1041 E-file: Aggregating Beneficiary K-1s

This process takes parts of the XML file containing federal Schedule K-1s or New York beneficiary information and merges them into the final federal and New York XML file that is e-filed.

Aggregation XML Preparation (in Sub Returns)

-

Go to Organizer > General Information > Basic Return Information.

-

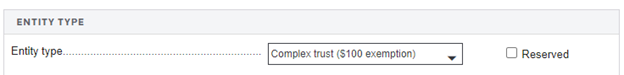

For the Entity Type, select Complex Trust ($100 exemption) or Complex Trust ($300 exemption).

-

In each sub return, enter the income as it is in the primary return.

-

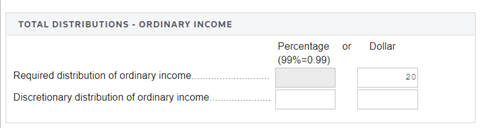

Under Organizer > Beneficiary Info (1041) > Beneficiary Data > Distribution Input – Totals, enter the totals distribution for this sub return either in a dollar amount or in a percentage, but not in both.

-

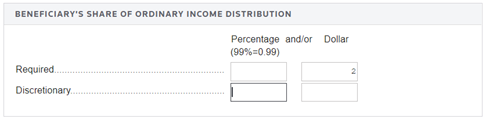

Under Organizer > Beneficiary Info (1041) > Beneficiary Data/Beneficiary Information > Individual Beneficiary Name, enter the Beneficiary’s Share of Ordinary Income distribution as a dollar amount ora percentage. Depending on which fields are used, the total of all beneficiaries’ dollar amounts must be equal to the total distribution dollar amount, or the total percentage of all beneficiaries must be 100%.

If the individual beneficiary’s share of ordinary income distribution was imported, then you can skip this step.

-

Fully recompute the return.

-

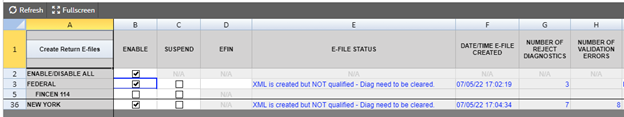

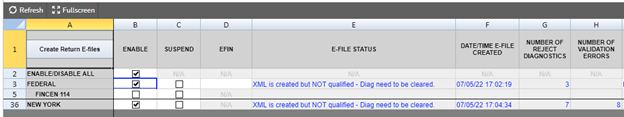

Go to Organizer > E-file > Enable/Create, and click the Create Return E-files button.

Be sure to review and address K-1 e-file reject diagnostics and K-1 XML validation errors. You can ignore any other diagnostics and XML validation errors. This will create the XMLs that will be aggregated into the primary return’s federal and New York XMLs.

Federal Beneficiary K-1 Aggregation Process

Step 1: Attach Federal K-1 XML File (in Primary Return)

-

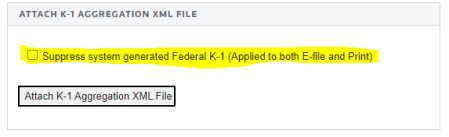

Go to Organizer > Federal E-file > Attachments > K-1 Aggregation.

-

Select the Attach K-1 Aggregation XML File button.

-

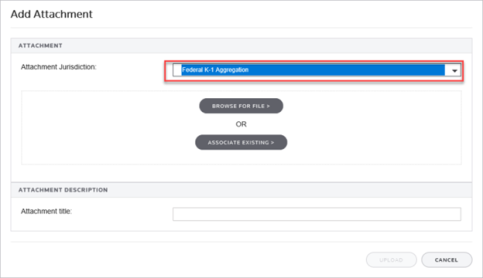

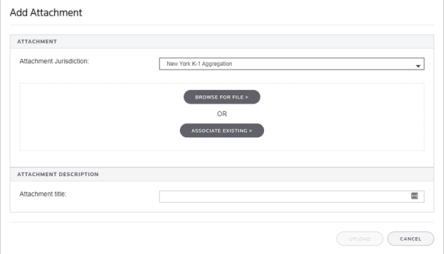

On the Add Attachments pop-up dialog box, select Federal K-1 Aggregation from the drop-down list.

-

Browse to and select the applicable XML file that was created in the previous steps.

If needed, the attachment title can be modified.

-

Select Upload.

-

On the Electronic Filing Attachments screen, click Done.

-

Repeat this process for each XML file to be included.

-

To delete the federal K-1 XML files, highlight the attachment on the Electronic Filing Attachments screen, and then select Delete.

