Insurance Returns: Net Operating Loss

A deduction is allowed on the tax return for an amount equal to the aggregate of (1) the net operating loss (NOL) carryover, plus (2) the net operating loss carry back. The mixed group consolidation has three types of net operating losses that can be calculated in the return:

- Non-SRLY net operating losses

- SRLY net operating losses

- S382 net operating losses.

Each type of net operating loss has its own Organizer where you can enter the amounts. All entries for each loss type should be entered in the pertinent taxable entity. Depending on the type of NOL, the amount to be limited must be entered as well.

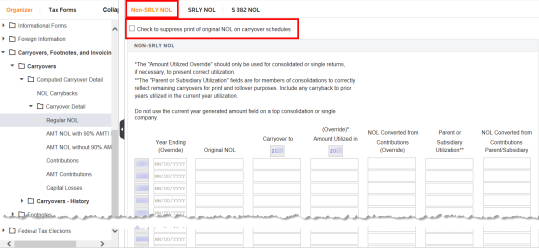

Navigation: Organizer > Carryovers, Footnotes, and Invoicing > Carryovers > Computed Carryover Details. Choose the appropriate tab for carrybacks or carryovers.

Non-SRLY NOL

The amount for the Non-SRLY net operating loss must be entered by year in both of the following columns: Original NOL and Carryover to XXXX, where XXXX represents the current year. The amounts must be entered in the lowest level subsidiary or parent return in order to consolidate correctly, and not in the top consolidation There are screen instructions for amounts to be utilized, mainly for print and rollover purposes. These are consolidated to the top consolidation return and limited against other subgroup income according to the LNL eligibility check box, IRS rules, and the Organizer overrides. Non-SRLY NOLS are NOT displayed in the lower entities tax forms.

Non-SRLY NOLS are displayed in the following tax returns:

- Nonlife subgroup Subconsolidation

- NL top consolidation

- LNL top consolidation.

Navigation: Organizer > Carryovers, Footnotes, and Invoicing > Carryovers > Computed Carryover Detail > Carryover Detail > Regular NOL > Non-SRLY NOL tab

- Select the check box to suppress the print of original NOL on carryover schedules, if desired.

- Enter Original NOL and Carryover NOL.

- Enter carryover amounts if NOL occurred before 8/6/1997.

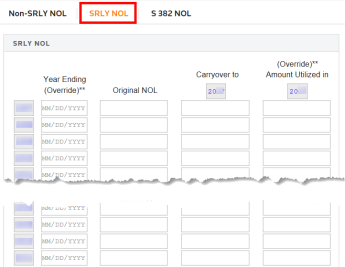

SRLY NOL Entry

The amounts for the SRLY net operating losses must be entered by year in both of the following columns, Original NOL and Carryover to XXXX, where XXXX represents the current year. The amounts must be entered in the lowest level subsidiary or parent return in order to consolidate correctly, and not in the top consolidation.

The SRLY NOL amounts are displayed in the following tax returns:

- a lower level return where the amount is entered

- the subgroup level

- the NL subgroup Subconsolidation

- the NL top consolidation and the LNL top consolidation.

These amounts are consolidated in the top consolidation and limited to be applied against other subgroup income according to the LNL eligibility check box.

Read the instructions found on the screen displayed below to determine if you need to enter the amount utilized (mainly for print and rollover purposes).

Navigation: Organizer > Carryovers, Footnotes, and Invoicing > Carryovers > Computed Carryover Detail > Carryover Detail > Regular NOL > SRLY NOL tab

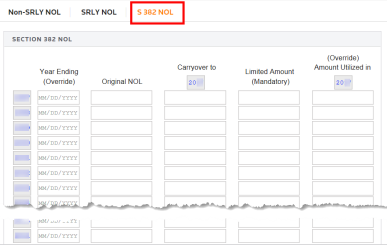

S382 NOL

The amount for the S382 net operating loss must be entered by year in the taxable entity's parent, subsidiary, or divcon column. In order for the return to consolidate correctly, enter both the Carryover to XXXX (where XXXX is the current year) and the Limited amount in the lowest level subsidiary or parent return and not in the top consolidation return. The limitation must be entered to process accurately. S382 NOLs must be applied against the income of its entity. Any remainder that results is carried forward and used against next year’s income. The column labeled Amount Utilized is the override column.

S382 NOL amounts are displayed in the following tax returns:

- a lower level return where the amount is entered

- the subgroup level

- the NL subgroup Subconsolidation

- the NL top consolidation (topcon) and LNL top consolidation.

Navigation: Organizer > Carryovers, Footnotes, and Invoicing > Carryovers > Carryover Detail > Regular NOL > S 382 NOL tab.

Enter Carryover NOL and Limited Amount (Mandatory).

1120/ins_nol_1.htm/TY2021

Last Modified: 03/20/2020

Last System Build: 01/31/2023

©2021-2022 Thomson Reuters/Tax & Accounting.