FinCEN Report 114: General Requirements

Click here to download a PDF copy of this guide.

In e-filing your FBARs through our software, you will be using some of the same basic steps used when e-filing a tax return.

- Complete and review your FBAR(s) within a return. Only one FBAR can be prepared in a return, with the exception of 1040 returns.

For 1040, separate FBARs can be prepared for taxpayer and spouse.

Multiple financial accounts can be included on a single FBAR.

FBARs for Individual Filers must be prepared within the 1040 returns.

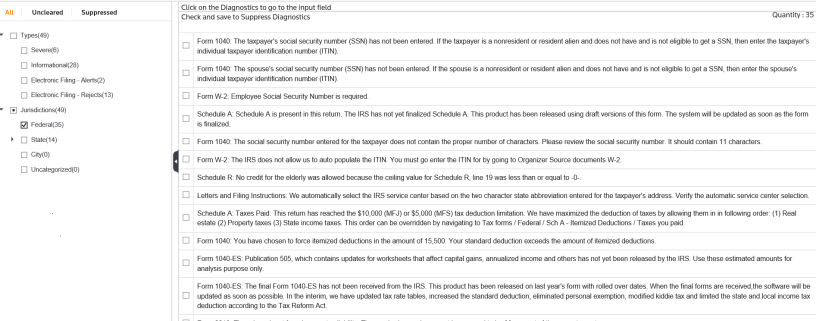

- Run a full re-compute of the return and then generate a validation file. In the e-file folder within the FBAR Organizer, generate the validation file. Rather than programming an extensive list of reject diagnostics, input errors and omissions are detected using the validation process. With an XML file generated for validation, errors are accessed through the View > Diagnostics > Efile XML Validations Errors > FBAR menu. Each error explains the specific item that must be completed, and double-clicking takes you to the specific field in the FBAR for correction. Repeat this process until all errors are eliminated.

1040 Returns: Within a 1040 return, separate FBARs can be prepared for taxpayer and spouse. If separate FBARs are prepared, separate validation files should be generated. But note that the validation errors shown under View > Diagnostics only display errors from the last generated validation file. Therefore, generating a validation file and correcting errors for one FBAR before validating the second FBAR might be more efficient.

- Create FBAR e-file and review using the E-file Viewer. After eliminating all errors through the validation process, create the FBAR e-file in the e-file folder within the FBAR Organizer. The E-file Viewer displays the contents of the FBAR. While the e-file that is transmitted to FinCEN is a text-based file, the E-file Viewer displays information as an XML file. The FBAR information can also be viewed as a PDF file.

1040 Returns: If separate FBARs are prepared for taxpayer and spouse, separate FBAR e-files should be created. The E-file Viewer displays both the taxpayer and the spouse FBARs as separate files.

- Submit the qualified FBAR e-file.

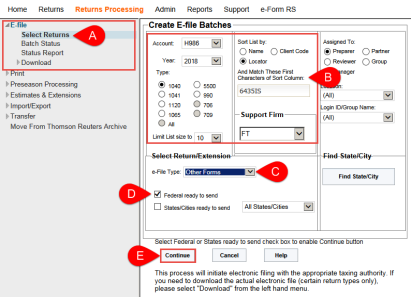

- In RS Browser, select Returns Processing > E-File > Select Returns.

- On the Create E-file Batches screen, enter the Account, Year, Type, and Sort List by information.

- Select Other Forms for the E-file Type.

- Select the Federal ready to send check box.

- Click Continue to display the qualified FBARs meeting your search criteria.

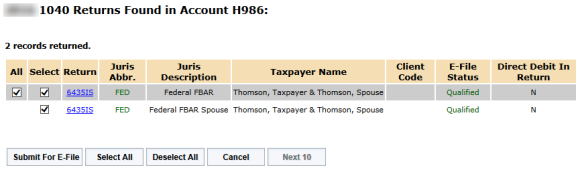

1040 Returns: If separate FBARs are prepared for taxpayer and spouse, and both FBARs are qualified, each FBAR is displayed in the search results. Each FBAR is displayed with identical locator numbers and taxpayer names.

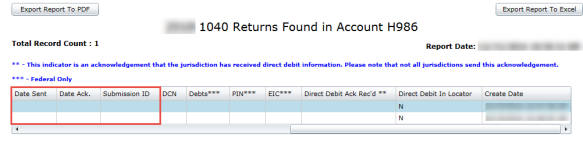

Example of taxpayer and spouse FBARs are shown below:

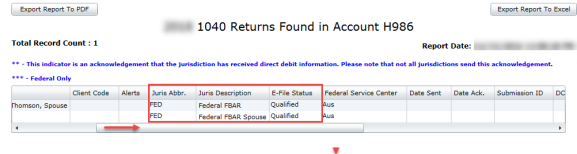

- Monitor the e-file status.

- In RS Browser, select Returns Processing > E-File > Status Report.

- Select your search criteria on the E-file Status screen, and then click Continue.

- Use the scroll bar to display the FBAR e-files, which are shown in the Juris Description column with the status displayed in the E-file Status column.

- Slide to view the Cumulative e-File History. The acknowledgment information when received is shown in the Date Sent and Date Ack. columns. The Submission ID, also known as the BSA Identifier, is issued by FinCEN. You will need the BSA Identifier if filing a corrected FBAR.

E-file/fbar_gst_1.htm/TY2021

Last Modified: 06/12/2020

Last System Build: 08/30/2022

©2021-2022 Thomson Reuters/Tax & Accounting.