5500 Disaster Assistance Designation

Click here to download a PDF copy of this guide.

The IRS, DOL, and PBGC may announce special extensions of time to file Form 5500 series returns/reports for filers affected by presidentially-declared disasters or who are serving the Armed Forces of the United States in a combat zone. See www.irs.gov, www.efast.dol.gov, and www.pbgc.gov/practitioners for announcements regarding such special extensions.

Reference to the Form 5500 can be found in the announcement under the bold caption Grant of Relief. Any special extension of filing Form 5500 granted by the IRS will also be automatically permitted by the DOL and PBGC. Whether or not DOL or PBGC announces a special extension, Form 5500 series filers to whom the IRS has granted a special extension may file their annual returns/reports by the extended due date stated in the IRS announcement.

Filers affected by presidentially-declared disasters are plan administrators, employers, and other entities who file Form 5500 series that are located in the areas designated as federal disaster areas (as listed in the IRS announcement). These special extensions also apply to filers located outside the designated disaster areas who are unable to obtain the information necessary for filing from service providers, bands or insurance companies whose operations are directly affected by the disasters.

In the event of a natural disaster or other event where the IRS extends the due date of the federal return, enter the IRS-required statement (e.g. April 16 Storm). This statement will print at the top of the Form 5500 series return/report.

Federal

To enter disaster designations for the 5500 federal return, do the following:

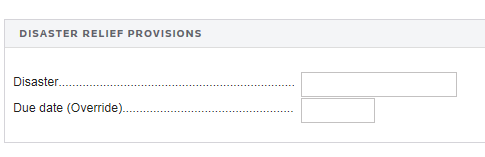

- Go to Organizer > 5500 Series > [Plan Name] > Basic Plan Information.

- Scroll to the Disaster Relief Provisions area at the bottom of the screen.

- Enter the IRS-issued Disaster Designation.

- If necessary, enter an override for the due date.

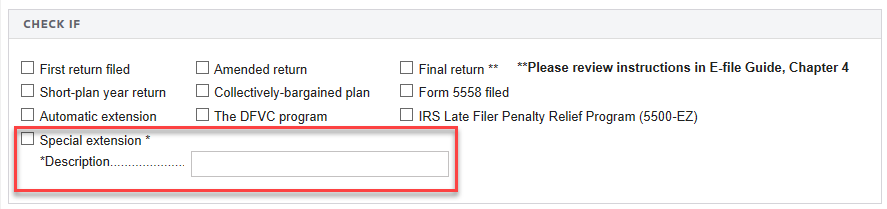

- For 5500 or 5500-SF filers, go to Organizer > 5500 Series > [Plan Name] > Basic Plan Information.

- Scroll down to the Check if part, check Special Extension, and enter the description.

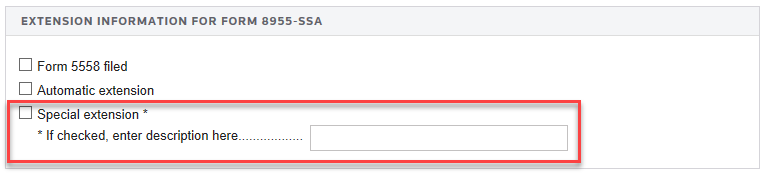

- For 8955-SSA filers, go to Organizer > Form 8955-SSA > Def. Vested Benef.

- Check Special Extension, and enter the description under Extension Information for 8955-SSA.

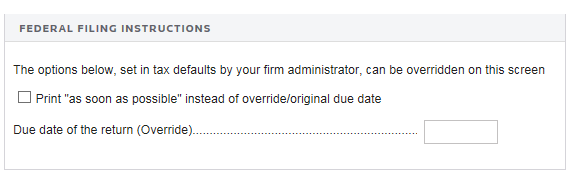

- Go to Organizer > Letters and Filing Instructions > Filing Instruction Options.

- Enter the IRS-designated extended due date for the given return.

Tax Application Disaster Assistance/5500_disaster.htm/TY2021

Last Modified: 02/03/2022

Last System Build: 02/03/2022

©2021-2022 Thomson Reuters/Tax & Accounting.