Insurance Returns: General Information

The General Information folder contains data entry screens that allow you to make selections and customize the return. This folder also contains options for print, compute, and schedules.

Basic Return Information

Navigation: Organizer > General Information > Basic Return Information > Entity Information

The Entity Information screen displays the company Name, Entity Number, EIN, Address (or Foreign), Dates, and has sections for the Return/Entity Type, Failed Life Return, and Business Activity information. We recommend that you visually review and verify this information.

- Business Codes link: Select link to view a Help screen where another link exists to the IRS Business Activity Codes.

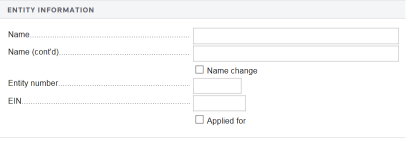

- Entity Information: For the Electronic Organizer returns, enter the Name as desired that populates the Tax Return. A check box is provided for Name changes. For Annual Statement returns, the name from the Annual Statement is automatically filled in on both the federal and state the tax return. Enter the Entity number in the field provided. The federal EIN is only needed for taxable entities, not divisions, eliminations, or subconsolidation entities. A check box is provided if EIN is Applied for.

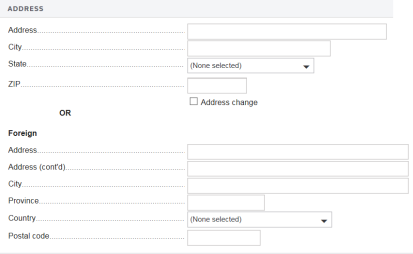

- Address: Address information is not required for the eliminations or the subgroup subconsolidation return. For Annual Statement returns, the federal and state tax return automatically fills in the address that is shown on the Annual Statement. Included are Address, City, State (drop-down list), and ZIP fields for domestic addresses with a check box to indicate an Address Change. Foreign addresses include Province, Country (drop-down list), and Postal Code.

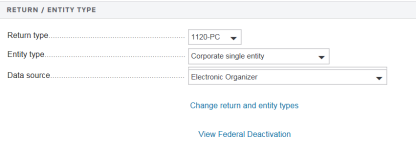

- Return/Entity Type: Select the return type, entity type, and data source.

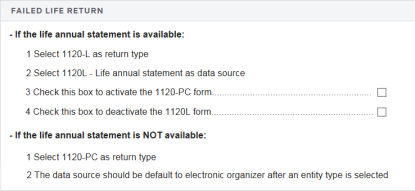

- Failed Life Return: If the life annual statement is available, select the applicable check box to activate 1120-PC and/or deactivate 1120L.

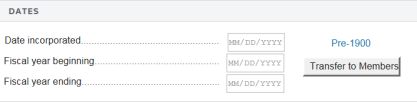

- Date of incorporation: The date is only needed for taxable entities, not divisions or elimination returns. Select the Pre-1900 hyperlink if the date is before 1900. Enter the Month, Day, and Year of incorporation. Do not enter dates after 1900 here.

- Business Activity: Select the Business Codes link to look up the Business Activity Code and enter it in the field provided. A check box indicates if the business in Inactive. Type in the Principal business activity and the Product or service.

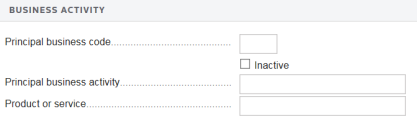

Return and Print Options

One of the choices under the Basic Options tab is to enter the number of federal and state returns. You can make selections to print or suppress reports and summaries and indicate the items printed on every page, on the attachments, or on non-tax form items.

Navigation: Organizer > General information > Return and Print Options > Basic Options tab

