Statuses, Cumulative Histories, and Acknowledgments

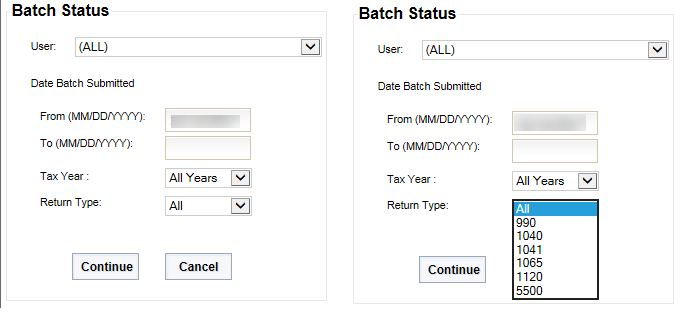

Batch Status

Once a return is e-filed, Thomson Reuters begins tracking the stages the return goes through before final acceptance.

One way to review the e-file processing stages is as follows:

- Select Returns Processing > E-file > Batch Status.

- The Batch Status options will default to your login ID, today’s date, All Years, and All Return types. Use the drop-down lists to refine your choices:

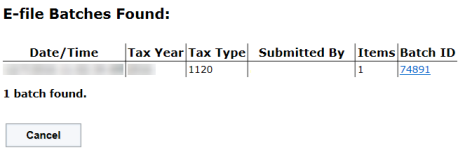

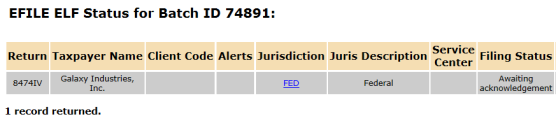

- The batch ID and batch detail will appear based on your criteria. Double-click the batch ID hyperlink, and the e-file processing status will display.

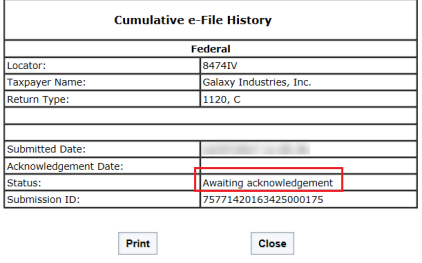

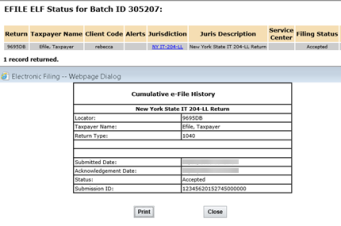

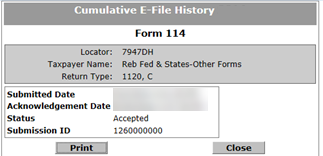

Cumulative E-File History

When you double-click any jurisdiction hyperlink on the E-file Batch Status list, a Cumulative History report will appear showing current and previous e-file histories for that particular jurisdiction.

The following shows the Batch Status Report and Cumulative History for the recently submitted return:

After the state has processed the NY IT 204-LL, it will send the Accepted notification to Thomson Reuters. We will update the Batch Status and Cumulative History Reports to show the acceptance.

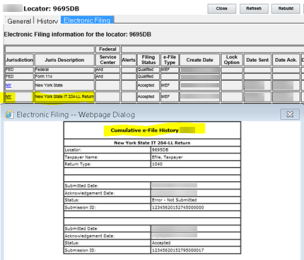

Return Information E-file Tab

Another way to review the Cumulative History for a jurisdiction is on the returns list where the specific returns are shown.

- Select Returns on the top menu. Enter the criteria and options for finding your e-filed return.

- Place a check mark next to the return to activate it.

- Select Info.

- Select the E-filing tab and review the results.

- Select the jurisdiction hyperlink to show the Cumulative History again.

The e-Filing tab contains the following information:

- jurisdiction code

- jurisdiction name

- service center for federal

- alerts

- filing status (see note below)

- e-file type

- creation date

- lock option

- date sent

- date acknowledged

- DCN

- debts

- PIN (federal)

- EIC (federal)

- direct debit acknowledgment received

- direct debit in locator.

Click the filing status to display a printable summary of the e-file, including the following information:

- report date

- account number

- tax type

- taxpayer name

- locator number

- tax year

- federal

- severity of error

- form number

- form occurrence number

- field sequence number

- page number

- message

- rule number

- XML path

- error message, including links to the e-file reject help system for more information.

