single Alabama and/or New York will allow you to submit these two states in the same way as all other Single company jurisdictions. Simply check the All check box or the Select box or hyperlink for any or all of the Single company states.

Considerations for Other States

Consolidated New York and Alabama must be accessed from the Alabama or New York hyperlinks in order to e-file the parent, subsidiary and consolidated returns. If you click the Select All option on the initial Returns screen, the Alabama and/or New York consolidations will NOT be submitted.

For consolidation companies with states other than Alabama and/or New York, you have two options for submitting these other states for e-file.

- From the Returns screen: All the qualified states will display and be available to submit for e-file except for Alabama and New York. Check the Select option next to the states and click the Submit For E-File button at the bottom of the screen. All states other than the two mandatory states can be submitted to their respective jurisdictions from the first Returns screen.

- From the Alabama or New York hyperlink: If an Alabama or New York consolidated return is grayed out on the initial Returns page, then you must click the Alabama or New York hyperlink. The results will give you the same list of qualified states as above, but now you can submit the Alabama and/or New York parent, subsidiary, and consolidated returns as well.

From this hyperlink on the initial Returns screen, review and check the Select box next to each jurisdiction that is part of your Alabama and/or New York consolidated group as well as all Alabama and/or New York consolidated group members. All state returns checked on this Returns screen will be submitted for e-file when you click the Submit For E-file button at the bottom of the screen. If you prefer, you may submit the returns by using the jurisdiction’s hyperlink.

E-file/rs_efile_viewer_8.htm/TY2021

Last Modified: 08/13/2020

Last System Build: 08/30/2022

©2021-2022 Thomson Reuters/Tax & Accounting.