Insurance Returns: Form 851: Corporate Affiliations Schedule

Preparing Form 851

Form 851 is printed from the top consolidation return, but consists of information entered in the parent and subsidiary returns. To create the 851 correctly, it is important to know where to enter information for each field and section of the form. These instructions lead you through that process.

Generally, information for the 851 comes from these three places: the top consolidation return, the parent return, and the subsidiary returns. When you create a consolidation return, select the active members to be included in the consolidation on the What to Consolidate screen. The program can now transfer in certain information from the entities you have listed. The corporation name, address, FEIN, estimated and extension payments, Principal Business Activity, and PBA code information is carried in from the General Information area in the respective parent and subsidiary returns.

Consolidation Carry Information

We call the information that transfers into the top consolidation from other returns consolidation carry information. Every time you perform a consolidation, the program sweeps the parent and subsidiary returns to collect the Consolidation Carry Information.

Be careful not to enter any of this information in the top consolidation’s Organizer or Tax Forms. If you manually enter any data in these fields, the application overwrites this information each time you consolidate, when it transfers the Consolidation Carry Information into the Organizer.

First we look at what information comes from which return, and then go through the form field-by-field, and list the source for the data. In general, the following information transfers from the returns shown.

Parent

The following information carries automatically to the top consolidation return from the parent. To have this transfer take place, you must enter the company locator numbers on the top consolidation return in Organizer > Consolidated Returns > What to Consolidate screen.

- Name and address (street, city, state, zip code)

- Tax year ending

- Employer identification number

- Prepayment credits

- PBA (Principal Business Activity) Code number.

Subsidiaries

The following information carries automatically to the top consolidation return from the subsidiary returns:

- Names and addresses

- Employer identification numbers

- Prepayment credits

- Principal business activity

- PBA code numbers.

Top Consolidation

Enter the following information in the top consolidation return:

Inactive Subsidiary Information

If you do not prepare returns for inactive members of the consolidation, you can add these members to your Form 851 on the top consolidation return. This information carries to Part I of the Form 851 tax return.

- In the top consolidation return, access Organizer > Informational Forms > Affiliation Schedule > Inactive Subsidiary Information.

- Enter the name, address, FEIN, and PBA information for each inactive member company.

- Be sure to assign the first inactive subsidiary a company number that follows the last number assigned to active subsidiaries on the Consolidated Returns > What to Consolidate > Consolidation Locator List screen.

Voting Stock Information

Enter your company number, the PBA activity, and the code appears.

Part III and Part IV Information

Enter Parent and Subsidiary information for Parts III and IV of Form 851.

Entering Information for Form 851

Part I

For Part I, the following tables indicate where information is entered.

Page 1, top section: General Information

| Form 851 Item | Where to Enter in Organizer |

|---|---|

| In the Parent Return | |

| Common Parent corporation name | General Information > Basic Return Information > Entity Information tab |

| Address |

General Information > Basic Return Information > Entity Information tab |

| FEIN |

General Information > Basic Return Information > Entity Information tab |

| Tax year end |

General Information > Basic Return Information > Entity Information tab |

For Part I, the following shows where information is entered.

| Form 851 Item | Where to Enter in Organizer |

|---|---|

| In the Top Consolidation Return | |

| Company Number | Consolidated Returns > What to Consolidate |

| In the Parent Return | |

| Portion of Form 7004 tax deposits |

Payments and Extensions > Payment of Taxes |

| Portion of estimated tax credits and deposits |

Payments and Extensions > Payment of Taxes |

| In Subsidiary Returns | |

| Name and address of corporation | General Information > Basic Return Information > Entity Information tab |

| Employer identification number |

General Information > Basic Return Information > Entity Information tab |

| Portion of Form 7004 tax deposits |

Payments and Extensions > Payment of Taxes |

| Portion of estimated tax credits and deposits |

Payments and Extensions > Payment of Taxes |

If you enter payments on Form 851 in the top consolidation return, these amounts override the carry information.

| Form 851 Item | Where to Enter in Organizer |

|---|---|

| In the Top Consolidation Return | |

| Company Number(s) | Informational Forms > Affiliations Schedule > 851 Page 1 |

| Did the subsidiary make any non dividend distributions? |

Informational Forms > Affiliations Schedule > 851 Page 1 |

|

Stock holdings at beginning of year Number of shares Percent of voting power Percent of value Owned by corporation number |

