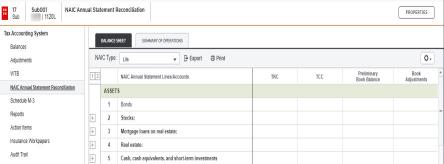

Tax Accounting System Menu Tree with Insurance

In 1120L and 1120PC binders, you can see the screens on the Tax Accounting System navigation tree on the NAIC Annual Statement Reconciliation and Insurance Workpapers screens.

The 1120PC Tax Accounting System 1120PC navigation menu is similar to the 1120L, with an additional item for Schedule M-2, and it does not include Insurance Workpapers.

NAIC Annual Statement Reconciliation Screen

The views on this screen are sorted by the NAIC Annual Statement lines and display accounts according to the mapping chart you created in the Home Window. Amounts display normal balances to be consistent with the NAIC Annual presentation. On the workpaper, you can select the NAIC Type from the drop-down list.

You can rollover the chart either individually or by using the batch chart rollover feature.

Opening the NAIC Annual Statement Reconciliation

- Open a binder.

- On the TAS navigation tree, select NAIC Annual Statement Reconciliation.

- Select the NAIC Type from the drop-down list.

- Click Export to save this information to a spreadsheet file.

- Click Print to print a copy. The print default settings are landscape and letter sized paper.

Action Items

Action Items in TAS in addition to items generated for other tax return types also generate items for the following:

- NAIC Annual Statement Map identifies and lists accounts in the binder that have data but have not been mapped in the NAIC Annual Statement Map chart.

- A Data Input Review item informs you whenever total assets do not equal total liabilities, surplus, and other funds on the NAIC Annual Statement Reconciliation. The comparison is for the Adjusted Book Balances.

These action item messages are created whenever one account has been mapped for the tax return type, NAIC type, and the federal chart of accounts is assigned to the binder.

1120/TAS_Menu_with_Insurance.htm/TY2021

Last Modified: 08/10/2021

Last System Build: 01/31/2023

©2021-2022 Thomson Reuters/Tax & Accounting.