Business Returns E-file: Viewing Status of Returns and Extensions

Once the return is e-filed, Thomson Reuters receives an acknowledgment from the IRS and other taxing authorities that the return was filed.

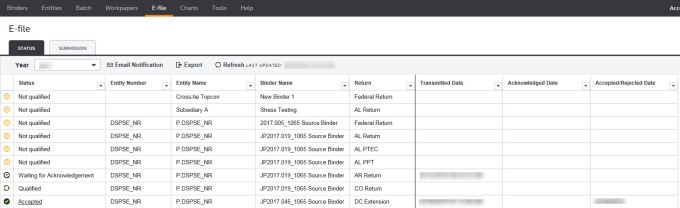

To view the status of e-filed returns or extensions:

- On the Income Tax menu bar, select E-file.

- On the Status screen, select the tax year from the drop-down list. The system generates a list on the screen.

- When you open this screen for the first time, the system populates it with the current year returns that have e-filing XMLs. To view a different year, select the year drop-down list at the top.

- Use the sort/filter features on each column header (Company, Entity, Binder, Return, Status, Transmission Date, Acceptance Date) to customize the report. The system maintains all your settings by default.

- Select the return to open the Electronic Filing View Details for more information about the status of that return.

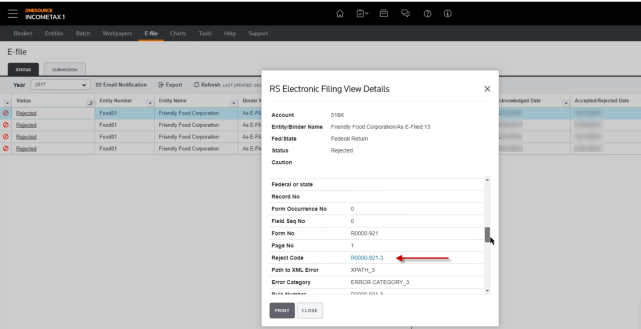

- If a return has a Rejected status, open the Electronic Filing View Details screen.

- Go to the Reject Code and click the link for the code to see more information about the reject code.

Click here to open the E-file Reject Code help to see more information for all reject codes.

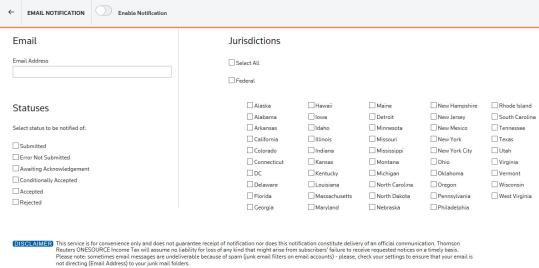

- Select Email Notification to receive emails based on the return status.

- Toggle on Enable Notification.

- Select the options that apply to receive notifications about the returns.

E-file/oit_ef_steps_9.htm/TY2021

Last Modified: 08/10/2021

Last System Build: 08/30/2022

©2021-2022 Thomson Reuters/Tax & Accounting.