Informational Forms > Affiliations Schedule > 851 Page 1 |

| In the Parent Return | |

| PBA Code Number |

General Information > Questions |

| In Subsidiary Returns | |

| Principal business activity (PBA) | General Information > Questions |

| PBA Code No. |

General Information > Questions |

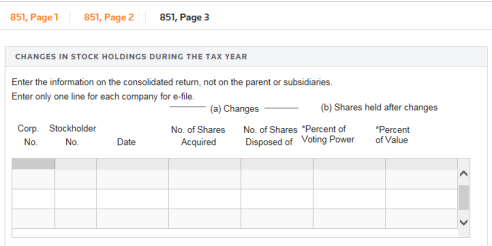

Part III: Changes in Stock Holdings During the Year

You are not required to complete Part III for all members of the affiliated group. Therefore, we default to leaving this part blank. If the affiliated group has members who must complete Part III, enter the following information to the Organizer screens:

| Form 851 Item | Where to Enter in Organizer |

|---|---|

| In the Top Consolidation Return | |

| Company Number(s) | Informational Forms > Affiliations Schedule > 851 Page 2 |

| Stockholder (Corporation No.) |

Informational Forms > Affiliations Schedule > 851 Page 2 |

|

Change in stock holdings during the year (a) Changes (b) Shares held after changes described in Column (a) |

Informational Forms > Affiliations Schedule > 851 Page 2 |

| If the equitable owners of any capital stock shown above were other than the holders of record, give full details | Informational Forms > Affiliations Schedule > 851 Page 2 |

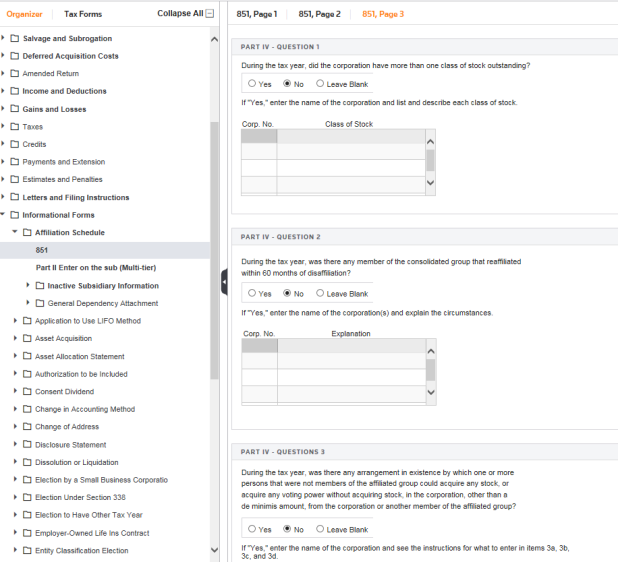

Part IV: Additional Information

You are not required to complete Part IV for all members of the affiliated group. Therefore, we default to leaving this part blank. If the affiliated group has members who must complete Part IV, enter the following information on the Organizer screens:

| Form 851 Item | Where to Enter in Organizer |

|---|---|

| In the Top Consolidation Return | |

|

Question 1 Company number(s) Answer to Question 1 If yes, list and describe each class of stock |

Informational Forms > Affiliations Schedule > 851 Page 3 |

|

Question 2 Company number(s) Answer to Question 2 If yes for any part of question 2, list and explain the circumstances |

Informational Forms > Affiliations Schedule > 851 Page 3 |

|

Question 3 Company number(s) Answer to Question 3 Item 3a, 3b, 3c Item 3d – description of arrangements |

Informational Forms > Affiliations Schedule > 851 Page 3 |

Printing Form 851

Form 851 has been changed to print only on the top consolidation; it does not print on the subgroup, subcon, or divcon.

The system does not transfer Part III and IV information from members. This information must be entered on the top consolidation.

Part III

Part IV

1120/ins_consol_6.htm/TY2021

Last Modified: 03/20/2020

Last System Build: 01/31/2023

©2021-2022 Thomson Reuters/Tax & Accounting.