1040 E-file: Selecting Signature Options

For federal 1040 extension e-file, PINs and Form 8878 are not required unless there is a payment with the extension.

The taxpayer can provide a practitioner- or self-selected PIN/Signature Authorization. For more information on PINs, see 1040 E-file: Appendix C - PIN Information.

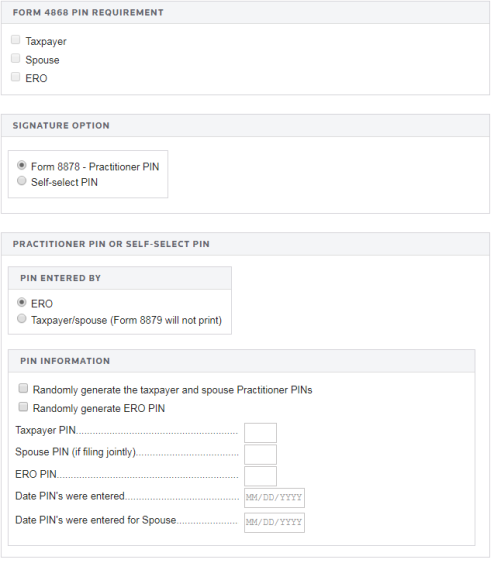

- Select E-file > Extensions > Signature Authorization.

- Select the type of PIN signature: Form 8879 - Practitioner PIN or Self-Select PIN.

- Select the appropriate option to indicate who entered the PIN into the program: ERO or Taxpayer/spouse.

If you select Taxpayer/spouse and Self-Select PIN, Form 8878 will not print. The preparer must keep the signed Form 8879 for three years. Do NOT send Form 8878 to the IRS!

- For the taxpayer/spouse, you can select one or both of the following options:

- randomly generate the taxpayer and spouse PINs

- randomly generate the ERO PIN.

- Enter the five-digit PINs (the numbers cannot contain all zeros) for the taxpayer, spouse, and ERO. For more information on self-select PINs, see 1040 E-file: Appendix C - PIN Information.

- Enter the date the PIN(s) were entered into the program.

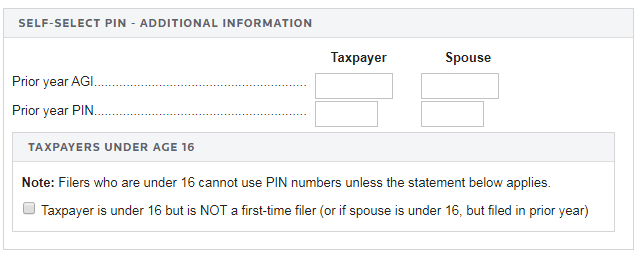

- Enter the taxpayer’s 2020 Adjusted Gross Income (AGI) on the original return filed (not from an amended return) or 2020 PIN or EFP (E-file PIN) obtained from the IRS.

- If you are preparing a joint return in 2021, but the spouse filed a separate return in 2020, enter the spouse’s 2020 AGI or 2020 PIN. If the AGI was zero or negative, enter NONE.

- For taxpayers under the age of 16, indicate if the underage taxpayer is under 16 but is not a first-time filer. Filers under 16 cannot use PINs unless they indicate that they have filed in the past.

- For Form 2350 extension only, enter the following:

- agent name

- agent PIN signature

- agent signature date.

E-file/1040_ef_ext_3.htm/TY2021

Last Modified: 08/13/2020

Last System Build: 08/30/2022

©2021-2022 Thomson Reuters/Tax & Accounting.