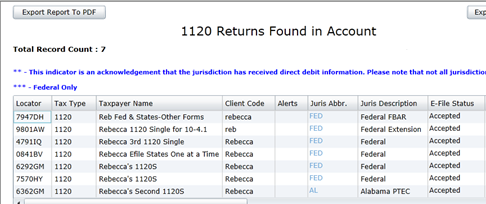

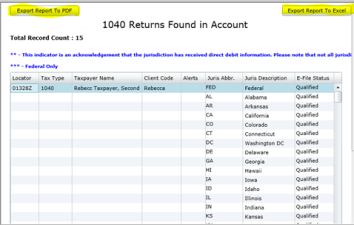

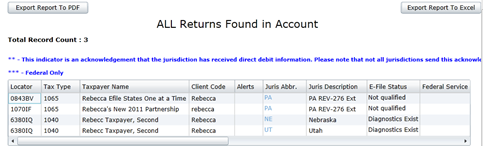

E-file Status Report

The E-file Status Report is found in under the Returns Processing > E-file menu or the Reports menu. This report displays the status on a return-by-return basis of the various stages of e-filed returns and returns that are not yet ready to be e-filed.

Search for returns and jurisdictions on the E-file Status Report as follows:

- Go to Reports > E-file Status Report to enter your search criteria and options.

- Choose the search criteria, sorting and filtering choices that will give you the information you want.

- Make choices for either or both federal and states jurisdictions at the bottom of the E-file Status Report options page.

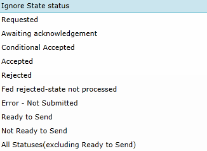

- Listed below are the federal and/or state search options and what they do:

- Ignore Federal or Ignore State: This option lets you further refine your search criteria and limits the time and volume of data produced in the Status Report.

- Requested: This option shows the jurisdictions that have been acknowledged but have not yet been reviewed by the taxing authority.

- Awaiting Acknowledgment: This option will show you which returns and jurisdiction have been successfully transmitted but have not yet been through the receiving process of the taxing authority.

- Conditional Accepted: The return is accepted with conditions.

- Accepted: Choose this option to list the returns and jurisdictions that have been successfully transmitted and accepted by the taxing authorities.

- Rejected: Choose this option to see which jurisdictions have been submitted to the correct taxing authority and have been rejected by them. When returns show with this status, you must correct the reason for the rejection and resubmit the tax form.

- Fed rejected - state not processed: If the federal return and state return are submitted together, and the federal return is rejected, the state return will not be processed. The following 1040 states require that the federal return be filed with the state return: Alabama (residents only), Arizona, Arkansas, Kansas, Michigan (only if federal 8879 is used), Mississippi, Oklahoma.

- Error - Not Submitted: This status will list returns that encountered errors during the transmission of submitted jurisdictions. Returns with this status will need to be resubmitted to the taxing authorities.

- Ready to Send: Qualified jurisdictions not yet submitted will be shown on the report when this option is chosen.

- Not Ready to Send: This option will show you which returns and jurisdictions still have e-file diagnostics in the return’s Organizer or other disqualifications that prevent them from being successfully e-filed.

- All Statuses (excluding Ready to Send): This option will show you all of the returns that have been submitted for e-file and all the current statuses for each jurisdiction within each submitted return.

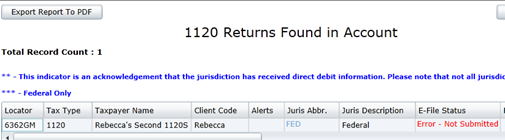

E-file Status Report Results

- Option chosen: Error Not Submitted

This option is for both federal and state jurisdictions for both returns and extensions (All E-file Types). This option will list the submitted returns that, for any reason, cannot finish the submission process.

- Option chosen: Accepted status for both federal and states looks like this:

Clicking the hyperlink on a listed jurisdiction abbreviation will display the Cumulative History Report for the selected jurisdiction.

- Option chosen: Ready to Send for both federal and states produces a Status Report like this:

You can export this report to a PDF format or an Excel spreadsheet.

- Option chosen: Not Ready to Send – states only for All Tax Types

E-file/rs_efile_viewer_7.htm/TY2021

Last Modified: 08/07/2020

Last System Build: 08/30/2022

©2021-2022 Thomson Reuters/Tax & Accounting.