Insurance Returns: NAIC Annual Statement

The bulk of the information needed to prepare insurance income tax returns (1120-L and 1120-PC) is found in the National Association of Insurance Commissioners (NAIC) Annual Statement. NAIC determines the standards for financial reporting for insurance companies. The Annual Statement information is stored in designated NAIC files that are then filed with the regulatory state. Each file is identified by a standard name that indicates the return type and the filing period to which it pertains, and each insurance company’s unique NAIC number.

An import of the NAIC Annual Statement file populates the Annual Statement of the Organizer pages, which then flows to the appropriate Tax Forms in the tax application. Not all data is transferred from the Annual Statement, only the data that is needed for tax compliance calculations and print is imported into the Organizer.

To transfer the NAIC Annual Statement for the 1120-L or 1120-PC tax returns, choose the correct data source type. The tax application allows the transfer of these types of Annual Statements:

- Life (1120-L)

- Separate Accounts (1120-L)

- Property and Casualty (1120-PC)

- Health (1120-PC)

- Title (1120-PC)

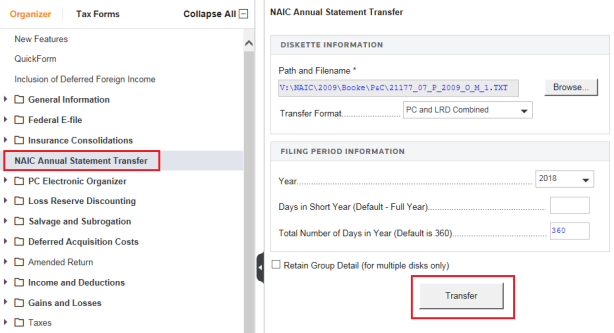

NAIC Annual Statement Transfer

You can import NAIC data directly from their Annual Statement file to the appropriate place in the tax application. However, only certain pages, and not the entire statement, are transferred into the Annual Statement Organizer because the rest is not needed. If additional data is desired, the client can use the Electronic Organizer to add this information.

To transfer data:

- On the Organizer tab, select NAIC Annual Statement Transfer.

- Verify the path and filename, transfer format, and filing year are correct. You must be able to fit the entire path, including the TXT extension inside the field provided.

- Select Browse.

- Browse to the import file, and select Open.

- Select the Transfer Format drop-down box. This lists the available transfers.

- Select the Year drop-down box. Prior years are available for life and separate account annual statements and LRD transfers.

- After verifying the information, select Transfer, and then select OK.

Data transferred into the Annual Statement pages from an NAIC statement flows automatically to the provided yellow tax detail workpapers. Workpapers are used to show the calculations and how a particular number in a return was derived. You can print the workpapers with the federal return, or print them separately along with the federal schedules that support the return. They are available for the preparer’s use and are intended to simplify the review process, as well as provide an audit trail.

Annual Statement Transfer for Short Year Returns

Income statement items for the short year tax return period are automatically prorated based on the number of days in the short year when compared to the total number of days in the tax year. In the example below, the income statement amounts would be calculated as half of the full year transferred amounts. Balance sheet items are not prorated.

The tax software supports Annual Statement transfers only. The import of quarterly statement files is not supported.

NAIC Mapping to the Tax Return

Worksheets are available to identify mapping of the NAIC Annual statement to 1120-L and 1120-PC, and to assist in the reconciliation and preparation of the tax return. There are two separate files available:

The files are updated annually to reflect the latest tax law changes.

Statutory-to-Tax Adjustments

Important differences between accrual and statutory accounting methods require special statutory-to-tax adjustments that are made when preparing the federal and state tax returns. Adjustments are made automatically when transferring the Annual Statement.

Statutory-to-tax adjustments are made to the statutory data of the transferred Annual Statement balances to arrive at net taxable income for the federal return. These adjustments follow the same general philosophy as those made to book income for a domestic corporation. The most common example is the adjustment made when depreciation for financial reporting purposes differs from depreciation for tax purposes.

Other adjustments that must take place for the taxable income computation include:

- Tax-exempt interest

- Change in due and accrued dividends

- Change in deferred and uncollected premiums

- Change in deposit type contracts

- Premium amortization

- Capital gains

- Elimination of change in loading

- Elimination of home office rent

- Elimination of NAIC amortization

- Elimination of NAIC depreciation

- Elimination of market discount accrual

- Difference in collected and earned real estate

- Interest on encumbrances

- Increase in loading on deferred & uncollected premiums

- Investment expenses.

1120/ins_data_source_2.htm/TY2021

Last Modified: 03/20/2020

Last System Build: 01/31/2023

©2021-2022 Thomson Reuters/Tax & Accounting.