Insurance Return: 1120L: Unique Items

DAC – Deferred Acquisition Costs

Deferred Acquisition Costs (DAC) are amortized under Section 848 and entered mostly on 1120-L returns, and occasionally on 1120-PC returns. The Deferred Acquisition Costs are located on the 1120-L, Page 4, Schedule G (go to Tax Forms > Federal > 1120-L - US Corporation Inc Tax Return > 1120-L - US Corporation Inc Tax Return > Page 3). These expenses are incurred when gathering new premiums that then must be amortized on the 1120-L tax return.

Annual Statement Users

The tax application automatically transfers in Premiums, Advance Premiums, and Deferred and Uncollected Premiums from the Annual Statement.

Adjustments to DAC

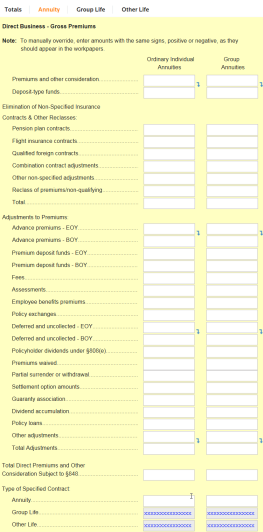

To make adjustments in each premium type, choose a tab in the Direct Business Premiums Worksheet such as Annuity, Group Life, or Other Life. In the Other Adjustments to Premiums column in the last row, you can enter adjustment in the field titled Other Adjustments.

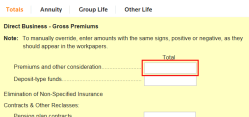

The Totals tab sums all three tabs for review purposes.

Navigation: Organizer > Deferred Acquisition Costs > Direct Business > Direct Business Premiums Worksheet > Totals tab

Navigation: Organizer > Deferred Acquisition Costs > Direct Business > Direct Business Premiums Worksheet > Annuity tab

Schedule T

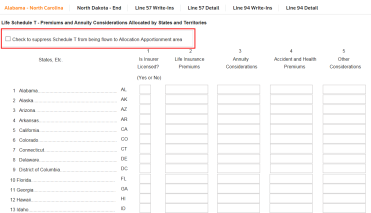

The Annual Statement Schedule T provides state premium numbers for the state tax returns. Schedule T in the Organizer is automatically populated when you import the Annual Statement for Life and PC Annual Statement returns. The premium total numbers also populate the Allocation and Apportionment area automatically for the states once the state area is activated.

Navigation: Organizer > Life Annual Statement > Page 48 - Schedule T

If you want to suppress the Schedule T premium amounts from populating the States Allocation and Apportionment area, use the check box in the Organizer at the top of the Schedule T. The figure above shows the check box to suppress Schedule T.

Organizer users can only enter the data directly into the Allocation and Apportionment area if needed.

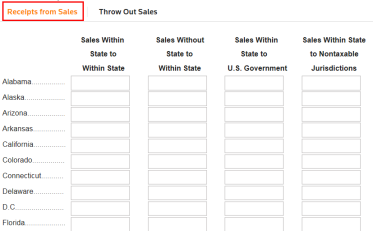

Navigation: Organizer > States > Allocation and Apportionment > Data Entry > Sales Data Entry > Receipts from Sales

1120/ins_1120l_3.htm/TY2021

Last Modified: 03/20/2020

Last System Build: 01/31/2023

©2021-2022 Thomson Reuters/Tax & Accounting.