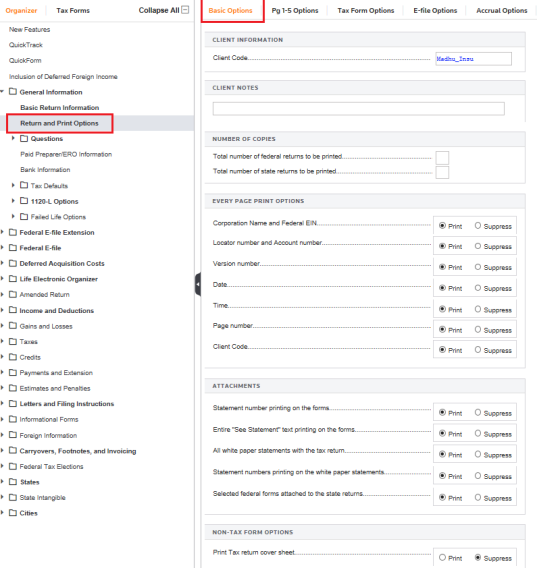

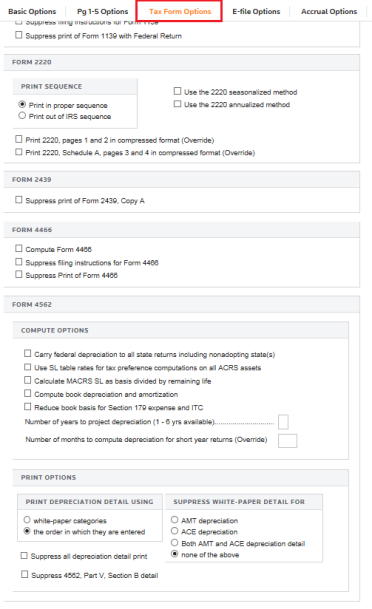

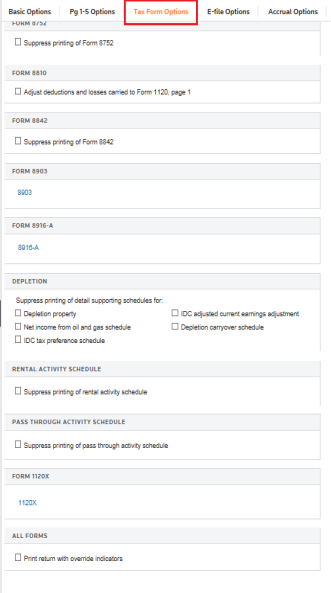

Tax Form Options

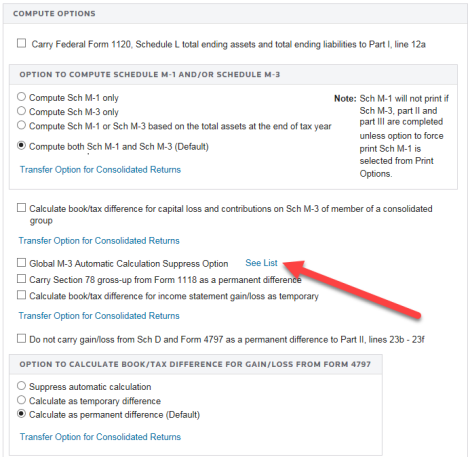

This page shows calculation options for Schedules D, M-1, M-3, PN, and N.

There are also some form calculation check boxes for some forms such as Forms 1118, 1120-W, 1138, 1139, 2220, 4466, and 4562. A check box is provided to print the return with override indicators at the bottom of the form.

Navigation: Organizer > General Information > Return and Print Options > Tax Form Options tab

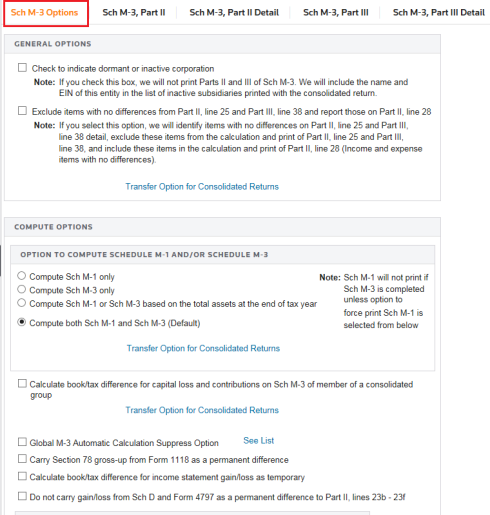

M-3 Options

According to the M-3 rules from the IRS, the M-3 must be filed if the entity has $50 million or more in assets, which is an increase from $10 million in 2016. If an M-3 is filed, then a Schedule N reconciliation is not required. For additional M-3 rules and instructions, see www.irs.gov.

There are various M-3 options for calculation, print, and suppression of amounts. Select the Schedule M-3 Options link to view the Schedule M-3 options shown below.

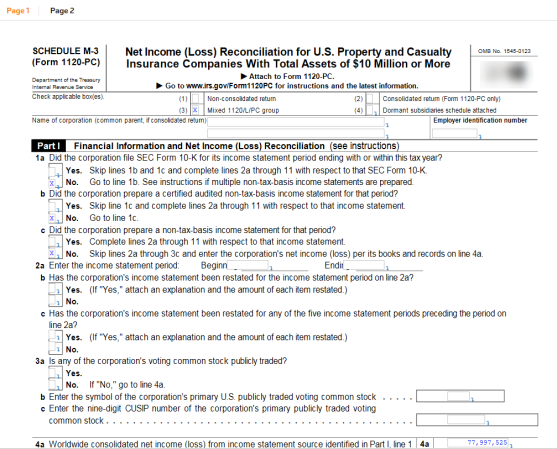

Mixed Group 1120/L/PC Group Entity check box

The entity check boxes at the top of the Schedule M-3 tax form automatically populate for Mixed Group entities.

Navigation: Tax Forms > LNL PC Schedule M-3/Form 8916 > Page 1

Global M-3 Automatic Calculation Suppression Check box

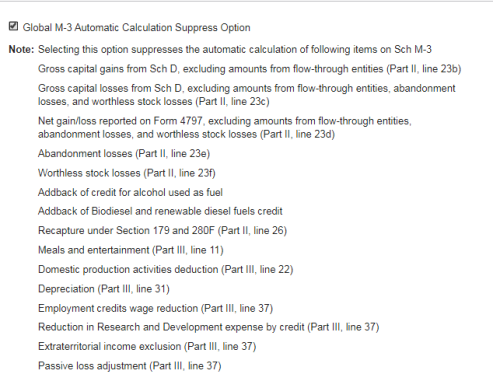

There is an option to suppress the automatic calculation of the following items on the Schedule M-3 for 1120, 1120-PC and 1120-L for Annual Statement and Electronic users. If this check box is selected, the automatic calculations listed are suppressed. However, if you enter amounts in the M-3 Organizer, the amounts flow to the M-3 as overrides.

Navigation: Organizer > Return and Print Options > Tax Form Options. Select the Schedule M-3 link . On the resulting M-3 Sch Options tab screen, scroll down to the Compute Options section.

Select the See List link to view a list of suppressed items.

Select the check box to activate the Global M-3 Automatic Calculation Suppress Option.

1120/oit_taxapp_3.htm/TY2021

Last Modified: 03/20/2020

Last System Build: 01/31/2023

©2021-2022 Thomson Reuters/Tax & Accounting.