990 E-file: Enabling E-file

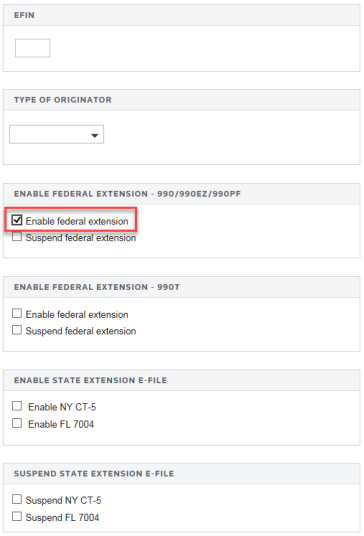

- On the Organizer tab, select E-file > Extension > Enable E-file > Enable E-file.

- Enter the EFIN (a six-digit number assigned by the Andover IRS service center).

- Select the type of originator: ERO, Online Filer, Reporting Agent, IRS Agent, Financial Agent, or Large Taxpayer. The default is None selected.

- Check the box to enable e-file for the applicable federal extension (990/990EZ/990PF or 990T).

- If you wish to suspend an extension, check the box to suspend e-file for the applicable first or second federal extension.

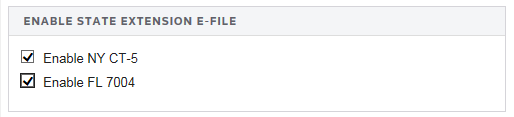

- To enable a state extension, select the check box for the applicable state.

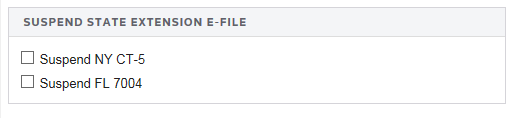

- To suspend a state extension, select the check box for the applicable state.

Deleting the E-file

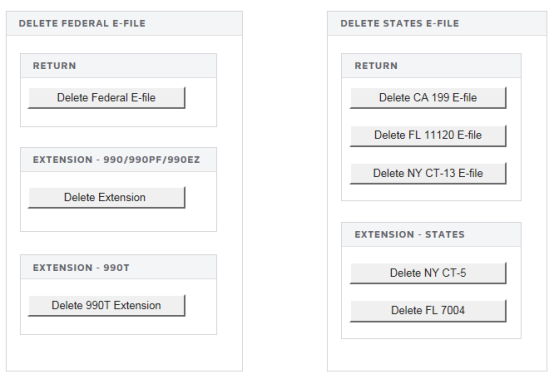

- On the Organizer tab, select E-file > Extension > Enable E-file > Delete E-file.

- Select the e-file you wish to delete (federal, first or second extension, and/or state e-file and/or extensions).

- Click the appropriate button.

E-file/990_ef_extensions_4.htm/TY2021

Last Modified: 08/13/2020

Last System Build: 08/30/2022

©2021-2022 Thomson Reuters/Tax & Accounting.