1041 E-file: Extension - Entering Signature Information

- Select E-file > Signature Authorization.

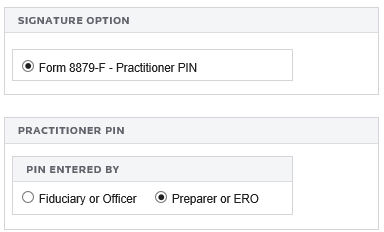

- Select the type of PIN signature: Form 8879F - Practitioner PIN.

- Select the appropriate option to indicate who entered the PIN into the program.

If you select Preparer, Form 8879-F will print for the fiduciary to sign. The preparer must keep the signed Form 8879-F for three years. Do NOT send Form 8879-F to the IRS!

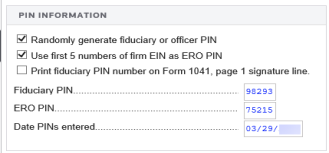

- For the fiduciary/officer PIN, you can select any or all of the following options:

- randomly generate the fiduciary or officer PIN

- use the first five numbers of the Firm Employer ID Number (FEIN) as the ERO PIN

- print the fiduciary PIN on the signature line on Form 1041, Page 1.

- Enter the five-digit PINs (the numbers cannot contain all zeros) for the fiduciary.

- Enter the date the PIN(s) were entered into the program.

E-file/1041_8868_5.htm/TY2021

Last Modified: 03/20/2020

Last System Build: 08/30/2022

©2021-2022 Thomson Reuters/Tax & Accounting.