Insurance Returns: NOL Organization and Rules

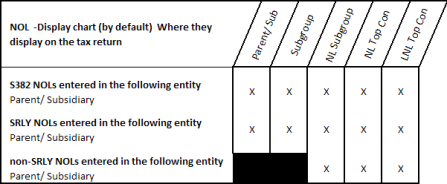

The following chart details where NOLs are displayed on the tax return.

NOL Offsetting Rules and Order

The following list of net operating loss rules provides the order that the rules are applied in a Mixed Group consolidation. Read each NOL type carefully to fully understand before applying.

- NOL carryovers of the same return type (1120 NOLs, 1120-PC NOLs, OR 1120-L NOLs) must be absorbed by income of the same return type FIRST. Any carryovers that remain can then be utilized by other subgroup return types.

- NOLs of the same return type (1120 NOLs, 1120-PC NOLs, OR 1120-L NOLs) are utilized by income of the same return type FIRST. Any carryovers that remain are utilized by other return type subgroups.

- NOLs are offset WITHIN each subgroup before being consolidated to the top consolidation return, according to the IRS rules. The limited amounts are entered in the Organizer, AND the Organizer overrides are entered also.

- NOLs in the top consolidation are offset according to the IRS rules,

- Limited amounts must be entered in the Organizer for each Life company, and at the LNL level.

- Limitations, such as the 35 percent limitation on Nonlife subgroup losses against Life subgroup income, are automatically applied when the LNL eligibility is checked for each applicable year of loss.

- The Organizer overrides must be entered.

NOL Organizer Override Rules

The following items are some of the net operating loss rules for entering Organizer overrides. Overrides should not be entered on the tax form, nor used to accomplish consolidation accuracy. Instead, use the Organizer fields at each level for entry overrides.

| Level | Field | Description | Navigation |

|---|---|---|---|

| Lowest | Override column - see NOL (SRLY, Non-SRLY, S382) Organizer entry screen | In Organizer, select check box labeled Unlimited NOL computations |

Navigate to the override field in the Organizer for each return type:

|

| Subgroup and Nonlife Subgroup | Override column |

Navigate to the override field in the Organizer for each return type:

|

|

| Topcon |

Overrides must be entered in the lower level fields or subgroups in the Organizer. |

1120/ins_nol_2.htm/TY2021

Last Modified: 03/20/2020

Last System Build: 01/31/2023

©2021-2022 Thomson Reuters/Tax & Accounting.