1120 E-file: Aggregating International Forms from Returns Created with Third Party Software

To aggregate XML files, attach the XML file of the other return to the primary return.

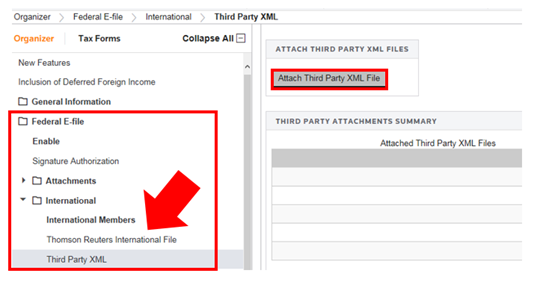

- Within the primary return, in Organizer > Federal E-file > International > Third Party XML, select the Attach Third Party XML File button on the Third Party XML screen.

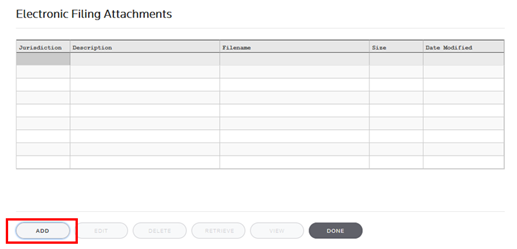

- On the Electronic Filing Attachments window, select Add.

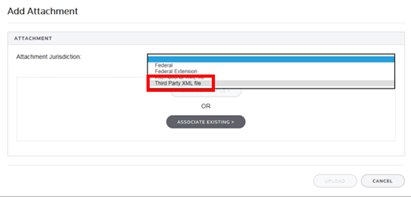

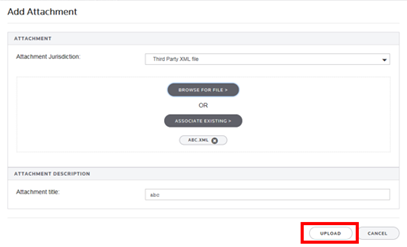

- On the Add Attachments dialog box, select Third-Party XML File from the drop-down list, and then select Next.

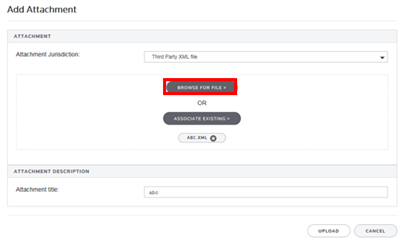

- Select Browse for File and select the applicable XML file.

- Select Upload to attach the file.

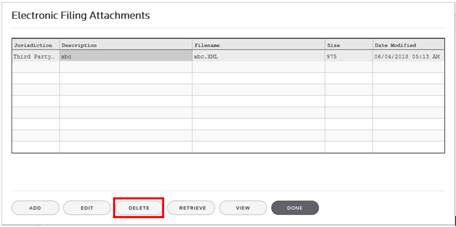

- Repeat this process for each XML file to be included. Select Done when finished.

To delete third party XML files, highlight the attachment on the Electronic Filing Attachments screen, and then select Delete.

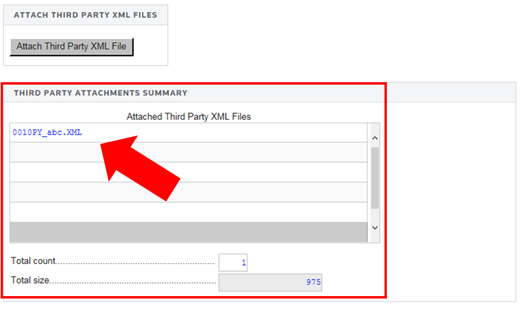

- After attaching all the XML files, confirm that the XML attachment details are correct in the Third Party Attachments Summary on the Third Party XML screen.

The attached XML file names include the locator number of the primary return.

- The attached XML files must be validated to detect XML errors. Select the Validate Third-Party XML File button on the Third Party XML screen.

If validation errors exist:

- Delete the attachment.

- Use the third-party software to correct the error.

- Recreate a new XML file.

The aggregation process cannot be completed if any third party XML files contain validation errors.

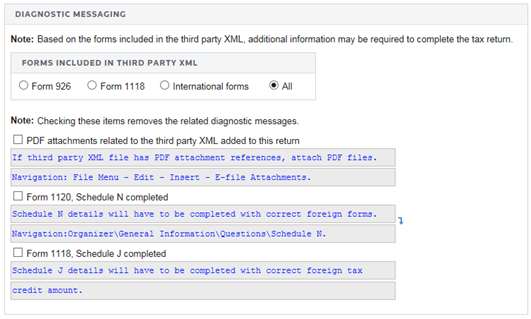

For corporate returns only, the items listed below are not automatically updated during the aggregation process. Information about these items is located in the Diagnostic Messaging section on the Third Party XML screen. Reject diagnostics will exist until these items are checked:

- PDF files (if applicable) have been attached,

- Schedule N Questions have been answered regarding foreign forms now included in the return, and

- The foreign tax credit is correct on Form 1120, Schedule J.

The aggregation of international forms is complete when creating the final e-file.

E-file/1120_ef_aggregation_2.htm/TY2021

Last Modified: 03/20/2020

Last System Build: 08/30/2022

©2021-2022 Thomson Reuters/Tax & Accounting.