Insurance Returns: 1120L: Failed Life

A life insurance company is in the business of issuing life, annuity, and certain health insurance policies. A failed life return is a Life Insurance company with a Life Insurance Annual Statement that does not meet the reserves qualifications to file on an 1120-L tax return per IRS rules. An insurance company that does not qualify as a life insurance company under the IRS rules files an 1120-PC tax return for the IRS’s filing purpose.

Using The Life NAIC Import

If you have a failed life tax return and you want to import the Life Annual Statement, the return must be created as an 1120-L tax return in our tax application. After creation, you must import the Life Annual Statement and check the Failed Life check box to convert the life insurance data from the 1120-L. We then automatically populate the 1120-PC tax return. The 1120-PC tax return is the tax return visible on the Tax Forms page for filing to the IRS. The 1120-L tax return is disabled.

Which type of subgroup Subconsolidation does the failed life belong to?

Without regard to the way you created the failed life or the method you used to populate the failed life return data, the failed life tax return (1120-PC) is included in the 1120-PC subgroup for consolidation purposes. It can be confusing since you might have to create the failed life return by creating a life return to use the Life Annual Statement transfer, and then convert it to an 1120-PC return. The PC subgroup Subconsolidation consists of all the 1120-PC returns to be filed to the IRS, whether they are created as 1120-PC, or converted to 1120-PC because they are failed life returns.

Failed Life Conversion

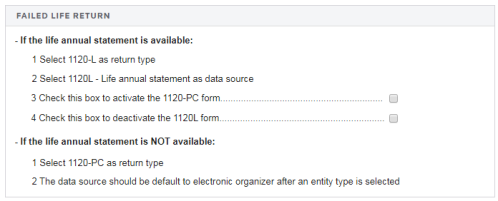

Use the following steps to help you create your failed life return, if you are using the Life Annual Statement transfer method.

- Create an 1120-L return.

- Do not enter any numbers in the 1120-L Organizer at this point. Wait until after conversion to the 1120-PC to enter amounts in the Organizer.

- Transfer the Life Annual Statement.

- Turn off Auto Compute in the 1120-L return.

- In the Failed Life Return section, select both check boxes at the bottom of the screen. One box deactivates the 1120-L; the other activates the 1120-PC area and the tax form. The failed life check boxes are at on the screen shown in the Organizer > General Information > Basic Return Information > Entity Information.

- The 1120-PC tax forms now appear in Tax Forms and the 1120-PC Organizer. All Organizer entries must now be made in the 1120-PC Organizer, not in the 1120-L Organizer.

- If this failed life return is to be consolidated with other returns, it must be included in an 1120-PC subgroup Subconsolidation.

1120/ins_1120l_2.htm/TY2021

Last Modified: 03/20/2020

Last System Build: 01/31/2023

©2021-2022 Thomson Reuters/Tax & Accounting.