Insurance Returns: Reviewing the Tax Return

We provide different reconciliations to review your tax return amounts such as the comparison of the NAIC Annual Statement income to the taxable income and the reconciliation of the taxable income to the Schedule M-3.

Reconciliations of the Annual Statement Income to Taxable Income

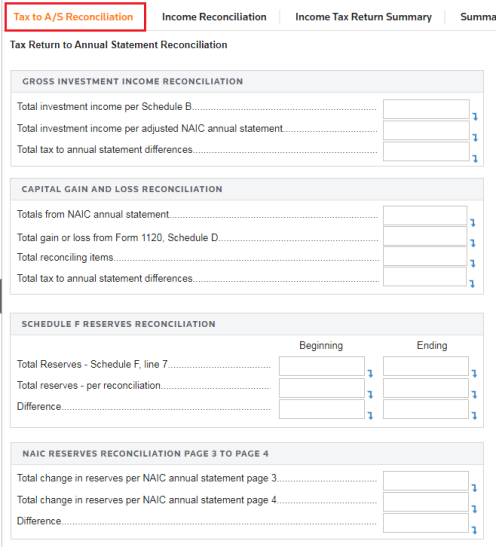

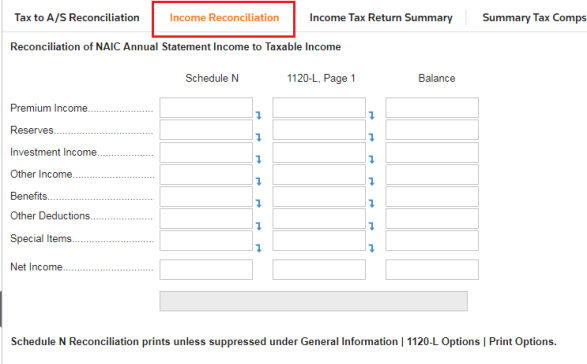

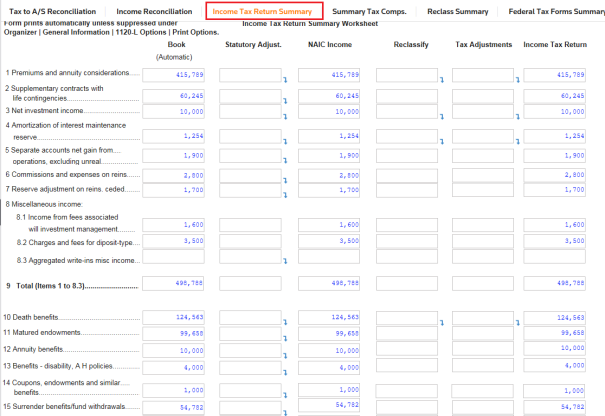

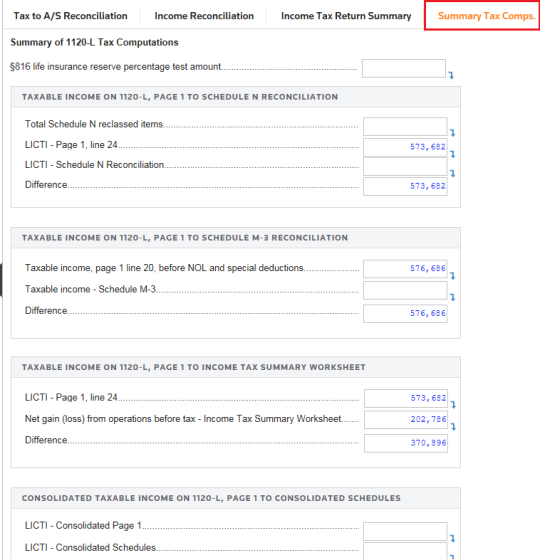

Worksheets in the Tax Summary reconcile the Annual Statement income to the taxable income. The Tax to A/S Reconciliation, Income Reconciliation, and Income Tax Return Summary Worksheets helps you reconcile the Annual Statement income to the 1120-PC or 1120-L tax return income by displaying any reclassifications, tax adjustments, and M-1 adjustments.

If you want this reconciliation to consolidate in an 1120-L or 1120-PC subgroup with Annual Statement returns and Electronic Organizer returns, you must enter amounts on this worksheet.

Navigation: Tax Forms > Federal > 1120-L Corporate Income Tax Return > Tax Summary. Select one of the following tabs:

- Tax to A/S Reconciliation

- Income Reconciliation

- Income Tax Return Summary

- Summary Tax Comps

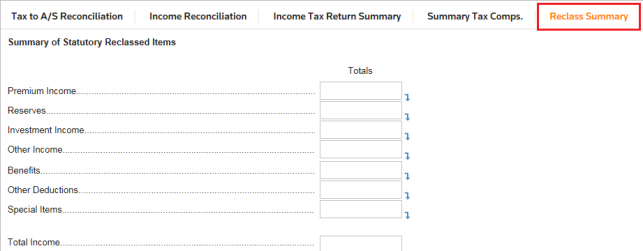

- Reclass Summary

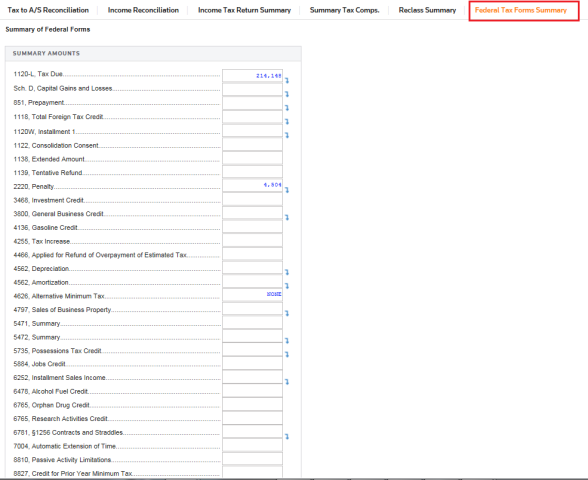

- Federal Tax Forms Summary

1120-L Tax to A/S Reconciliation Screen

1120-L Income Reconciliation

1120-L Income Tax Summary

1120-L Summary Tax Comps

1120-L Reclass Summary

1120-L Federal Tax Forms Summary

Reconciliations of Taxable income to other Schedules

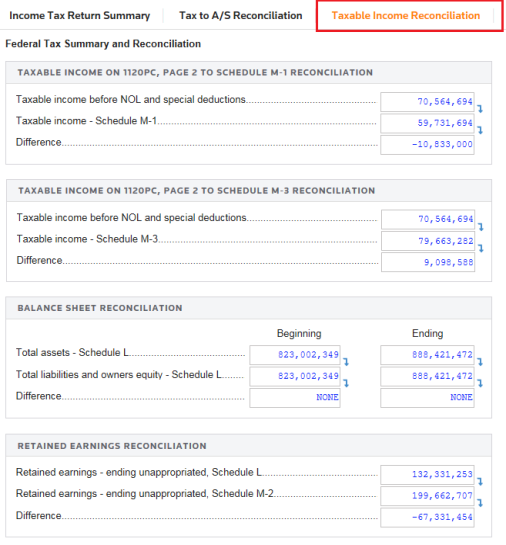

Certain worksheets in the Tax Summary reconcile the taxable income to other tax schedules. The 1120-PC Taxable Income to Schedule M-1 and Taxable Income to Schedule M-3 Income worksheets, for example, show the 1120-PC or 1120-L tax return income by displaying any reclassifications, tax adjustments, and M-1 adjustments.

Navigation: Tax Forms > Federal > 1120-PC Corporate Income Tax Return > Tax Summary. Select one of the following tabs:

- Income Tax Return Summary (similar to 1120L)

- Tax to A/S Reconciliation (similar to 1120L)

- Taxable Income Reconciliation (see below)

- Federal Tax Forms Summary (similar to 1120L)

1120-PC Taxable Income Reconciliation

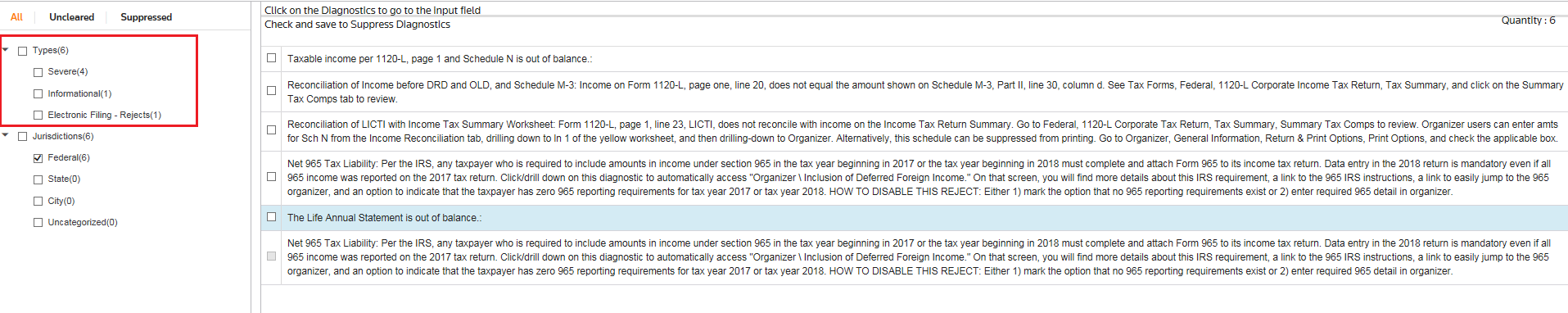

Diagnostics

The system provides diagnostics to help you determine inconsistencies, omissions, or override errors. To review diagnostics, select View > Diagnostics, and then select the type.

In the left pane, the tax application categorizes diagnostics into three types for Federal, States, and Cities categories:

- Severe: Should be cleared before printing the return (for example, an out-of balance return).

- Informational: Shows special calculations and the effects of overrides (such as schedules matched to line items of the return). It can also display print and tax return errors that should be addressed before filing.

- E-file: Three types of e-file diagnostics must be cleared if the return is to be accepted by the IRS or the state tax departmen

- Electronic Filing – Alerts.

- Electronic Filing – Rejects: Errors the tax application has detected that must be cleared to e-file.

- E-file XML Validation errors: Errors detected after creating the e-file. These must be cleared to get a qualified return.

1120/oit_taxapp_4.htm/TY2021

Last Modified: 03/20/2020

Last System Build: 01/31/2023

©2021-2022 Thomson Reuters/Tax & Accounting.