-

After attaching the XML files, confirm that the XML attachment details are correct in the K-1 Attachments Summary. Note that the attached XML file names will include the locator number of the primary return. The attached XML files must be validated to detect XML errors. If validation errors exist, delete the attachment. Correct, and then recreate a new XML file for attachment.

-

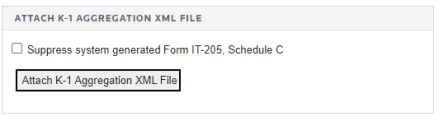

If the primary K-1 is not to be included in the XML file, check the box Suppress system generated Federal K-1 on the page.

To re-aggregate an XML, delete the XML being replaced and then reaggregate.

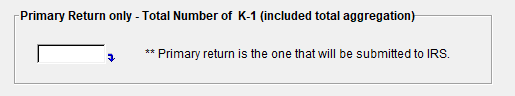

Step 2: Override Total Number of K-1s (in Primary Return)

On the K-1 Aggregation page, override the total number of K-1. This number will be included in the total number of K-1s of the aggregated XML file.

Step 3: Create Aggregated E-file (in Primary Return)

This final step combines the federal K-1 files into the XML file of the primary return.

-

On the E-file > Enable/Create screen, select the Create Federal E-file button.

-

Download the e-file and review. In all cases, be sure to review the E-file Viewer to confirm the federal K-1s are included in the complete XML file as expected.

If the XML file is too big for the E-file Viewer, download and view with a third-party software.

The K-1 aggregation XML file that is being attached must NOT include any elements with a value of 0. These elements are not required and should be removed. The IRS does not want these elements to be included in the e-file submission.

New York Beneficiary Information Aggregation Process

Step 1: Change New York E-file name (in Sub Return)

After creating the sub return e-file, the New York e-file will have an extension of XXXXXXXX.XNY. Change this to XXXXXXXXNY.XML.

Step 2: Attach New York XML File (in Primary Return)

-

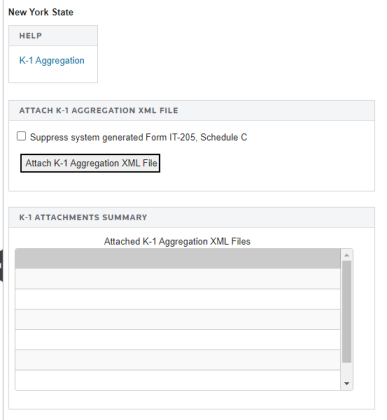

Go to Organizer > States > New York > E-file > Attachments > K-1 Aggregation > NY K1 Aggregation.

-

Select the Attach K-1 Aggregation XML File button.

-

On the Add Attachments pop-up dialog box, select New York K-1 Aggregation from the drop-down list.

-

Browse to and select the applicable XML file that was created in the previous steps.

If needed, the attachment title can be modified.

-

Select Upload.

-

On the Electronic Filing Attachments screen, click Done.

-

Repeat this process for each XML file to be included.

-

To delete the New York K-1 XML files, highlight the attachment on the Electronic Filing Attachments screen, and then select Delete.

-

After attaching the XML files, confirm that the XML attachment details are correct in the K-1 Attachments Summary. Note that the attached XML file names will include the locator number of the primary return. The attached XML files must be validated to detect XML errors. If validation errors exist, delete the attachment. Correct the errors, and then recreate a new XML file for attachment.

-

If the beneficiary information in primary return is not to be included in the XML file, check the box Suppress system generated Form IT-205, Schedule C.

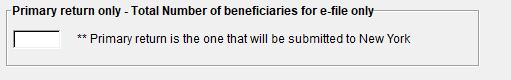

Step 3: Override Total Number of Beneficiaries for New York (in Primary Return)

On the New York K1 Aggregation page, override the total number of beneficiaries. This number will be included in the total number of beneficiaries in the aggregated XML file.

Step 4: Create Aggregated E-file (in Primary Return)

This final step combines the New York beneficiary files into the New York XML file of the primary return.

-

On the E-file > Enable/Create screen, check the New York box in the Enable column.

-

Select the Create Return E-file button.

-

In all cases, be sure to review the E-file Viewer to confirm the New York beneficiaries are included.

Note: If the XML file is too big for the E-file Viewer, download and view with a third-party software.

E-file/ef_aggregation_1.htm/TY2021

Last Modified: 07/19/2022

Last System Build: 08/30/2022

©2021-2022 Thomson Reuters/Tax & Accounting.