990 Disaster Assistance Designation

Click here to download a PDF copy of this guide.

Federal

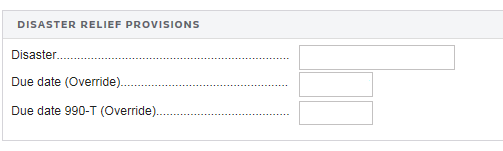

To enter disaster designations for the 990 federal return, do the following:

- Go to Organizer > General Information > Basic Return Information > Return Information.

- Scroll to the Disaster Relief Provisions section at the bottom of the screen.

- Enter the IRS-issued Disaster Designation.

- If necessary, enter an override for the due date. You may wish to enter a special override due date for Form 990-T.

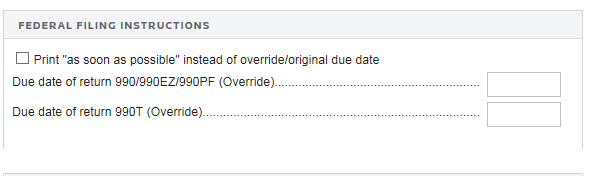

- Go to Organizer > Letters and Filing Instructions > Filing Instruction Options.

- Enter the IRS-designated extended due date for the given return.

States

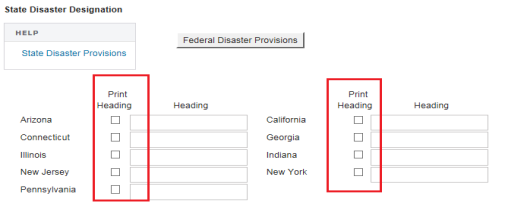

If the IRS extends the federal return due date as a result of a natural disaster or other event, states may adopt the same provision. If this is the case for any of the states that you are processing OR any state-specific events that might exist which are not adopted by the IRS, take the following steps:

States Adopting the IRS Extension Provisions

- Enter the federal information as indicated above.

- Go to Organizer > States > Common State > State Disaster Provisions.

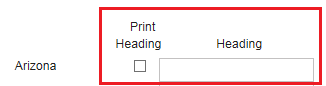

- Check Print Heading for those states adopting the IRS extension provision.

- Perform a full recompute. The Heading field will be populated with the same entry made in the Federal Disaster Provision field. This information will print at the top of the state return.

- If the state requires different text, override the Heading field with the required wording.

Other Situations Requiring Unique State-Specific Heading Information

- Check Print Heading for a specific state.

- Enter the unique, state-specific heading information. This information does not have to be entered in the Federal Disaster Provision field.

- Perform a full recompute. This information will print at the top of the state return.

Tax Application Disaster Assistance/990_disaster.htm/TY2021

Last Modified: 02/03/2022

Last System Build: 02/03/2022

©2021-2022 Thomson Reuters/Tax & Accounting.