Business Returns E-file: Creating the E-file

- Select Organizer > Federal E-file > Create E-file.

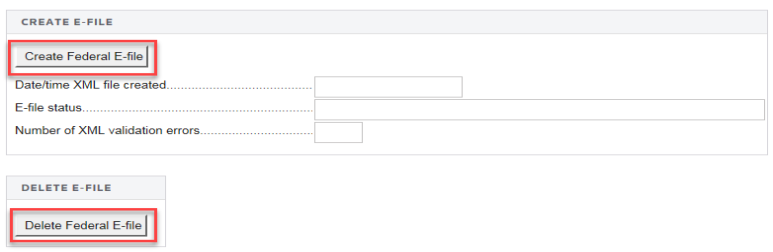

- Select the Create E-file button.

- An XML file is created. When completed, a date/time stamp is displayed and the e-file status is given. If the return contains a reject e-file diagnostic or XML validation errors, the e-file status section displays a message stating that the XML file was created, but is not qualified to be e-filed.

- The reject diagnostics and XML validation errors must be cleared and the XML file is re-created.

- Select the Delete Federal E-file button to delete an existing federal e-file.

Possible E-file Status Statements

The possible status statements that can be displayed in the E-file Status section are:

- Created, but Not Qualified: The e-file (or extension e-file) has been created for viewing, but cannot be transmitted until the reject diagnostics and XML validation errors are corrected.

- Qualified: E-file return (or extension) can be transmitted.

- Sent, Started, Transmission, or Waiting: Each of these statuses indicates that the e-file return is being processed. The e-file cannot be recreated while the return shows this status.

- Rejected: The return has been rejected by IRS (or state authority). The condition causing the reject should be corrected and the e-file recreated and retransmitted.

- Accepted: The IRS (or state authority) has accepted the return.

E-file/oit_ef_steps_7.htm/TY2021

Last Modified: 03/20/2020

Last System Build: 08/30/2022

©2021-2022 Thomson Reuters/Tax & Accounting.