1120 Disaster Assistance Designation

Click here to download a PDF copy of this guide.

Federal

To enter disaster designations for the 1120 federal return, do the following:

- Go to Organizer > General Information > Basic Return Information > Return Information.

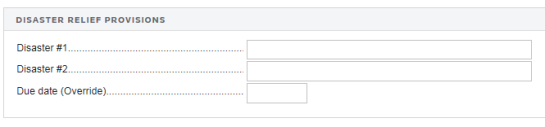

- Scroll to the Disaster Relief Provisions section at the bottom of the screen.

- Enter the IRS-issued Disaster Designation (you may enter up to two). This statement will print at the top of the federal return.

- Enter an override for the return due date, if required.

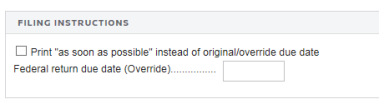

- Go to Organizer > Letters and Filing Instructions > Filing Instruction Options.

- In the Filing Instructions section, enter an override date for the federal return.

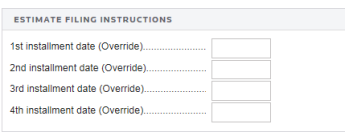

- If applicable, scroll down on the same screen, and enter the Estimate Filing Instructions installment date overrides.

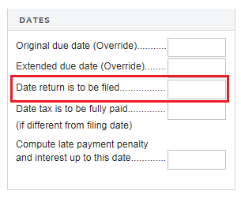

- Go to Organizer > Estimates and Penalties > Underpayment of Estimates > Penalties/Interest.

- In the Dates section, enter the override due dates for late penalties and interest in the Date return is to be filed field.

- Perform a full recompute before generating the print file and/or the e-file.

States

If the IRS extends the federal return due date as a result of a natural disaster or other event, then states may adopt the same provision. If this is the case for any of the states that you are processing OR any state-specific events that might exist which are not adopted by the IRS, then take the following steps:

States Adopting the IRS Extension Provisions

- Enter the federal information as indicated above.

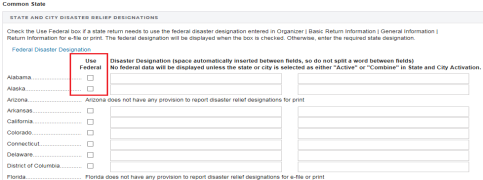

- Go to Organizer > States > Common State > Disaster Relief Provisions.

- If desired, click Use Federal to use the federal heading for disaster designation.

- To use a state-specific heading, enter the description in either the first or the second Disaster Designation field (to correspond to Disaster #1 or Disaster #2 specified in the Disaster Relief Provisions section at Organizer > General Information > Basic Return Information > Return Information.

Some states do not have provisions to report disaster relief designations for print and/or e-file.

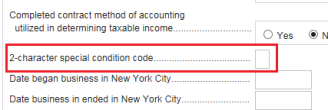

- For New York City, click the New York City Special Condition Code hyperlink.

- On the New York City General Information screen, scroll down to the 2-character special condition code field, and enter the code.

- Perform a full recompute before generating the print file and/or the e-file.

Tax Application Disaster Assistance/1120_disaster.htm/TY2021

Last Modified: 02/03/2022

Last System Build: 02/03/2022

©2021-2022 Thomson Reuters/Tax & Accounting.